Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 21 You are considering the purchase of a property today for $340,000. You plan to finance it with an 80 percent loan. The appreciation

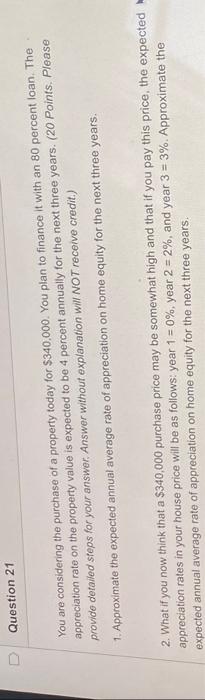

Question 21 You are considering the purchase of a property today for $340,000. You plan to finance it with an 80 percent loan. The appreciation rate on the property value is expected to be 4 percent annually for the next three years. (20 Points. Please provide detailed steps for your answer. Answer without explanation will NOT receive credit.) 1. Approximate the expected annual average rate of appreciation on home equity for the next three years. 2. What if you now think that a $340,000 purchase price may be somewhat high and that if you pay this price, the expected appreciation rates in your house price will be as follows: year 1 = 0%, year 2 = 2%, and year 3 = 3%. Approximate the expected annual average rate of appreciation on home equity for the next three years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started