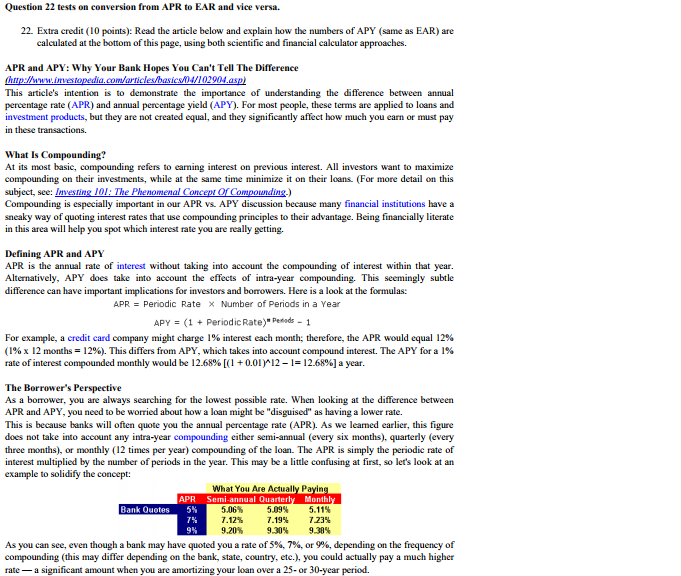

Question 22 tests on conversion from APR to EAR and vice versa. 22 Extra credit (10 points): Read the article below and explain how tbe numbers of APY (same as EAR) are calculated at the bottom of this page, using both scientific and financial calculator APR and APY: Why Your Bank Hopes You Can't Tell The Difference This article's intention is to demonstrate the importance of understanding the difference between annual percentage rate (APR) and annual percentage yield (APY). For most people, these terms are applied to loans and investment products, in these transactions. but they are not created equal, and they significantly affect how much you earn or must pay What Is Compounding? At its most basic, compounding refers to carming interest on previous interest. All investors want to maximize compounding on their investments, while at the same time minimize on their loans. (For more detail on this subject, see: Investing 101: The Phenomenal Concep Of Compounding.) Compounding is especially important in our APR vs. APY discussion because many financial institutions have a sneaky way of quoting interest rates that use compounding principles to their advantage. Being financially literate in this area will help you spot which interest rate you are really getting. Defining APR and APY APR is the annual rate of interest without taking into account the compounding of interest within that year Alternatively, APY does take into account the effects of intra-year compounding. This seemingly subtle difference can have important implications for investors and borrowers. Here is a look at the formulas: APR = Periodic Rate Number of Periods in a Year APY = (1 + Periodic Rate)"Petods-1 For example, a credit card company might charge 1% interest each month: therefore, the APR would equal 12% (1% x 12 months = 12%). This differs from APY, which takes into account compound interest. The APY for a 1% rate of interest compounded monthly would be 12.68% [(1+ 0.01 r12-1= 12.68%) a year. The Borrower's Perspective As a borrower, you are always searching for the lowest possible rate. When looking at the difference between APR and APY, you need to be worried about how a loan might be "disguised" as having a lower rate. This is because banks will often quote you the annual percentage rate (APR). As we leamed earlier, this figure does not take into account any intra-year compounding either semi-annual (every six months), quarterly (every three months), or monthly (12 times per year) compounding of the loan. The APR is simply the periodic rate of interest multiplied by the number of periods in the year. This may be a little confusing at first, so let's look at an example to solidify the concept: What You Are Actually Payin Semi-annual Quarterly Monthl 5.11% 1.23% 9.30% APR 5.09% 7.19% 9.30% 5.06% 7.12% 9.20% As you can see, even though a bank may have quoted you a rate of 5%, 7%, or 9%, depending on the frequency of compounding (this may differ depending on the bank, state, country, etc.), you could actually pay a much higher 7% 9% rate-a significant amount when you are amortizing your loan over a 25-or 30-year period