Answered step by step

Verified Expert Solution

Question

1 Approved Answer

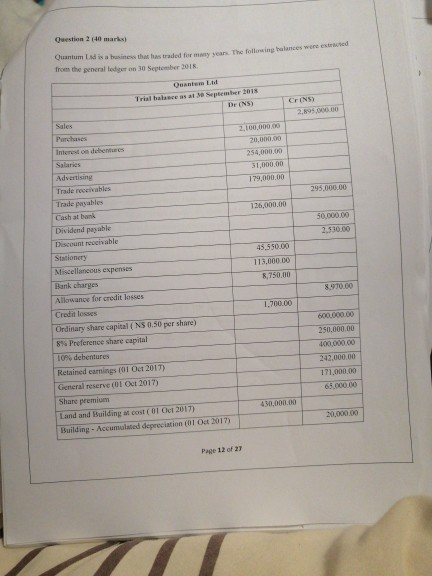

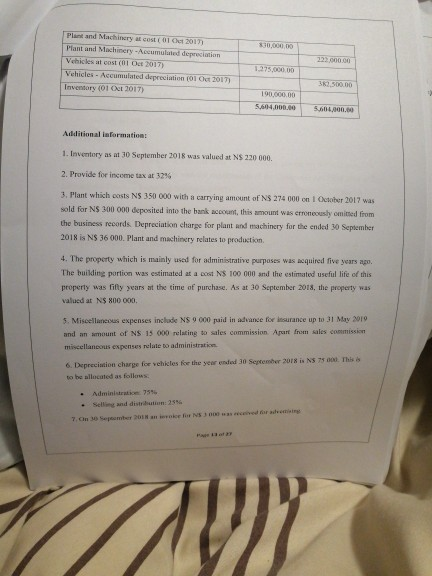

Question 240 mark) Quantum land is a business that has traded for many years. The following balances were extracted from the general ledger on 30

Question 240 mark) Quantum land is a business that has traded for many years. The following balances were extracted from the general ledger on 30 September 2018 Trial best September 2015 Dr (NS) CEINS) 2.100 ODD Sales Purchases 254.000.00 31,000.00 179,000.00 295,000.00 126,000.00 50.000,00 2.310.00 45.550.00 112,000.00 8.750,00 8.970.00 Salaries Advertising Trade movies Trade payables Cash at bank Dividend payable Discount receivable Stationery Miscellaneous expenses Bank charges Allowance for credit losses Credit losses Ordinary share capital (NS 0.50 per share) 8% Preference share capital Lo debentures Retained earnings (01 Oct 2017) General reserve (01 Oct 2017) Share premium Land and Building at cost 01 Oct 2017) Building - Accumulated depreciation (01 Oct 2017) 1.700.00 600,000.00 250,000.00 40000000 242,000.00 171,000.00 65.00000 410,000.00 Page 12 of 2 30,000.00 Plant and Machinery CDI 2017) Plant and Machinery - Accumulated depreciation Vehicles at cost (ol Oct 2017) Vehicles - Accumulated depreciation (01 Oct 2017) Inventory (2017) 1000 on 1275.000.00 32500.00 100.000.00 54604.000 50,000.00 Additional information 1. Inventory as at 30 September 2018 was valued at NS 220 000 2. Provide for income tax at 32% 3. Plant which costs NS 350 000 with a carrying amount of NS 274 000 on 1 October 2017 was sold for NS 300 000 deposited into the bank account, this amount was crroneously omitted from the business records Depreciation charge for plant and machinery for the ended 30 September 2018 is NS 36 000. Plant and machinery relates to production 4. The property which is mainly used for administrative purposes was acquired five years ago The building portion was estimated at a cost NS 100 000 and the estimated useful life of this property was fifty years at the time of purchase. As at 30 September 2018, the property was valued at N$ 800 000 5. Miscellaneous expenses include NS 9000 puid in advance for insurance up to 31 May 2010 and an amount of NS 15 000 relating to sales commission Apart from sales commission miscellaneous expenses relate to administratie 6. Depreciation charge for vehicles for the year ended 30 September 2018 is N75000. This to the allocated as follo Administratie & Allowance for credit kosse was to be reduced to NS 8000 9.8% preference shares are part of equity 10. The management wishes to provide for the following: Interest on debentures due A transfer to general reserve of NS 22000 Auditors fee NS 15 750 You are required to 1. Prepare a statement of profit or loss and other comprehensive income for the year ended 30 September 2018. It should comply with the requirements of the Companies Act 71 of 2008 and International Financial Reporting Standards (IFRS) (15 marks) 2. Prepare a statement of financial position as at 30 September 2018 to comply with the requirements of the Companies Act 71 of 2008 and IFRS. (16 marks) 3. Prepare the notes to the financial statements for the following (9 marks) 3.1 Basis of presentation 3.2 Summary of significant accounting policies 33 Trade and other receivables 3.4 Equity Page 14 of 27 Question 240 mark) Quantum land is a business that has traded for many years. The following balances were extracted from the general ledger on 30 September 2018 Trial best September 2015 Dr (NS) CEINS) 2.100 ODD Sales Purchases 254.000.00 31,000.00 179,000.00 295,000.00 126,000.00 50.000,00 2.310.00 45.550.00 112,000.00 8.750,00 8.970.00 Salaries Advertising Trade movies Trade payables Cash at bank Dividend payable Discount receivable Stationery Miscellaneous expenses Bank charges Allowance for credit losses Credit losses Ordinary share capital (NS 0.50 per share) 8% Preference share capital Lo debentures Retained earnings (01 Oct 2017) General reserve (01 Oct 2017) Share premium Land and Building at cost 01 Oct 2017) Building - Accumulated depreciation (01 Oct 2017) 1.700.00 600,000.00 250,000.00 40000000 242,000.00 171,000.00 65.00000 410,000.00 Page 12 of 2 30,000.00 Plant and Machinery CDI 2017) Plant and Machinery - Accumulated depreciation Vehicles at cost (ol Oct 2017) Vehicles - Accumulated depreciation (01 Oct 2017) Inventory (2017) 1000 on 1275.000.00 32500.00 100.000.00 54604.000 50,000.00 Additional information 1. Inventory as at 30 September 2018 was valued at NS 220 000 2. Provide for income tax at 32% 3. Plant which costs NS 350 000 with a carrying amount of NS 274 000 on 1 October 2017 was sold for NS 300 000 deposited into the bank account, this amount was crroneously omitted from the business records Depreciation charge for plant and machinery for the ended 30 September 2018 is NS 36 000. Plant and machinery relates to production 4. The property which is mainly used for administrative purposes was acquired five years ago The building portion was estimated at a cost NS 100 000 and the estimated useful life of this property was fifty years at the time of purchase. As at 30 September 2018, the property was valued at N$ 800 000 5. Miscellaneous expenses include NS 9000 puid in advance for insurance up to 31 May 2010 and an amount of NS 15 000 relating to sales commission Apart from sales commission miscellaneous expenses relate to administratie 6. Depreciation charge for vehicles for the year ended 30 September 2018 is N75000. This to the allocated as follo Administratie & Allowance for credit kosse was to be reduced to NS 8000 9.8% preference shares are part of equity 10. The management wishes to provide for the following: Interest on debentures due A transfer to general reserve of NS 22000 Auditors fee NS 15 750 You are required to 1. Prepare a statement of profit or loss and other comprehensive income for the year ended 30 September 2018. It should comply with the requirements of the Companies Act 71 of 2008 and International Financial Reporting Standards (IFRS) (15 marks) 2. Prepare a statement of financial position as at 30 September 2018 to comply with the requirements of the Companies Act 71 of 2008 and IFRS. (16 marks) 3. Prepare the notes to the financial statements for the following (9 marks) 3.1 Basis of presentation 3.2 Summary of significant accounting policies 33 Trade and other receivables 3.4 Equity Page 14 of 27

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started