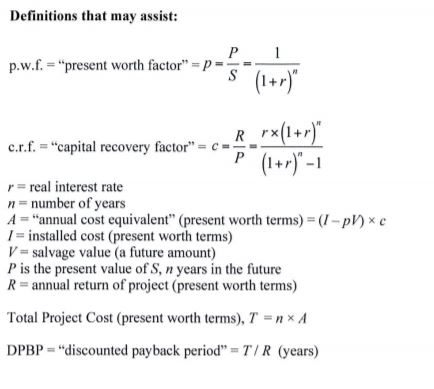

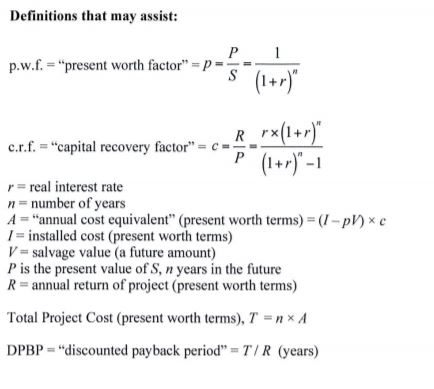

QUESTION 3 10 marks You are considering the purchase of a new automated CNC machining centre for your company's manufacturing division. The required capital is $3,300,000. The planned life of this machine is estimated at 1 years, after which the salvage value will be $450,000. You have calculated that this machining centre will enable the machining of precision components 24 hours per day (thus increasing gross revenue by $650,000 annually) and more efficiently (by reducing annual labor costs by $180,000). The prime-lending rate is currently 7.5%. Inflation is running at 1.0 % . aksan Figure 3: Typical Computer Numerically Controlled (CNC) machining centre Your tasks Calculate the discounted payback period for this proposal, taking account of the 'time-value of money. All financial estimates are in Australian dollars 3.1 8 marks 3.2a Explain why the caleulation does not depend on whether your company uses its own liquid assets to fund the project, or raises the capital by borrowing. 3.2b Recommend whether, in your opinion, the new automated CNC machining centre development should proceed. mark 3.2c State any assumptions you have made or additional information you require in order to answer this question more fully (i.e. if you were working as a professional consulting engineer preparing a briefing paper) I mark Definitions that may assist p.w.f. "present worth factor" P S (1+r c.r.f."capital recovery factor" cRrx(1+r) P (1+r)-1 r real interest rate n number of years A"annual cost equivalent" (present worth terms) (-pV) x c I installed cost (present worth terms) V salvage value (a future amount) P is the present value of S, n years in the future R annual return of project (present worth terms) Total Project Cost (present worth terms), T nxA DPBP-"discounted payback period" =T/R ( years) QUESTION 3 10 marks You are considering the purchase of a new automated CNC machining centre for your company's manufacturing division. The required capital is $3,300,000. The planned life of this machine is estimated at 1 years, after which the salvage value will be $450,000. You have calculated that this machining centre will enable the machining of precision components 24 hours per day (thus increasing gross revenue by $650,000 annually) and more efficiently (by reducing annual labor costs by $180,000). The prime-lending rate is currently 7.5%. Inflation is running at 1.0 % . aksan Figure 3: Typical Computer Numerically Controlled (CNC) machining centre Your tasks Calculate the discounted payback period for this proposal, taking account of the 'time-value of money. All financial estimates are in Australian dollars 3.1 8 marks 3.2a Explain why the caleulation does not depend on whether your company uses its own liquid assets to fund the project, or raises the capital by borrowing. 3.2b Recommend whether, in your opinion, the new automated CNC machining centre development should proceed. mark 3.2c State any assumptions you have made or additional information you require in order to answer this question more fully (i.e. if you were working as a professional consulting engineer preparing a briefing paper) I mark Definitions that may assist p.w.f. "present worth factor" P S (1+r c.r.f."capital recovery factor" cRrx(1+r) P (1+r)-1 r real interest rate n number of years A"annual cost equivalent" (present worth terms) (-pV) x c I installed cost (present worth terms) V salvage value (a future amount) P is the present value of S, n years in the future R annual return of project (present worth terms) Total Project Cost (present worth terms), T nxA DPBP-"discounted payback period" =T/R ( years)