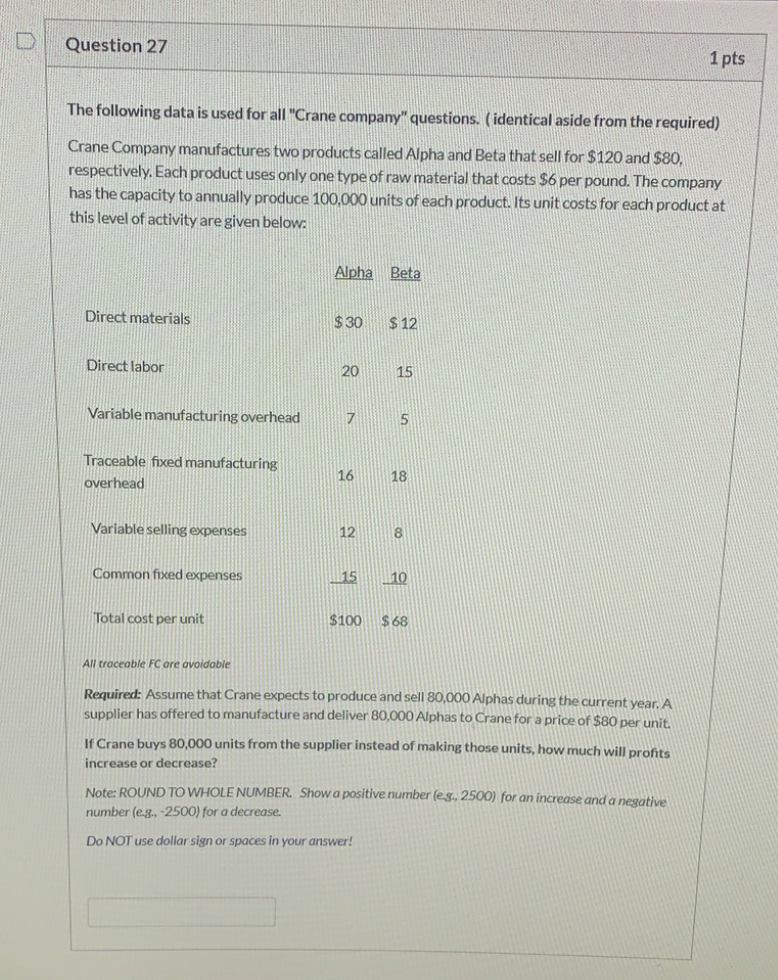

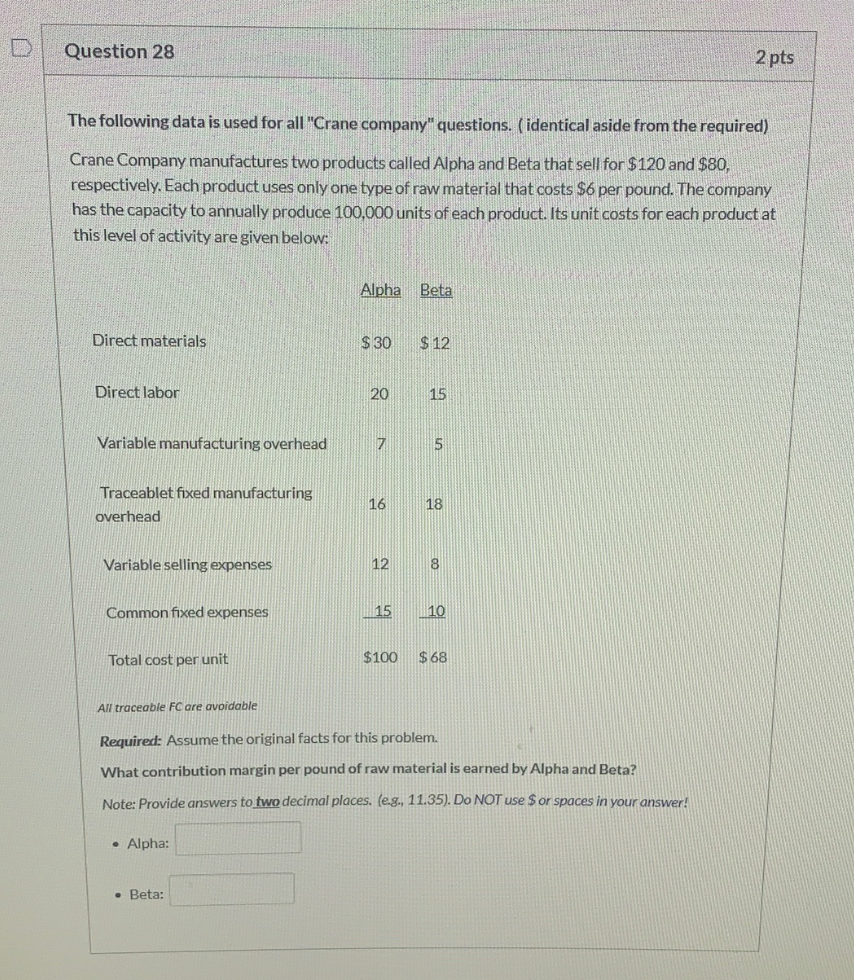

Question 27 1 pts The following data is used for all "Crane company" questions. (identical aside from the required) Crane Company manufactures two products called Alpha and Beta that sell for $120 and $80, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 100,000 units of each product. Its unit costs for each product at this level of activity are given below. Alpha Beta Direct materials $30 $ 12 Direct labor Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses 12 8 Common fixed expenses 15 10 Total cost per unit $100 $68 All traceable FC are avoidable Required: Assume that Crane expects to produce and sell 80,000 Alphas during the current year. A supplier has offered to manufacture and deliver 80,000 Alphas to Crane for a price of $80 per unit. If Crane buys 80,000 units from the supplier instead of making those units, how much will pronts increase or decrease? Note: ROUND TO WHOLE NUMBER. Show a positive number(es., 2500) for an increase and a negative number(eg., -2500) for a decrease. Do NOT use dollar sign or spaces in your answer! Question 28 2 pts The following data is used for all "Crane company" questions. (identical aside from the required) Crane Company manufactures two products called Alpha and Beta that sell for $120 and $80, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 100,000 units of each product. Its unit costs for each product at this level of activity are given below: Alpha Beta Direct materials $30 $12 Direct labor 20 15 Variable manufacturing overhead 7 Traceablet fixed manufacturing overhead 16 18 Variable selling expenses Common fixed expenses 15 10 Total cost per unit $100 $68 All traceable FC are avoidable Required: Assume the original facts for this problem. What contribution margin per pound of raw material is earned by Alpha and Beta? Note: Provide answers to two decimal places. (eg, 11.35). Do NOT use Sor spaces in your answer! Alpha: Beta