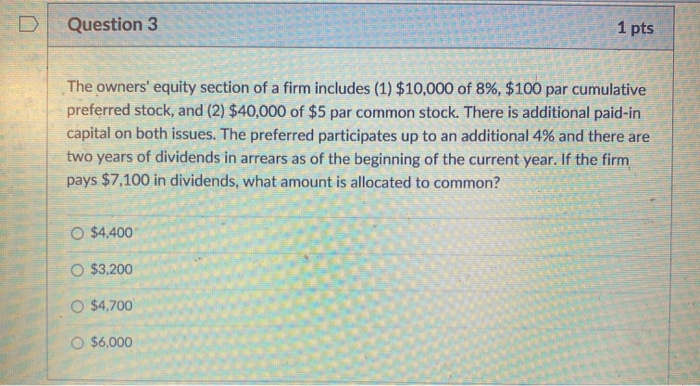

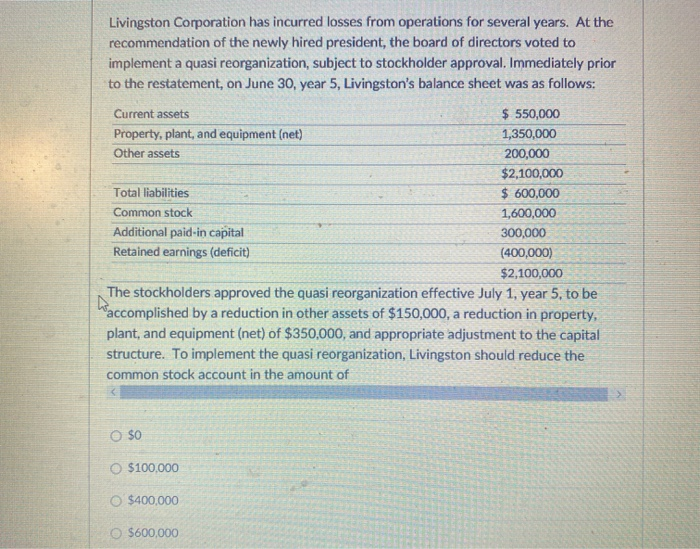

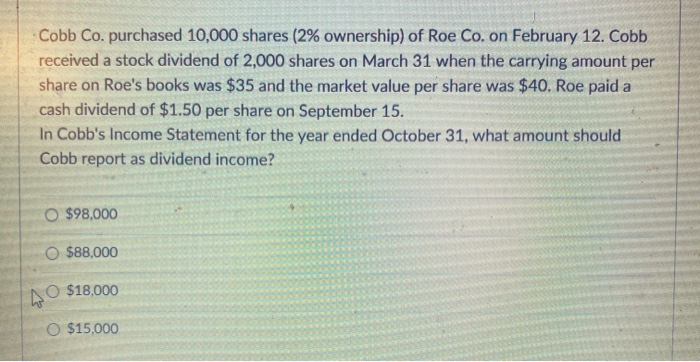

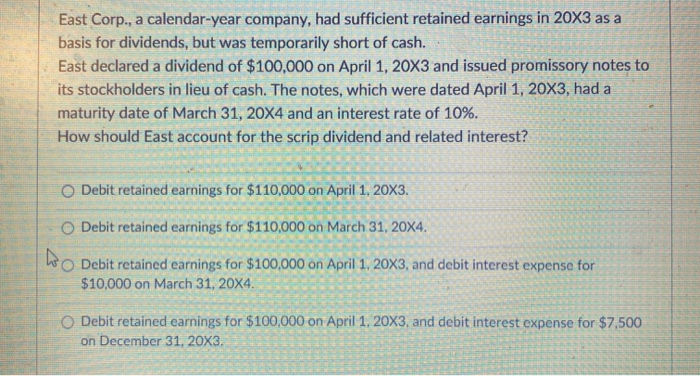

Question 3 1 pts The owners' equity section of a firm includes (1) $10,000 of 8%, $100 par cumulative preferred stock, and (2) $40,000 of $5 par common stock. There is additional paid-in capital on both issues. The preferred participates up to an additional 4% and there are two years of dividends in arrears as of the beginning of the current year. If the firm pays $7,100 in dividends, what amount is allocated to common? 0 $4,400 O $3,200 O $4.700 O $6,000 Current assets Other assets Livingston Corporation has incurred losses from operations for several years. At the recommendation of the newly hired president, the board of directors voted to implement a quasi reorganization, subject to stockholder approval. Immediately prior to the restatement, on June 30, year 5, Livingston's balance sheet was as follows: $ 550,000 Property, plant, and equipment (net) 1,350,000 200,000 $2,100,000 Total liabilities $ 600,000 Common stock 1,600,000 Additional paid-in capital 300,000 Retained earnings (deficit) (400,000) $2,100,000 The stockholders approved the quasi reorganization effective July 1, year 5, to be Waccomplished by a reduction in other assets of $150,000, a reduction in property, plant, and equipment (net) of $350,000, and appropriate adjustment to the capital structure. To implement the quasi reorganization, Livingston should reduce the common stock account in the amount of $0 $100,000 O $400,000 $600,000 Cobb Co. purchased 10,000 shares (2% ownership) of Roe Co. on February 12. Cobb received a stock dividend of 2,000 shares on March 31 when the carrying amount per share on Roe's books was $35 and the market value per share was $40. Roe paid a cash dividend of $1.50 per share on September 15. In Cobb's Income Statement for the year ended October 31, what amount should Cobb report as dividend income? O $98,000 O $88,000 NO $18,000 O $15,000 East Corp., a calendar-year company, had sufficient retained earnings in 20x3 as a basis for dividends, but was temporarily short of cash. East declared a dividend of $100,000 on April 1, 20X3 and issued promissory notes to its stockholders in lieu of cash. The notes, which were dated April 1, 20X3, had a maturity date of March 31, 20X4 and an interest rate of 10%. How should East account for the scrip dividend and related interest? Debit retained earnings for $110,000 on April 1, 20X3. O Debit retained earnings for $110,000 on March 31, 20X4. Wo Debit retained earnings for $100,000 on April 1, 20X3, and debit interest expense for $10,000 on March 31, 20X4. Debit retained earnings for $100,000 on April 1. 20X3, and debit interest expense for $7,500 on December 31, 20X3