Answered step by step

Verified Expert Solution

Question

1 Approved Answer

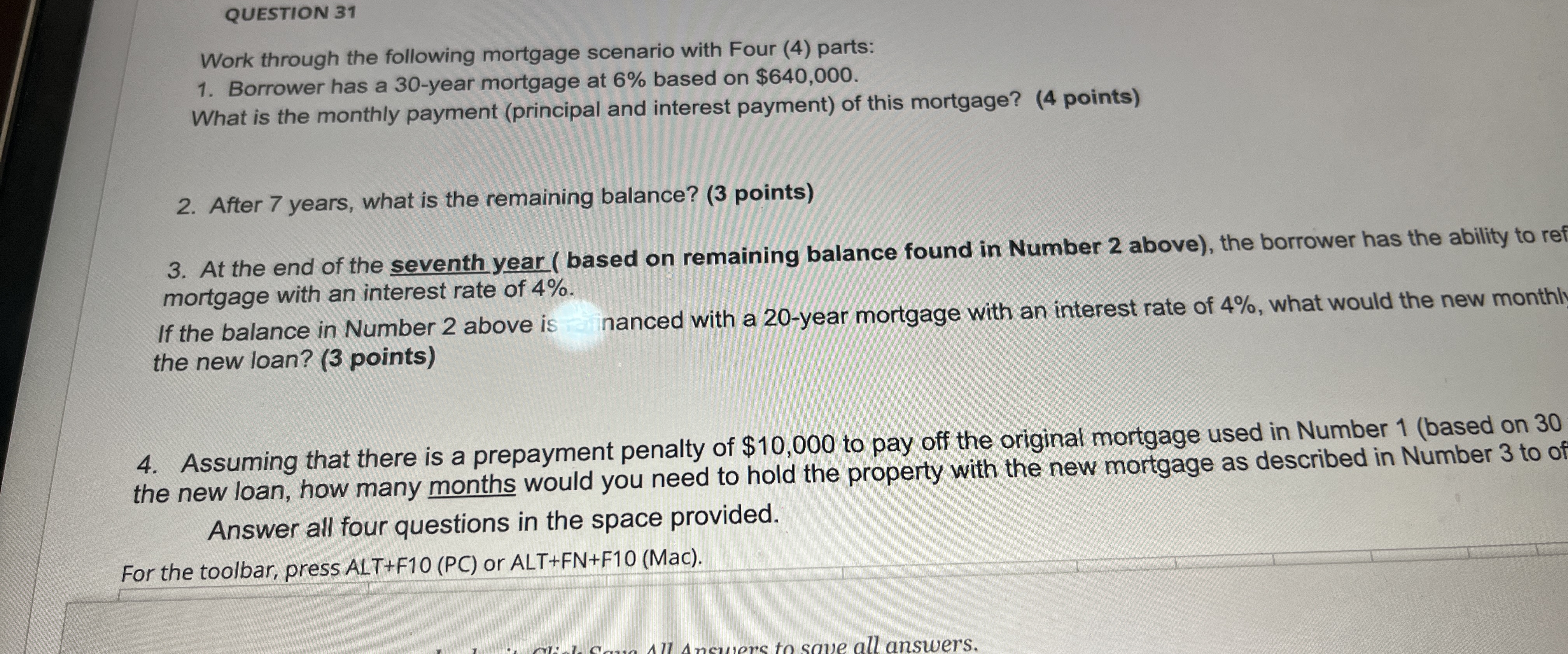

QUESTION 3 1 Work through the following mortgage scenario with Four ( 4 ) parts: Borrower has a 3 0 - year mortgage at 6

QUESTION

Work through the following mortgage scenario with Four parts:

Borrower has a year mortgage at based on $

What is the monthly payment principal and interest payment of this mortgage? points

After years, what is the remaining balance? points

At the end of the seventh year based on remaining balance found in Number above the borrower has the ability to ref mortgage with an interest rate of

If the balance in Number above is nanced with a year mortgage with an interest rate of what would the new monthl the new loan? points

Assuming that there is a prepayment penalty of $ to pay off the original mortgage used in Number based on the new loan, how many months would you need to hold the property with the new mortgage as described in Number to of Answer all four questions in the space provided.

For the toolbar, press ALTFPC or ALTFNFMac

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started