Answered step by step

Verified Expert Solution

Question

1 Approved Answer

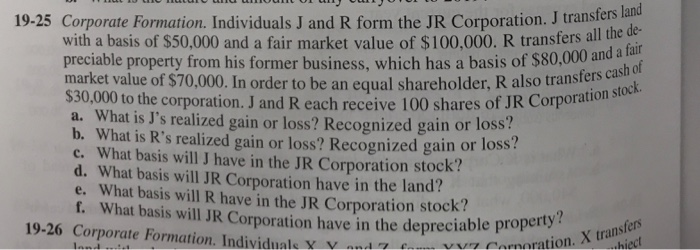

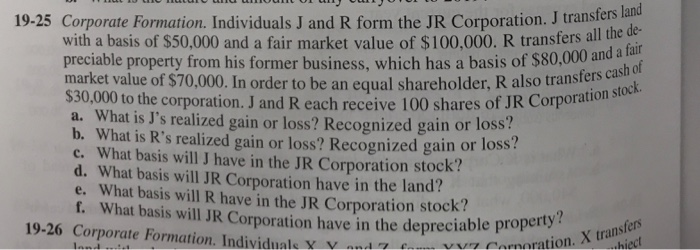

Question 25 19-25 Corporate Formation. Individuals J and R form the JR Corporation. J transfers lia with a basis of $50,000 and a fair market

Question 25

19-25 Corporate Formation. Individuals J and R form the JR Corporation. J transfers lia with a basis of $50,000 and a fair market value of $100,000. R transfers al u preciable property from his former business, which has a basis of $80,000 an d a fair s cash of market value of $70,000. In order to be an equal shareholder, R alotanterock $30,000 to the corporation. J and R each receive 100 shares of JR Corporation a. What is J's realized gain or loss? Recognized gain or loss b. What is R's realized gain or loss? Recognized gain or loss c. What basis will J have in the JR Corporation stock? d. What basis will JR Corporation have in the land? e. What basis will R have in the JR Corporation stock? r. What basis will JR Corporation have in the depreciable prope nsfers 19-26 Corporate Formation. Individual Y vrzennaration. X trans hi y and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started