Answered step by step

Verified Expert Solution

Question

1 Approved Answer

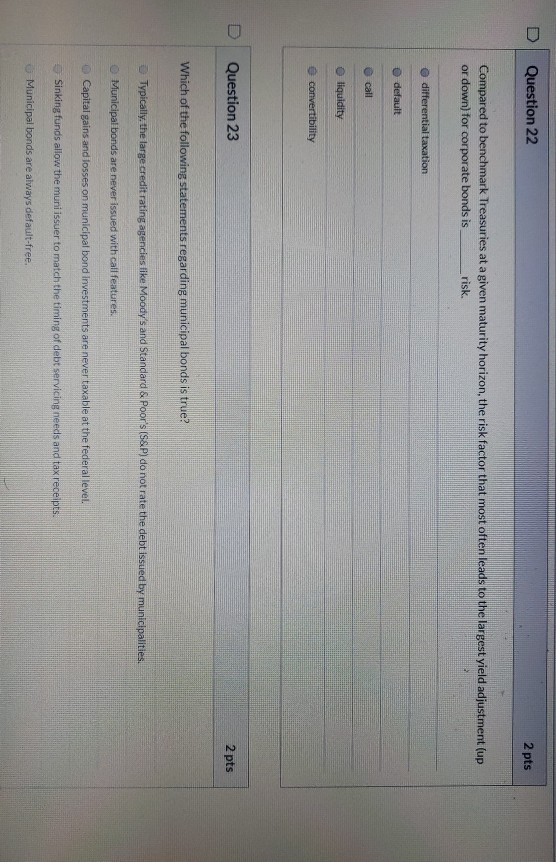

Question 22 2 pts Compared to benchmark Treasuries at a given maturity horizon, the risk factor that most often leads to the largest yield adjustment

Question 22 2 pts Compared to benchmark Treasuries at a given maturity horizon, the risk factor that most often leads to the largest yield adjustment (up or down) for corporate bonds is risk differential taxation default call liquidity convertibility Question 23 2 pts Which of the following statements regarding municipal bonds is true? Typically, the large credit rating agencies like Moody's and Standard & Poor's (S&P) do not rate the debt issued by municipalities. Municipal bonds are never issued with call features. Capital gains and losses on municipal bond Investments are never taxable at the federal level. Sinking funds allow the muni Issuer to match the timing of debt servicing needs and tax receipts. Municipal bonds are always default-free

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started