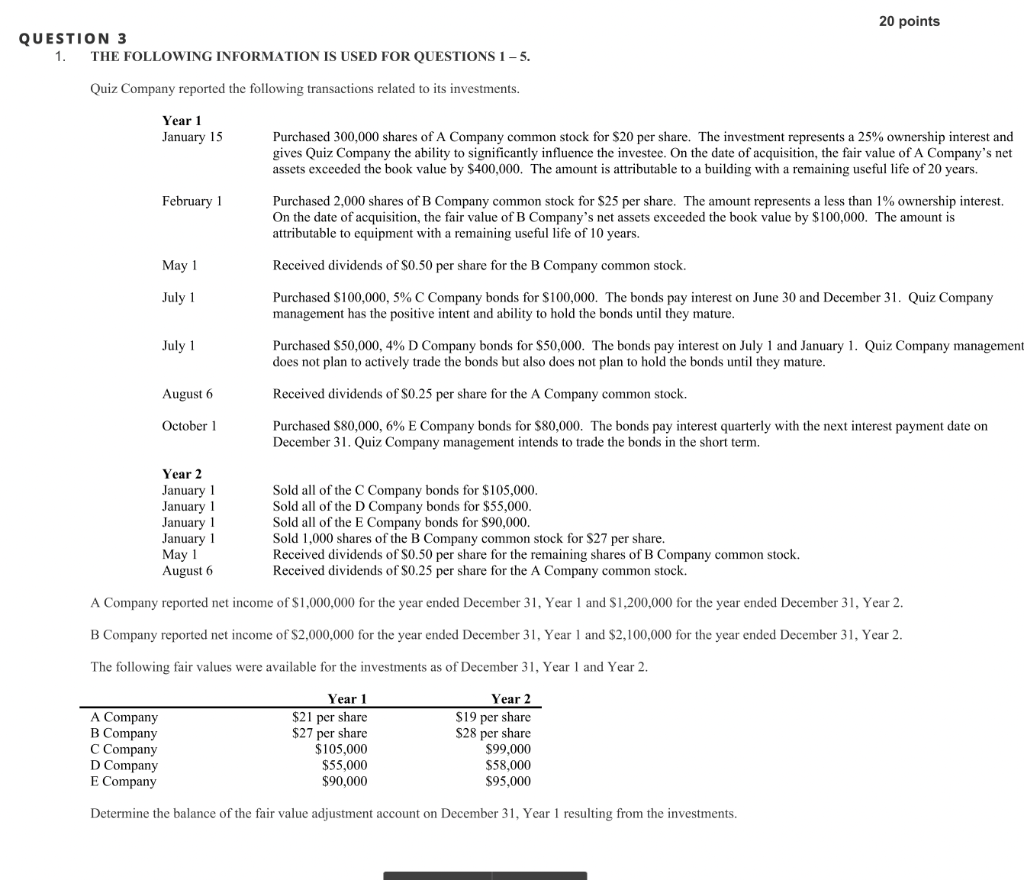

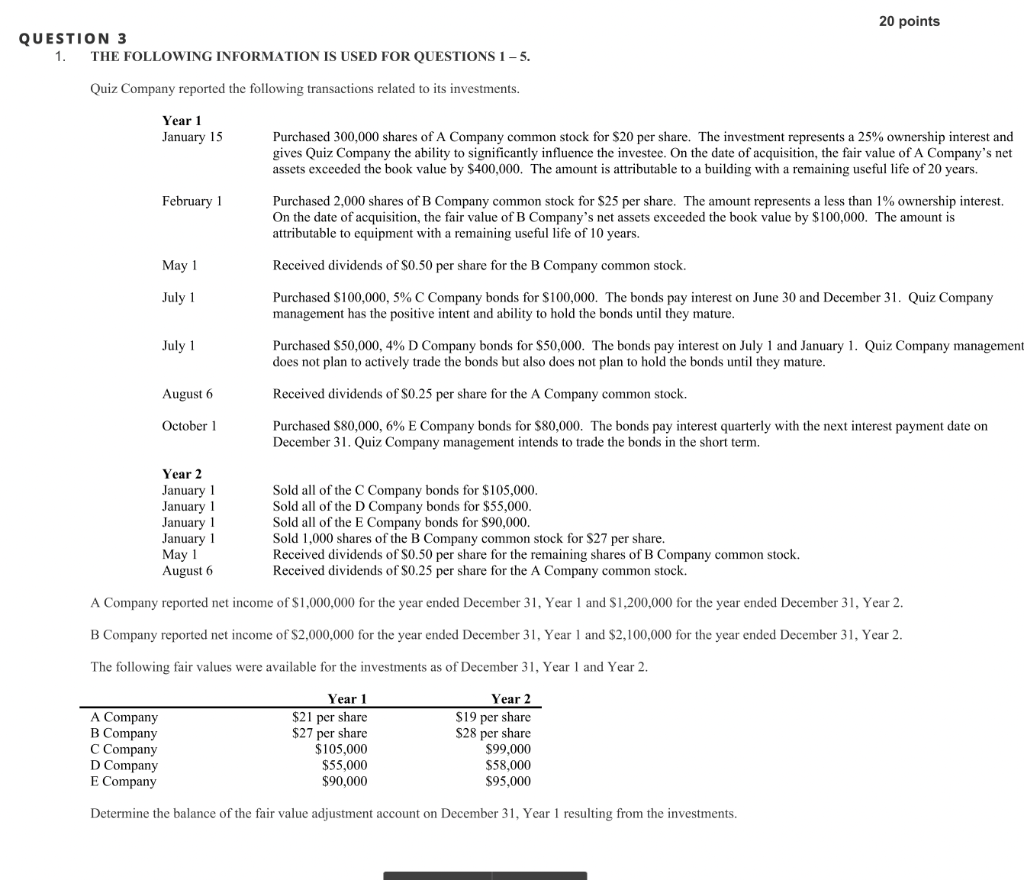

QUESTION 3 1. THE FOLLOWING INFORMATION IS USED FOR QUESTIONS 15. Quiz Company reported the following transactions related to its investments. Year 1 January 15 Purchased 300,000 shares of A Company common stock for $20 per share. The investment represents a 25% ownership interest and gives Quiz Company the ability to significantly influence the investee. On the date of acquisition, the fair value of A Company's net assets exceeded the book value by $400,000. The amount is attributable to a building with a remaining useful life of 20 years. February1May1July1Purchased2,000sharesofBCompanycommonstockfor$25pershare.Theamountrepresentsalessthan1%ownershipinterest.Onthedateofacquisition,thefairvalueofBCompanysnetassetsexceededthebookvalueby$100,000.Theamountisattributabletoequipmentwitharemainingusefullifeof10years.Receiveddividendsof$0.50persharefortheBCompanycommonstock.Purchased$100,000,5%CCompanybondsfor$100,000.ThebondspayinterestonJune30andDecember31.QuizCompany management has the positive intent and ability to hold the bonds until they mature. July1August6October1Purchased$50,000,4%DCompanybondsfor$50,000.ThebondspayinterestonJuly1andJanuary1.QuizCompanymanagedoesnotplantoactivelytradethebondsbutalsodoesnotplantoholdthebondsuntiltheymature.Receiveddividendsof$0.25persharefortheACompanycommonstock.Purchased$80,000,6%ECompanybondsfor$80,000.Thebondspayinterestquarterlywiththenextinterestpaymentdateon December 31. Quiz Company management intends to trade the bonds in the short term. Year 2 January 1 Sold all of the C Company bonds for $105,000. January 1 Sold all of the D Company bonds for $55,000. January 1 Sold 1,000 shares of the B Company common stock for $27 per share. May 1 Received dividends of \$0.50 per share for the remaining shares of B Company common stock. August 6 Received dividends of $0.25 per share for the A Company common stock. A Company reported net income of $1,000,000 for the year ended December 31, Year 1 and $1,200,000 for the year ended December 31 , Year 2. B Company reported net income of $2,000,000 for the year ended December 31, Year 1 and $2,100,000 for the year ended December 31 , Year 2. The following fair values were available for the investments as of December 31 , Year 1 and Year 2 . Determine the balance of the fair value adjustment account on December 31, Year 1 resulting from the investments. QUESTION 3 1. THE FOLLOWING INFORMATION IS USED FOR QUESTIONS 15. Quiz Company reported the following transactions related to its investments. Year 1 January 15 Purchased 300,000 shares of A Company common stock for $20 per share. The investment represents a 25% ownership interest and gives Quiz Company the ability to significantly influence the investee. On the date of acquisition, the fair value of A Company's net assets exceeded the book value by $400,000. The amount is attributable to a building with a remaining useful life of 20 years. February1May1July1Purchased2,000sharesofBCompanycommonstockfor$25pershare.Theamountrepresentsalessthan1%ownershipinterest.Onthedateofacquisition,thefairvalueofBCompanysnetassetsexceededthebookvalueby$100,000.Theamountisattributabletoequipmentwitharemainingusefullifeof10years.Receiveddividendsof$0.50persharefortheBCompanycommonstock.Purchased$100,000,5%CCompanybondsfor$100,000.ThebondspayinterestonJune30andDecember31.QuizCompany management has the positive intent and ability to hold the bonds until they mature. July1August6October1Purchased$50,000,4%DCompanybondsfor$50,000.ThebondspayinterestonJuly1andJanuary1.QuizCompanymanagedoesnotplantoactivelytradethebondsbutalsodoesnotplantoholdthebondsuntiltheymature.Receiveddividendsof$0.25persharefortheACompanycommonstock.Purchased$80,000,6%ECompanybondsfor$80,000.Thebondspayinterestquarterlywiththenextinterestpaymentdateon December 31. Quiz Company management intends to trade the bonds in the short term. Year 2 January 1 Sold all of the C Company bonds for $105,000. January 1 Sold all of the D Company bonds for $55,000. January 1 Sold 1,000 shares of the B Company common stock for $27 per share. May 1 Received dividends of \$0.50 per share for the remaining shares of B Company common stock. August 6 Received dividends of $0.25 per share for the A Company common stock. A Company reported net income of $1,000,000 for the year ended December 31, Year 1 and $1,200,000 for the year ended December 31 , Year 2. B Company reported net income of $2,000,000 for the year ended December 31, Year 1 and $2,100,000 for the year ended December 31 , Year 2. The following fair values were available for the investments as of December 31 , Year 1 and Year 2 . Determine the balance of the fair value adjustment account on December 31, Year 1 resulting from the investments