Question #21 Calculating EFN

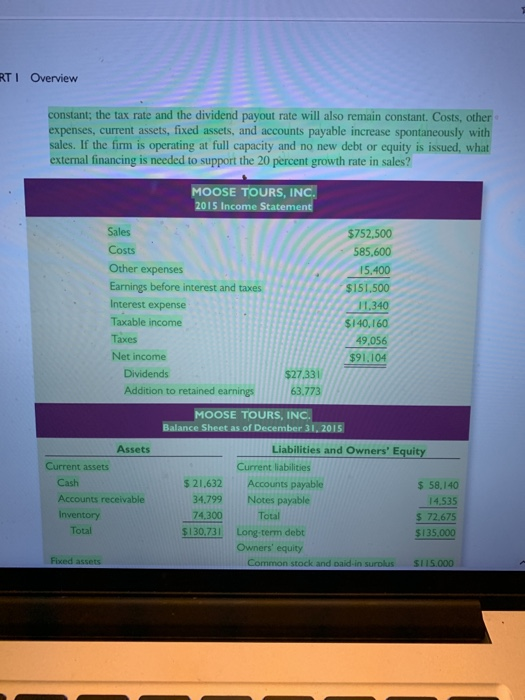

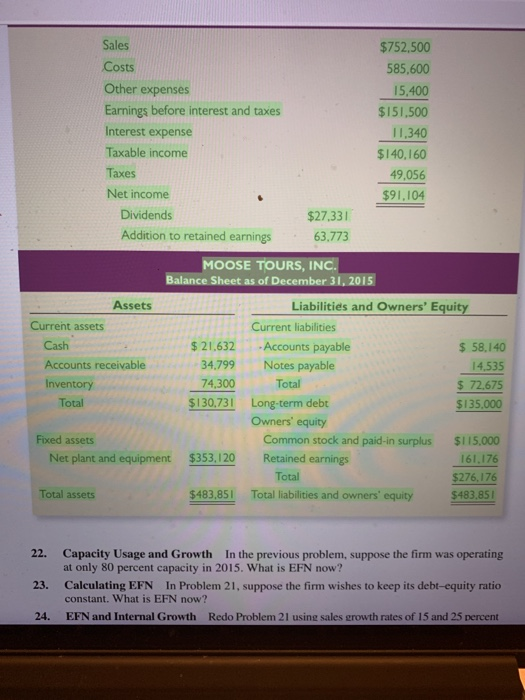

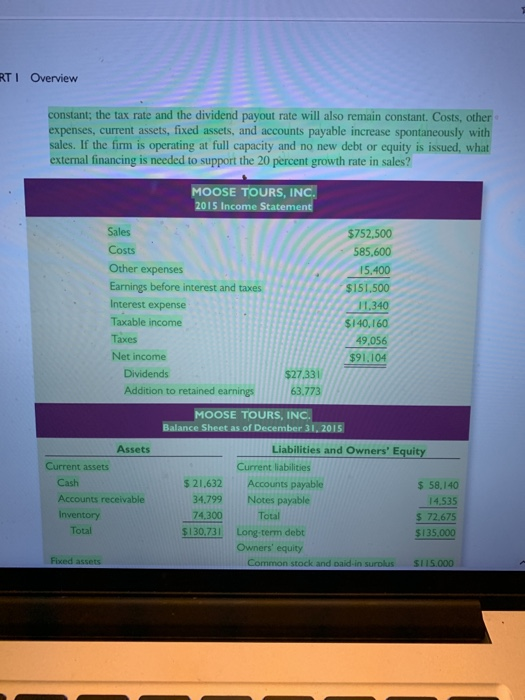

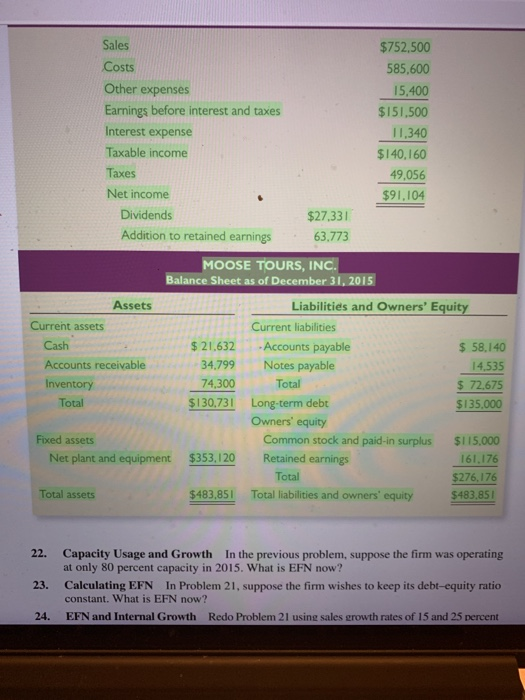

Tulal 210,027 Total liabilities and owners' equity otal assets $308,724 $381,633 $308,724 $381. Use the following information for Problems 19, 20, and 22: The discussion of EFN in the chapter implicitly assumed that the company was opera at full capacity. Often, this is not the case. For example, assume that Rosengarten operating at 90 percent capacity. Full-capacity sales would be $1,000/.90 = $1,111.7 balance sheet shows $1,800 in fixed assets. The capital intensity ratio for the company Capital intensity ratio = Fixed assets/Full-capacity sales = $1,800/$1,111 = 1.62 This means that Rosengarten needs $1.62 in fixed assets for every dollar in sales whe it reaches full capacity. At the projected sales level of $1,250, it needs $1,250 X 1.62 $2,025 in fixed assets, which is $225 lower than our projection of $2,250 in fixed asset So, EFN is only $565 - 225 = $340. 19. Full-Capacity Sales Thorpe Mfg., Inc., is currently operating at only 90 percent or fixed asset capacity. Current sales are $680,000. How much can sales increase before any new fixed assets are needed? 20. Fixed Assets and Capacity Usage For the company in the previous problem, suppose fixed assets are $640,000 and sales are projected to grow to $790,000. How much in new fixed assets are required to support this growth in sales? 21. Calculating EFN The most recent financial statements for Moose Tours, Inc., appear below. Sales for 2016 are projected to grow by 20 percent. Interest expense will remain Il FB F10 RTI Overview constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 20 percent growth rate in sales? MOOSE TOURS, INC. 2015 Income Statement Sales : Costs Other expenses Earnings before interest and taxes Interest expense Taxable income Taxes Net income Dividends Addition to retained earnings $752,500 585,600 15.400 $151.500 11.340 $140,160 49,056 $91.104 $27,331 63.773 MOOSE TOURS, INC. Balance Sheet as of December 31, 2015 Assets Current assets Cash Accounts receivable Inventory Total $ 21.632 34.799 74.300 $130.731 Liabilities and Owners' Equity Current liabilities Accounts payable $ 58,140 Notes payable 14,535 Total $72675 Long-term debt $135.000 Owners' equity Common stock and said in surolus S115.000 Fixed assets Sales Costs Other expenses Earnings before interest and taxes Interest expense Taxable income Taxes Net income Dividends Addition to retained earnings $752,500 585,600 15,400 $151,500 11.340 $140.160 49,056 $91,104 $27,331 63.773 MOOSE TOURS, INC. Balance Sheet as of December 31, 2015 Assets Current assets Cash Accounts receivable Inventory Total $ 21,632 34.799 74,300 $130,731 Liabilities and Owners' Equity Current liabilities Accounts payable $ 58.140 Notes payable 14,535 Total $ 72.675 Long-term debt $135.000 Owners' equity Fored assets Net plant and equipment $353.120 Common stock and paid-in surplus R etained earnings Total Total liabilities and owners' equity $115.000 161,176 $276,17 $483.851 Total assets $483,851 22. 23. Capacity Usage and Growth in the previous problem, suppose the firm was operating at only 80 percent capacity in 2015. What is EFN now? Calculating EFN In Problem 21, suppose the firm wishes to keep its debt-equity ratio constant. What is EFN now? EFN and Internal Growth Redo Problem 21 usine sales growth rates of 15 and 25 percent 24