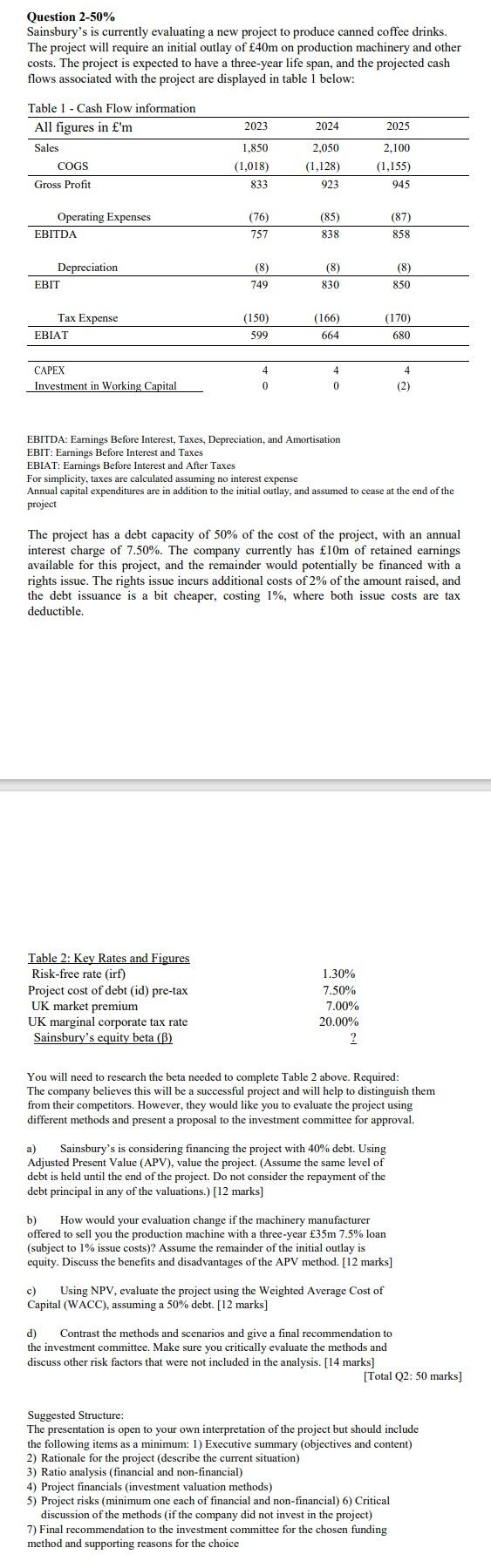

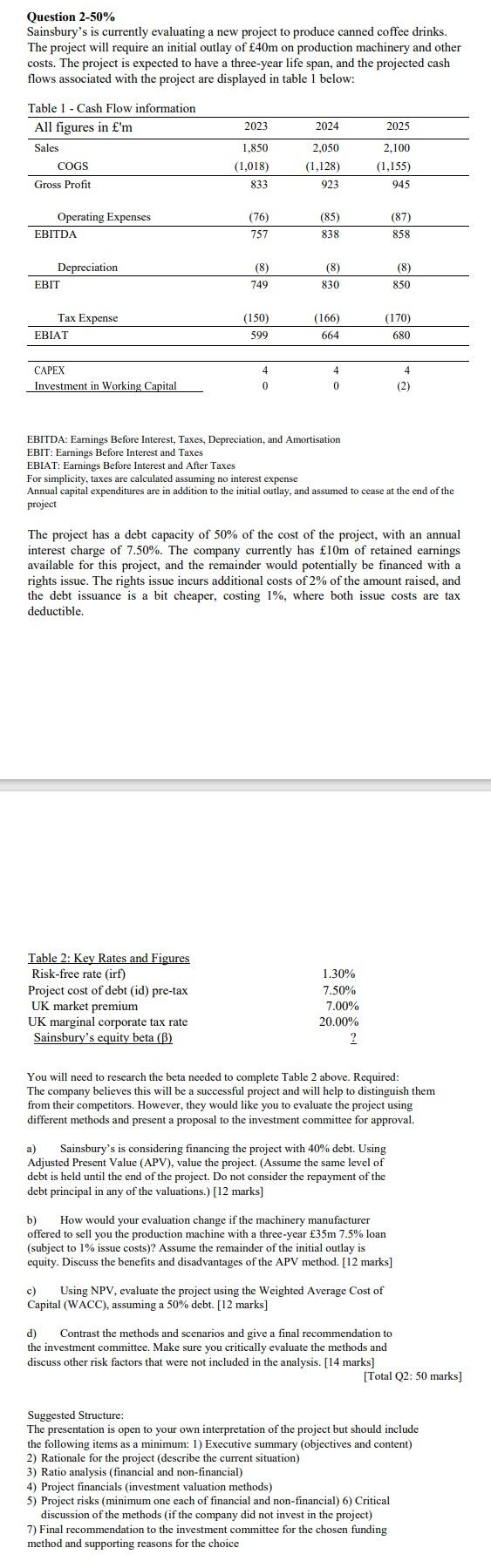

Question 2-50\% Sainsbury's is currently evaluating a new project to produce canned coffee drinks. The project will require an initial outlay of 40m on production machinery and other costs. The project is expected to have a three-year life span, and the projected cash flows associated with the project are displayed in table 1 below: EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortisation EBIT: Earnings Before Interest and Taxes EBIAT: Earnings Before Interest and After Taxes For simplicity, taxes are calculated assuming no interest expense Annual capital expenditures are in addition to the initial outlay, and assumed to cease at the end of the The project has a debt capacity of 50% of the cost of the project, with an annual interest charge of 7.50%. The company currently has 10m of retained earnings available for this project, and the remainder would potentially be financed with a rights issue. The rights issue incurs additional costs of 2% of the amount raised, and deductible. You will need to research the beta needed to complete Table 2 above. Required: The company believes this will be a successful project and will help to distinguish them from their competitors. However, they would like you to evaluate the project using different methods and present a proposal to the investment committee for approval. a) Sainsbury's is considering financing the project with 40% debt. Using Adjusted Present Value (APV), value the project. (Assume the same level of debt is held until the end of the project. Do not consider the repayment of the debt principal in any of the valuations.) [12 marks] b) How would your evaluation change if the machinery manufacturer offered to sell you the production machine with a three-year 35m7.5% loan (subject to 1% issue costs)? Assume the remainder of the initial outlay is equity. Discuss the benefits and disadvantages of the APV method. [12 marks] Using NPV, evaluate the project using the Weighted Average Cost of Capital (WACC), assuming a 50% debt. [12 marks] d) Contrast the methods and scenarios and give a final recommendation to the investment committee. Make sure you critically evaluate the methods and discuss other risk factors that were not included in the analysis. [14 marks] [Total Q2: 50 marks] Suggested Structure: The presentation is open to your own interpretation of the project but should include the following items as a minimum: 1) Executive summary (objectives and content) 2) Rationale for the project (describe the current situation) 3) Ratio analysis (financial and non-financial) 4) Project financials (investment valuation methods) 5) Project risks (minimum one each of financial and non-financial) 6) Critical discussion of the methods (if the company did not invest in the project) 7) Final recommendation to the investment committee for the chosen funding method and supporting reasons for the choice Question 2-50\% Sainsbury's is currently evaluating a new project to produce canned coffee drinks. The project will require an initial outlay of 40m on production machinery and other costs. The project is expected to have a three-year life span, and the projected cash flows associated with the project are displayed in table 1 below: EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortisation EBIT: Earnings Before Interest and Taxes EBIAT: Earnings Before Interest and After Taxes For simplicity, taxes are calculated assuming no interest expense Annual capital expenditures are in addition to the initial outlay, and assumed to cease at the end of the The project has a debt capacity of 50% of the cost of the project, with an annual interest charge of 7.50%. The company currently has 10m of retained earnings available for this project, and the remainder would potentially be financed with a rights issue. The rights issue incurs additional costs of 2% of the amount raised, and deductible. You will need to research the beta needed to complete Table 2 above. Required: The company believes this will be a successful project and will help to distinguish them from their competitors. However, they would like you to evaluate the project using different methods and present a proposal to the investment committee for approval. a) Sainsbury's is considering financing the project with 40% debt. Using Adjusted Present Value (APV), value the project. (Assume the same level of debt is held until the end of the project. Do not consider the repayment of the debt principal in any of the valuations.) [12 marks] b) How would your evaluation change if the machinery manufacturer offered to sell you the production machine with a three-year 35m7.5% loan (subject to 1% issue costs)? Assume the remainder of the initial outlay is equity. Discuss the benefits and disadvantages of the APV method. [12 marks] Using NPV, evaluate the project using the Weighted Average Cost of Capital (WACC), assuming a 50% debt. [12 marks] d) Contrast the methods and scenarios and give a final recommendation to the investment committee. Make sure you critically evaluate the methods and discuss other risk factors that were not included in the analysis. [14 marks] [Total Q2: 50 marks] Suggested Structure: The presentation is open to your own interpretation of the project but should include the following items as a minimum: 1) Executive summary (objectives and content) 2) Rationale for the project (describe the current situation) 3) Ratio analysis (financial and non-financial) 4) Project financials (investment valuation methods) 5) Project risks (minimum one each of financial and non-financial) 6) Critical discussion of the methods (if the company did not invest in the project) 7) Final recommendation to the investment committee for the chosen funding method and supporting reasons for the choice