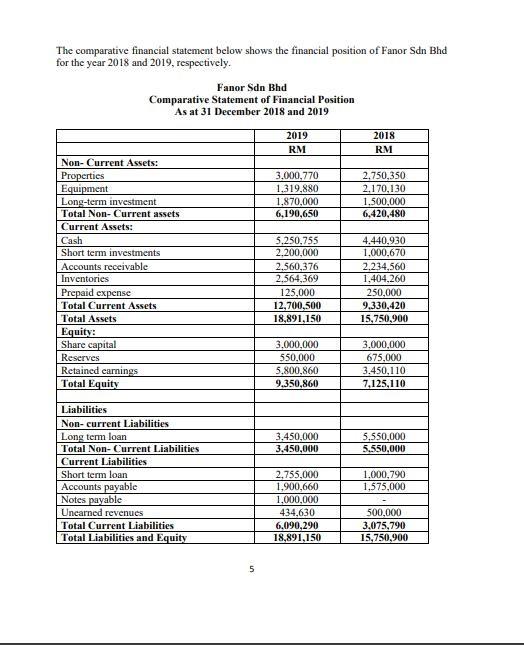

Question: The comparative financial statement below shows the financial position of Fanor Sdn Bhd for the year 2018 and 2019, respectively. Fanor Sdn Bhd Comparative

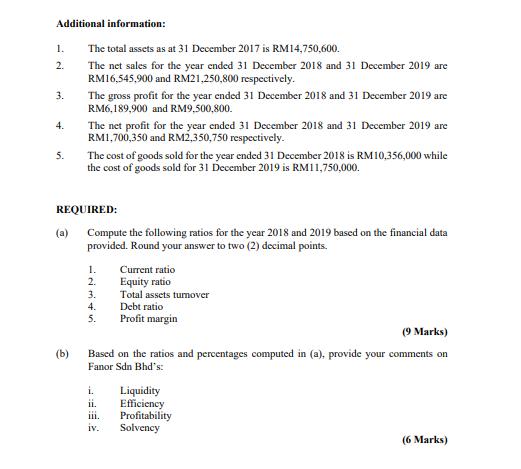

The comparative financial statement below shows the financial position of Fanor Sdn Bhd for the year 2018 and 2019, respectively. Fanor Sdn Bhd Comparative Statement of Financial Position As at 31 December 2018 and 2019 2019 2018 RM RM Non- Current Assets: Properties Equipment Long-term investment 2,750,350 3,000,770 1.319,880 1,870,000 6,190,650 2,170,130 1,500,000 6,420,480 Total Non- Current assets Current Assets: Cash Short term investments 5,250,755 2,200,000 4.440,930 1,000,670 Accounts receivable Inventories 2,560,376 2,564,369 2,234,560 1,404,260 Prepaid expense 125,000 250,000 Total Current Assets 12,700,500 9,330,420 Total Assets 18,891,150 15,750,900 Equity: Share capital Reserves 3,000,000 3,000,000 550,000 675,000 Retained earnings Total Equity 5,800,860 3.450,110 9.350,860 7,125,110 Liabilities Non- current Liabilities Long term loan 3,450,000 3,450,000 5,550,000 5.550,000 Total Non- Current Liabilities Current Liabilities Short term loan Accounts payable Notes payable Unearned revenues 2,755,000 1,900,660 1,000,000 434,630 1,000,790 1,575,000 500,000 3,075,790 6,090,290 18,891,150 Total Current Liabilities Total Liabilities and Equity 15,750,900 Additional information: 1. The total assets as at 31 December 2017 is RM14,750,600. 2. The net sales for the year ended 31 December 2018 and 31 December 2019 are RM16,545,900 and RM21,250,800 respectively. 3. The gross profit for the year ended 31 December 2018 and 31 December 2019 are RM6,189,900 and RM9,500,800. The net profit for the year ended 31 December 2018 and 31 December 2019 are RM1,700,350 and RM2,350,750 respectively. 4. The cost of goods sold for the year ended 31 December 2018 is RM10,356,000 while the cost of goods sold for 31 December 2019 is RM11,750,000. 5. REQUIRED: (a) Compute the following ratios for the year 2018 and 2019 based on the financial data provided. Round your answer to two (2) decimal points. 1. Current ratio Equity ratio Total assets tumover Debt ratio 2. 3. 4. 5. Profit margin (9 Marks) (b) Based on the ratios and percentages computed in (a), provide your comments on Fanor Sdn Bhd's: i. Liquidity Efficiency Profitability Solvency ii. iii. iv. (6 Marks)

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts