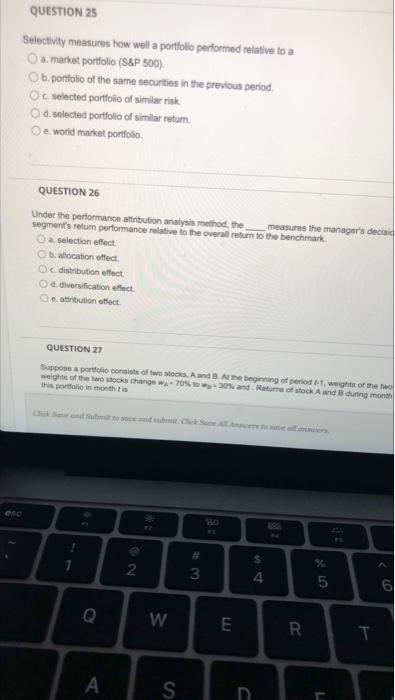

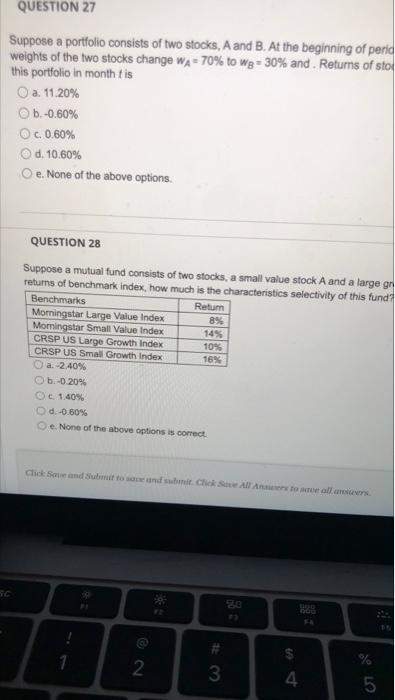

QUESTION 25 Selectivity measures how well a portfolio performed relative to a a market portfolio (S&P 500) b. portfolio of the same securities in the previous period, OC selected portfolio of similar risk Od selected portfolio of similar return De world market portfolio QUESTION 26 Under the performance attribution analysis method, the measures the manager's decisid segment's retum performance relative to the overall return to the benchmark a selection effect ballocation elect distribution efect d. diversification effect e attribution effect QUESTION 27 Suppose a porti consists of two and the beginning of period, weights of the two weighs of the two change - 70%-30% and Return of stock A and B during month this portfolio in months Semers esc. LO 2 3 $ 4 5 6 0 Q W E R T A S n 1 ve to a riod the meatures the manager's decision to ove or underweight a particular market segment in terms of that retum to the benchmark A beginning of pand weight of the two stos 0% and 0. At the beginning of penodt W 30% and Ritums of stock and during mordetare -10% -12% - The Granan measure for $: 4 5 6 7 8 9 R. . Y U G H . QUESTION 27 Suppose a portfolio consists of two stocks, A and B. At the beginning of perid weights of the two stocks change WA= 70% to wg - 30% and Returns of sto this portfolio in month tis a. 11.20% b.-0.60% O c.0.60% d. 10.60% Oe. None of the above options. QUESTION 28 Suppose a mutual fund consists of two stocks, a small value stock A and a large gn returns of benchmark index, how much is the characteristics selectivity of this fund? Benchmarks Retum Morningstar Large Value Index 8% Momingstar Small Value Index 14% CRSP US Large Growth Index 10% CRSP US Small Growth Index 16% a.-2.40% O b.- 20% O e 1.40% d.-0.60% e. None of the above options is correct Click Save and Submit tonbet Click Save All Aroll 56 LED DO $ 2 3 4. 5 glening ot period 1-1, weights of the two stocks are w-40% and wg 50%. At the beginning of period Returns of stock A and B during month are a 10% and 12. The Grinblatt-Titman measure for value-stock and a large growth stock BW30 W 70% 145 and Re=12%. Given the following istica selectivity of this fund? s 4 0) > & 7 5 6 8 9 R T Y 0 F. G H . J K V C N M