Answered step by step

Verified Expert Solution

Question

1 Approved Answer

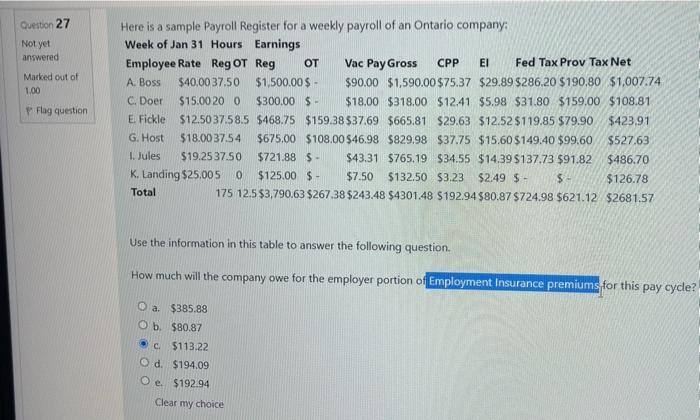

Question 27 Not yet answered Marked out of 1.00 Flag question Here is a sample Payroll Register for a weekly payroll of an Ontario

Question 27 Not yet answered Marked out of 1.00 Flag question Here is a sample Payroll Register for a weekly payroll of an Ontario company: Week of Jan 31 Hours Earnings Employee Rate A. Boss $40.00 37.50 C. Doer $15.00 20 0 E. Fickle $12.50 37.58.5 G. Host $18.00 37.54 1. Jules $19.2537.50 $721.88 $- K. Landing $25,005 0 $125.00 $- Total Reg OT Reg OT $1,500.00 $ - $300.00 $- Vac Pay Gross CPP Fed Tax Prov Tax Net $90.00 $1,590.00 $75.37 $29.89 $286.20 $190.80 $1,007.74 $18.00 $318.00 $12.41 $5.98 $31.80 $159.00 $108.81 $468.75 $159.38$37.69 $665.81 $423.91 $675.00 $108.00 $46.98 $829.98 $29.63 $12.52 $119.85 $79.90 $527.63 $37.75 $15.60 $149.40 $99.60 $43.31 $765.19 $34.55 $14.39 $137.73 $91.82 $7.50 $132.50 $3.23 $2.49 $- $486.70 $ $126.78 175 12.5 $3,790.63 $267.38 $243.48 $4301.48 $192.94 $80.87 $724.98 $621.12 $2681.57 Use the information in this table to answer the following question. How much will the company owe for the employer portion of Employment Insurance premiums for this pay cycle? O a $385.88 O b. $80.87 C $113.22 O d. $194.09 Oe. $192.94 Clear my choice An example of a taxable benefit would be: O a. A paid gym membership. b. Use of a company car while working. O C. An ergonomic chair provided for the employee to use at the office. O d. Tuition paid for a WordPress course required for work. Oe. Airline tickets to travel to an office event. Clear my choice Cell phone service paid for by the employer for the employee's personal use is: O a. Not taxable but subject to CPP deductions O b. Taxable with CPP and El deductions Not taxable Taxable with CPP deductions but not El Taxable with El deductions but not CPP c. O d. O e.

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

AnswerThe answer provided below has been developed in a clear step by step manner St...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started