Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 22 (11 marks) The Harveys are purchasing a home for $12,500,000 and have made the required deposit of 12% and have also paid the

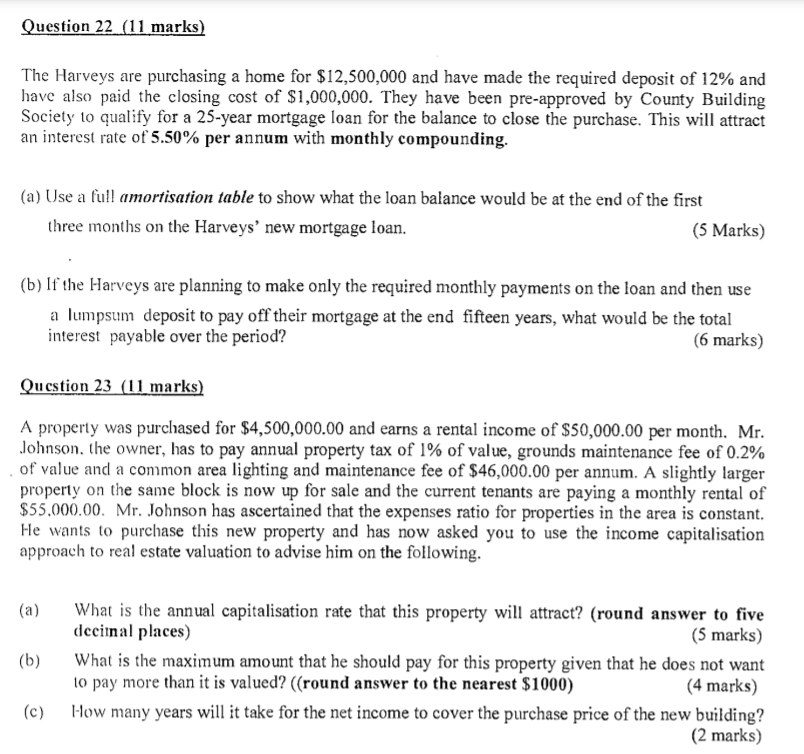

Question 22 (11 marks) The Harveys are purchasing a home for $12,500,000 and have made the required deposit of 12% and have also paid the closing cost of $1,000,000. They have been pre-approved by County Building Society to qualify for a 25-year mortgage loan for the balance to close the purchase. This will attract an interest rate of 5.50% per annum with monthly compounding. (a) Use a full amortisation table to show what the loan balance would be at the end of the first three months on the Harveys' new mortgage loan. (5 Marks) (b) If the Harveys are planning to make only the required monthly payments on the loan and then use a lumpsum deposit to pay off their mortgage at the end fifteen years, what would be the total interest payable over the period? (6 marks) Question 23 (11 marks) A property was purchased for $4,500,000.00 and earns a rental income of $50,000.00 per month. Mr. Johnson, the owner, has to pay annual property tax of 1% of value, grounds maintenance fee of 0.2% of value and a common area lighting and maintenance fee of $46,000.00 per annum. A slightly larger property on the same block is now up for sale and the current tenants are paying a monthly rental of $55.000.00. Mr. Johnson has ascertained that the expenses ratio for properties in the area is constant. He wants to purchase this new property and has now asked you to use the income capitalisation approach to real estate valuation to advise him on the following. (a) (b) What is the annual capitalisation rate that this property will attract? (round answer to five decimal places) (5 marks) What is the maximum amount that he should pay for this property given that he does not want 10 pay more than it is valued? ((round answer to the nearest $1000) (4 marks) How many years will it take for the net income to cover the purchase price of the new building? (2 marks) (c)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started