Answered step by step

Verified Expert Solution

Question

1 Approved Answer

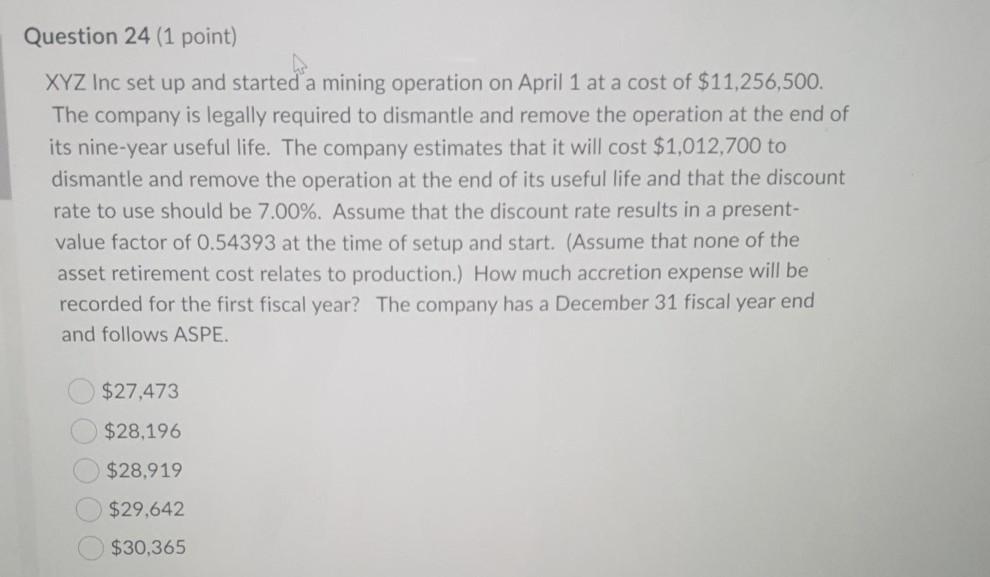

Question 24 (1 point) XYZ Inc set up and started a mining operation on April 1 at a cost of $11,256,500. The company is legally

Question 24 (1 point) XYZ Inc set up and started a mining operation on April 1 at a cost of $11,256,500. The company is legally required to dismantle and remove the operation at the end of its nine-year useful life. The company estimates that it will cost $1,012,700 to dismantle and remove the operation at the end of its useful life and that the discount rate to use should be 7.00%. Assume that the discount rate results in a present- value factor of 0.54393 at the time of setup and start. (Assume that none of the asset retirement cost relates to production.) How much accretion expense will be recorded for the first fiscal year? The company has a December 31 fiscal year end and follows ASPE. $27,473 $28.196 $28.919 $29,642 $30,365

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started