Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Today is November 8 , 2 0 0 6 . You have been retained to suggest an effective hedging strategy to an investor, who invested

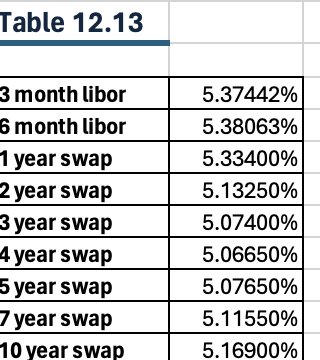

Today is November You have been retained to suggest an effective hedging strategy to an investor, who invested in callable bonds. In particular, the bond portfolio is long in year AAA rated corporate coupon bonds par million which will become callable in exactly three years. The investor is worried about prepayment risk, and your job is to set up an effective hedging strategy using American swaptions. The current LIBOR and swap rates are in Table From the LIBOR and swap rates compute the semiannual discount curve Z T up to T Table LIBOR and Swap Rates on November year swap Source: Bloomberg. I have attached the solutions but i can't seem to get itTable tablemonth libor,

Today is November You have been retained to suggest an effective hedging strategy to an investor, who invested in callable bonds. In particular, the bond portfolio is long in year AAA rated corporate coupon bonds par million which will become callable in exactly three years. The investor is worried about prepayment risk, and your job is to set up an effective hedging strategy using American swaptions. The current LIBOR and swap rates are in Table

From the LIBOR and swap rates compute the semiannual discount curve Z T up to T Table LIBOR and Swap Rates on November year swap

Source: Bloomberg. I have attached the solutions but i can't seem to get itTable

tablemonth libor,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started