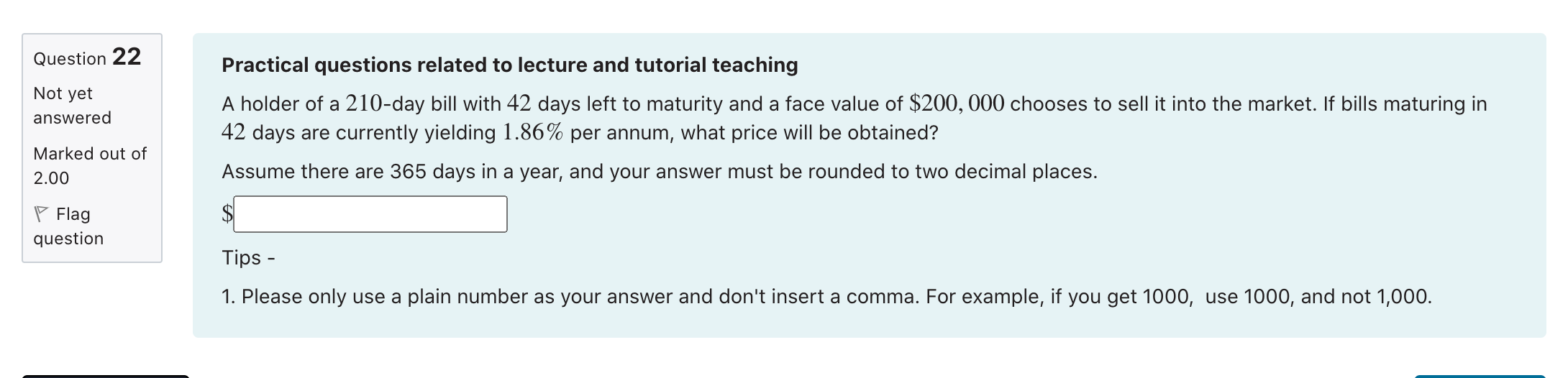

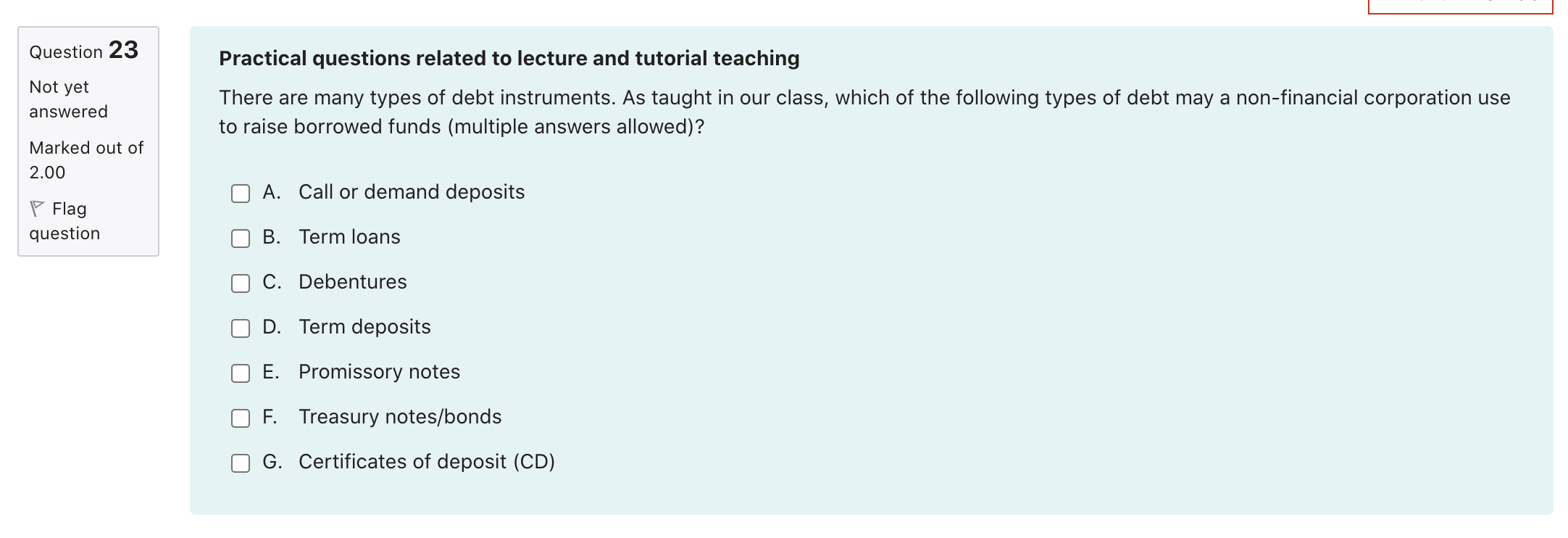

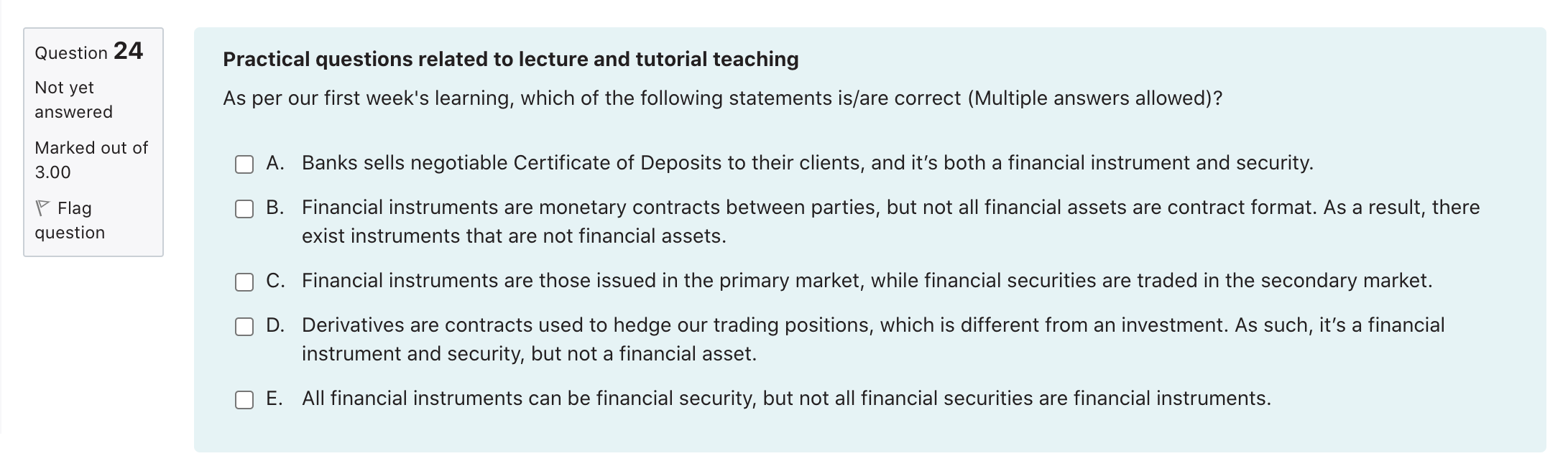

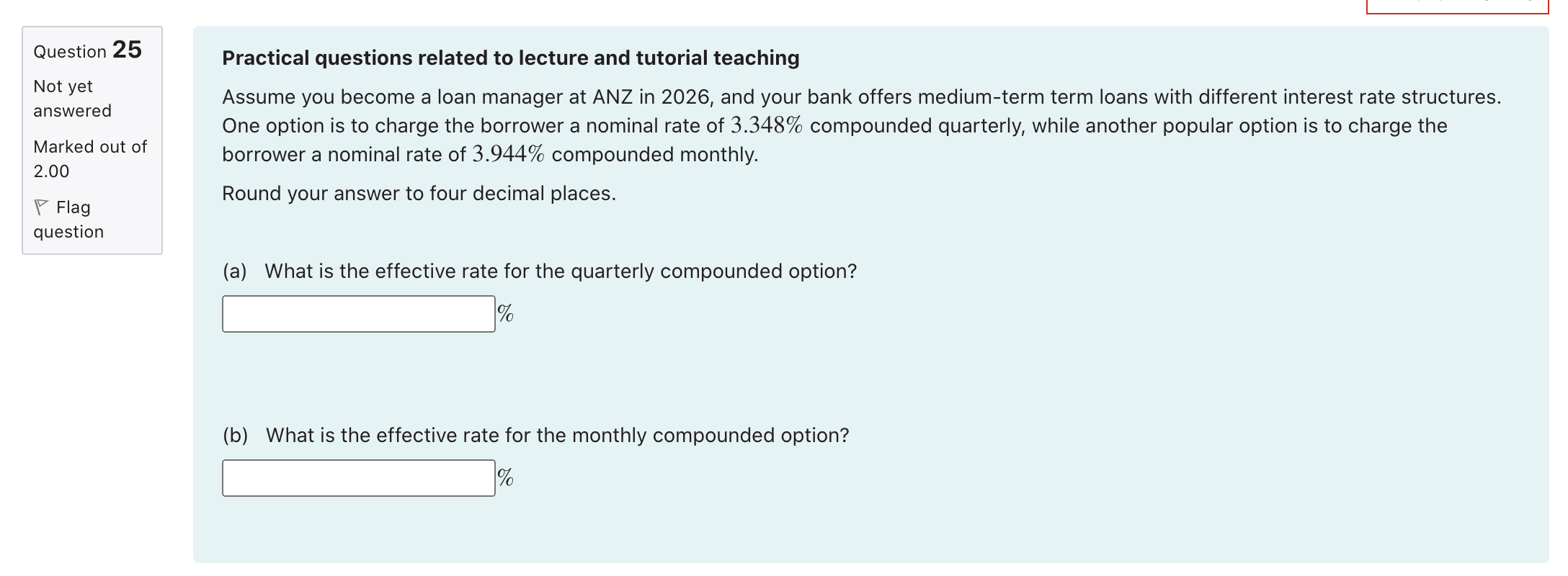

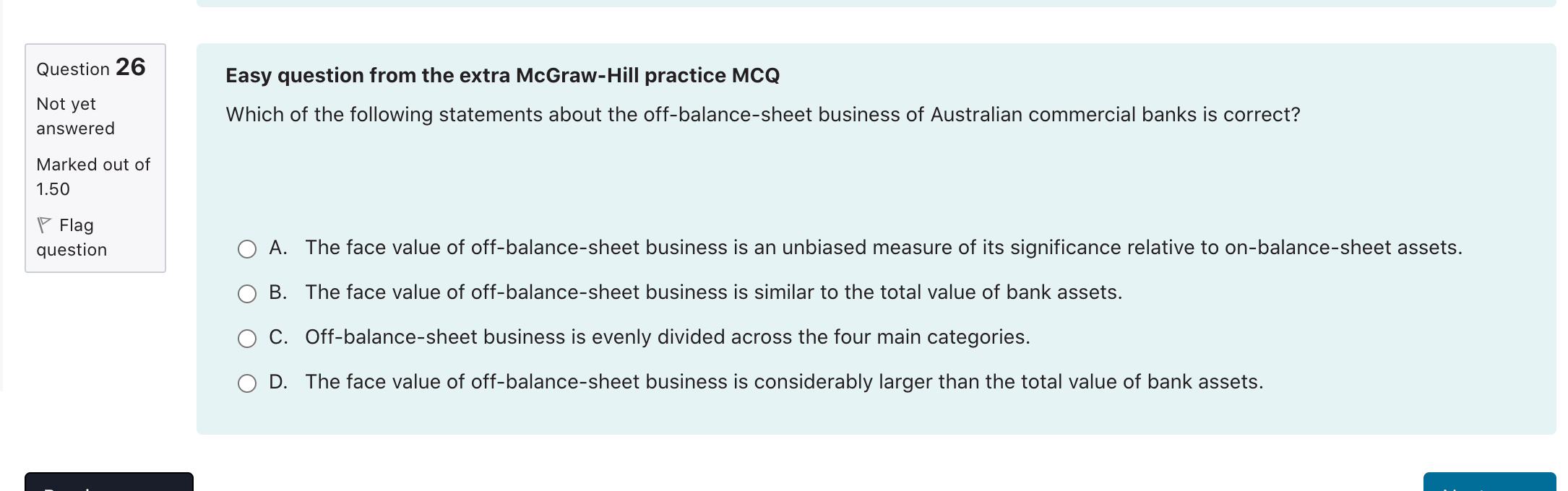

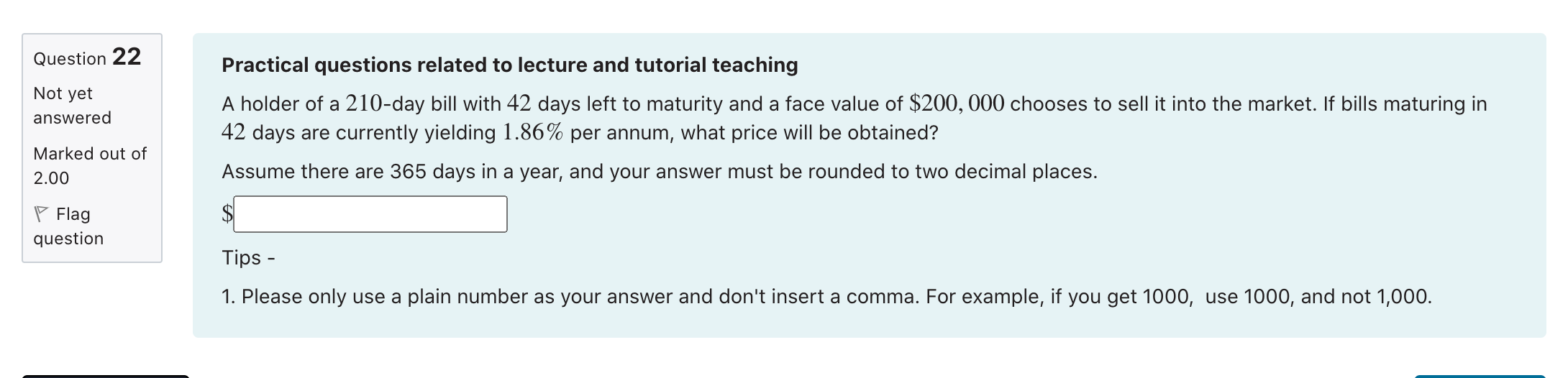

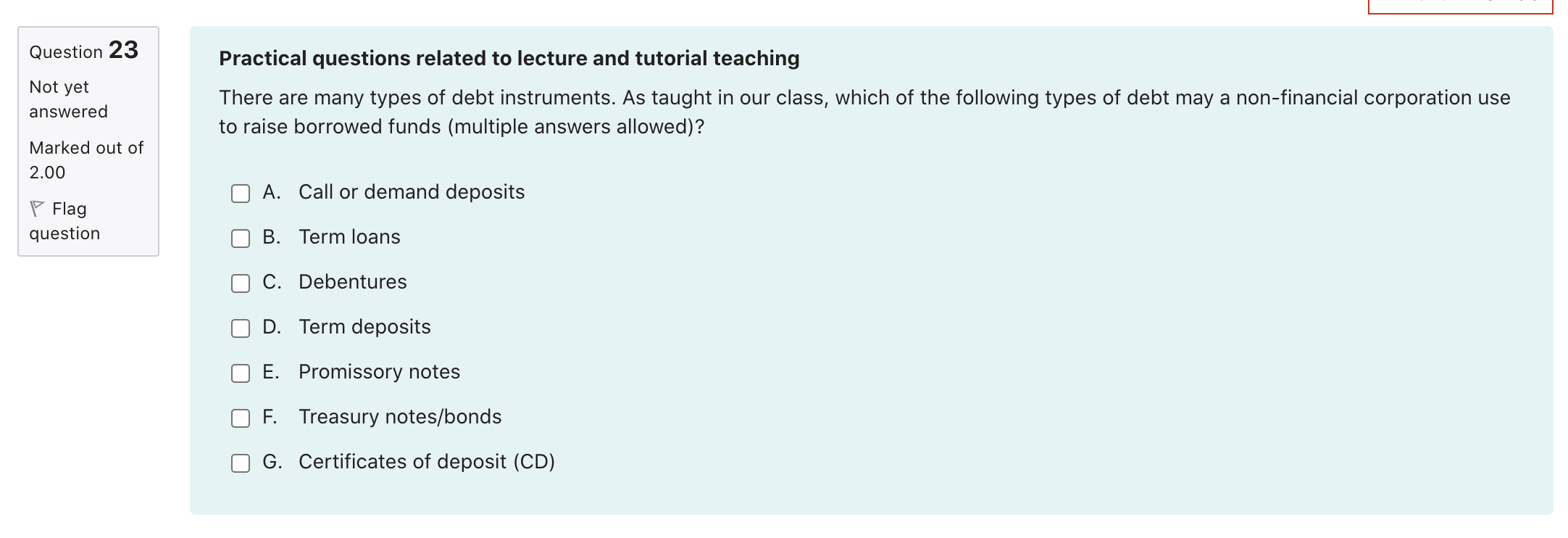

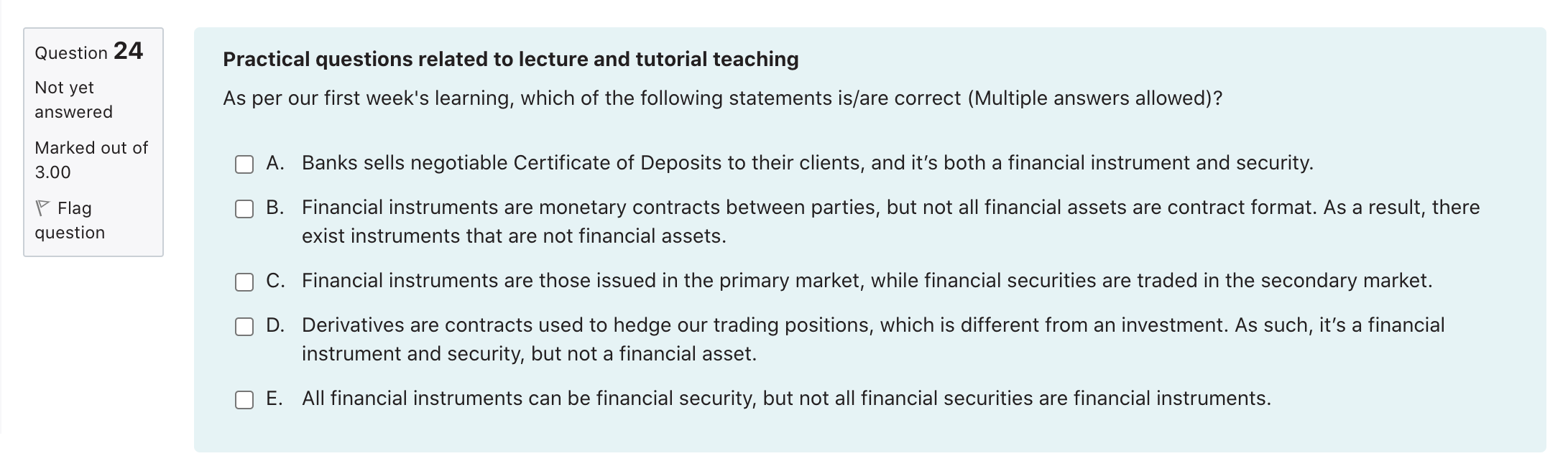

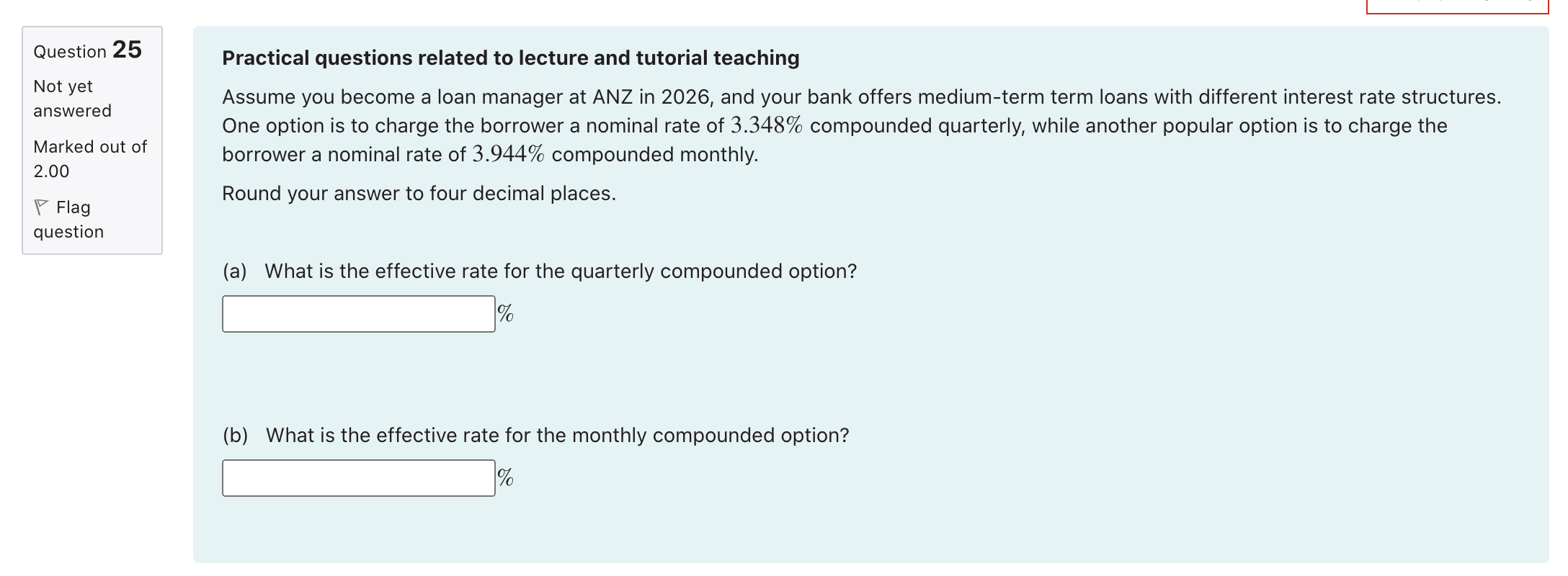

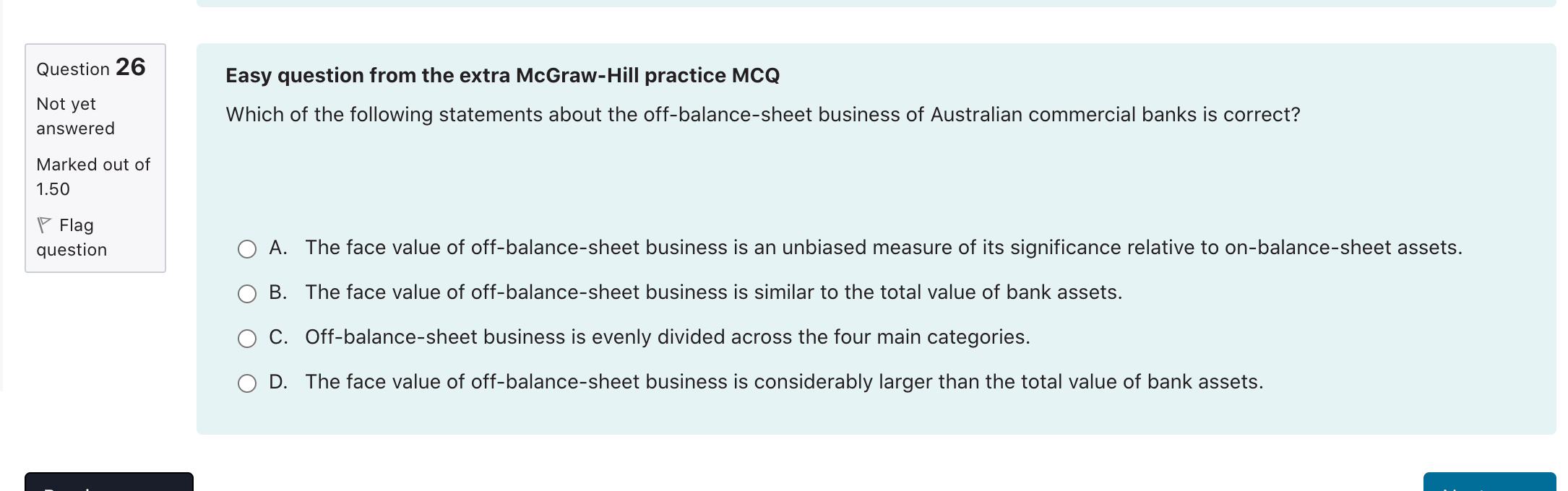

Question 22 Not yet answered Practical questions related to lecture and tutorial teaching A holder of a 210-day bill with 42 days left to maturity and a face value of $200,000 chooses to sell it into the market. If bills maturing in 42 days are currently yielding 1.86% per annum, what price will be obtained? Assume there are 365 days in a year, and your answer must be rounded to two decimal places. Marked out of 2.00 Flag question Tips - 1. Please only use a plain number as your answer and don't insert a comma. For example, if you get 1000, use 1000, and not 1,000. Question 23 Not yet Practical questions related to lecture and tutorial teaching There are many types of debt instruments. As taught in our class, which of the following types of debt may a non-financial corporation use to raise borrowed funds (multiple answers allowed)? answered Marked out of 2.00 A. Call or demand deposits P Flag question B. Term loans C. Debentures D. Term deposits U E. Promissory notes U F. Treasury notes/bonds U G. Certificates of deposit (CD) Question 24 Not yet Practical questions related to lecture and tutorial teaching As per our first week's learning, which of the following statements is/are correct (Multiple answers allowed)? answered Marked out of 3.00 A. Banks sells negotiable Certificate of Deposits to their clients, and it's both a financial instrument and security. P Flag question B. Financial instruments are monetary contracts between parties, but not all financial assets are contract format. As a result, there exist instruments that are not financial assets. C. Financial instruments are those issued in the primary market, while financial securities are traded in the secondary market. D. Derivatives are contracts used to hedge our trading positions, which is different from an investment. As such, it's a financial instrument and security, but not a financial asset. E. All financial instruments can be financial security, but not all financial securities are financial instruments. Question 25 Not yet answered Practical questions related to lecture and tutorial teaching Assume you become a loan manager at ANZ in 2026, and your bank offers medium-term term loans with different interest rate structures. One option is to charge the borrower a nominal rate of 3.348% compounded quarterly, while another popular option is to charge the borrower a nominal rate of 3.944% compounded monthly. Round your answer to four decimal places. Marked out of 2.00 Flag question (a) What is the effective rate for the quarterly compounded option? % (b) What is the effective rate for the monthly compounded option? % Question 26 Not yet Easy question from the extra McGraw-Hill practice MCQ Which of the following statements about the off-balance-sheet business of Australian commercial banks is correct? answered Marked out of 1.50 P Flag question O A. The face value of off-balance-sheet business is an unbiased measure of its significance relative to on-balance-sheet assets. B. The face value of off-balance-sheet business is similar to the total value of bank assets. C. Off-balance-sheet business is evenly divided across the four main categories. O D. The face value of off-balance-sheet business is considerably larger than the total value of bank assets