Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 (20 marks) a. List any five means by which an asset may be realised for the purposes of calculating gains or losses on

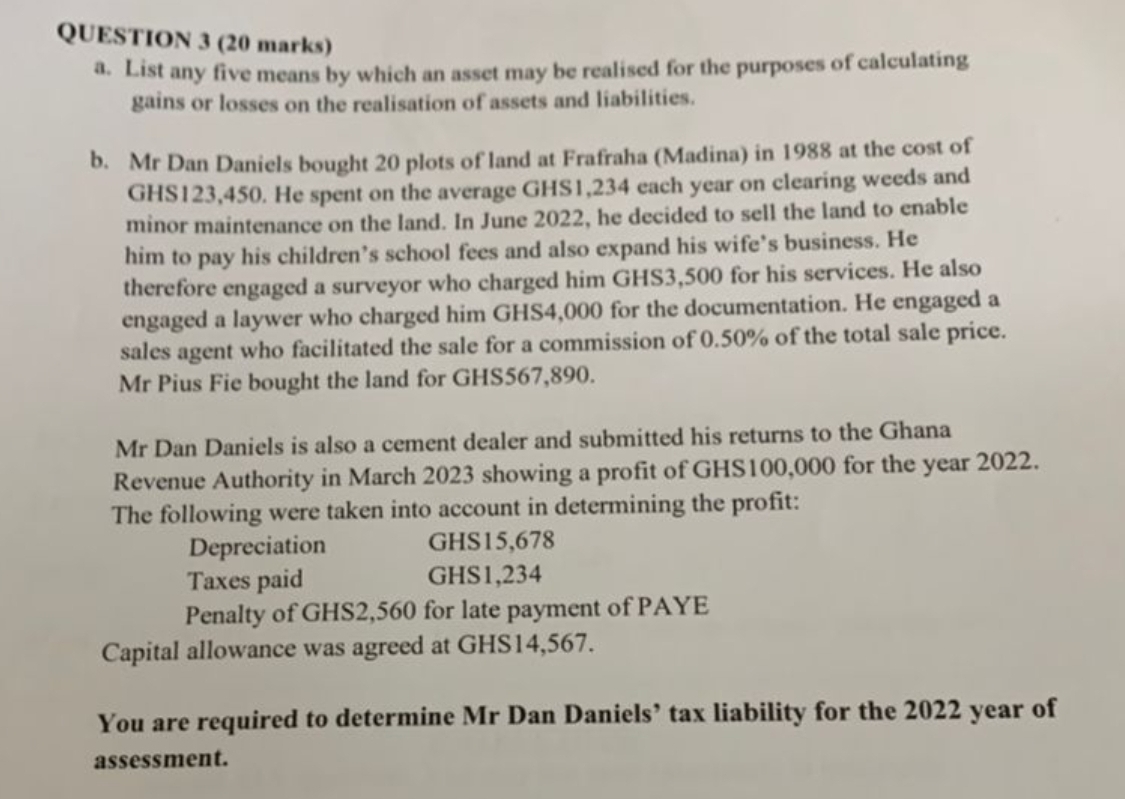

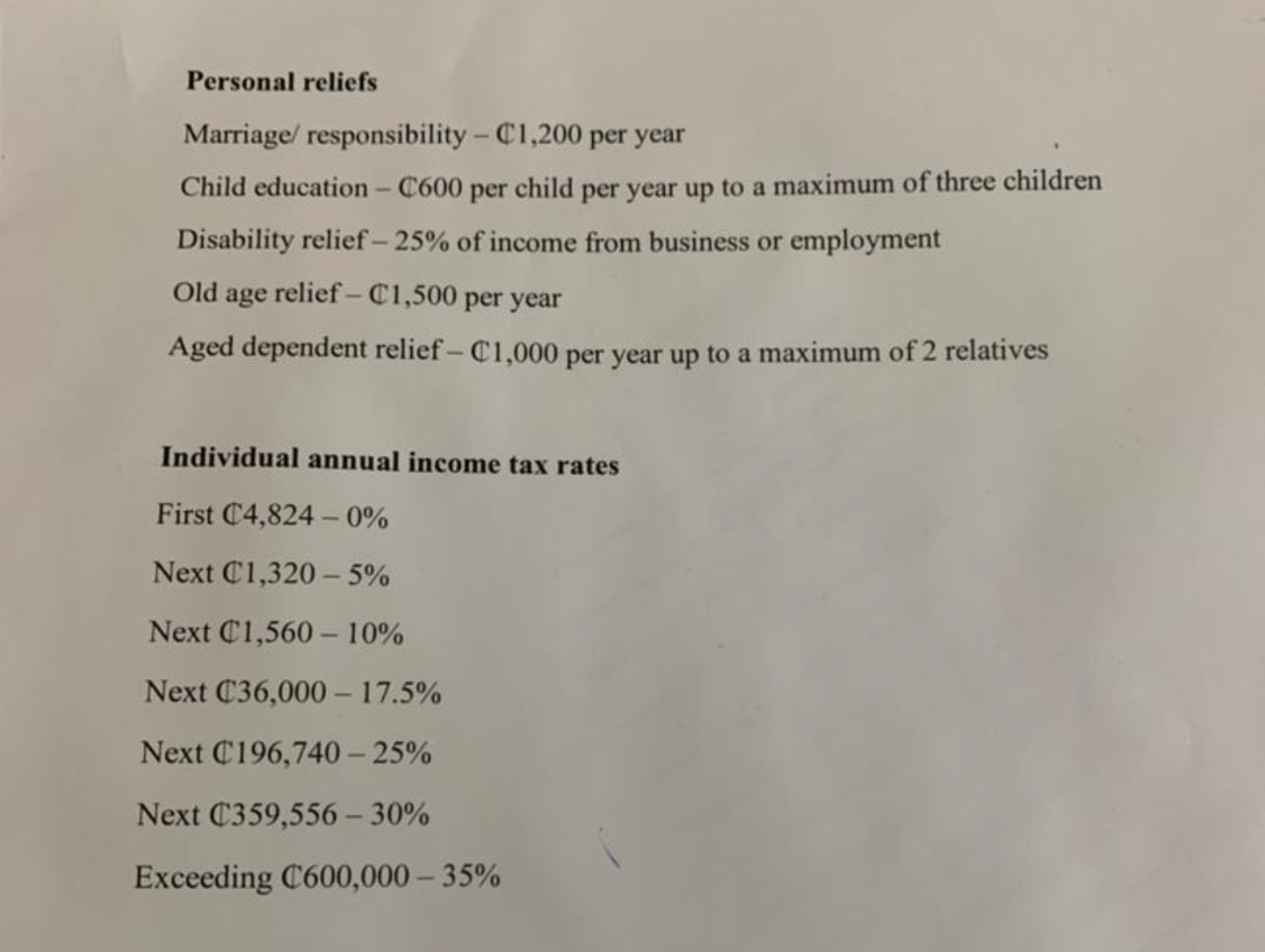

QUESTION 3 (20 marks) a. List any five means by which an asset may be realised for the purposes of calculating gains or losses on the realisation of assets and liabilities. b. Mr Dan Daniels bought 20 plots of land at Frafraha (Madina) in 1988 at the cost of GHS123,450. He spent on the average GHSI,234 each year on clearing weeds and minor maintenance on the land. In June 2022, he decided to sell the land to enable him to pay his children's school fees and also expand his wife's business. He therefore engaged a surveyor who charged him GHS3,500 for his services. He also engaged a laywer who charged him GHS4,000 for the documentation. He engaged a sales agent who facilitated the sale for a commission of 0.50% of the total sale price. Mr Pius Fie bought the land for GHS567,890. Mr Dan Daniels is also a cement dealer and submitted his returns to the Ghana Revenue Authority in March 2023 showing a profit of GHS100,000 for the year 2022. The following were taken into account in determining the profit: Depreciation GHS 15,678 Taxes paid GHS 1,234 Penalty of GHS2,560 for late payment of PAYE Capital allowance was agreed at GHS14,567. You are required to determine Mr Dan Daniels' tax liability for the 2022 year of assessment. Personal reliefs Marriage/ responsibility - C1,200 per year Child education - C600 per child per year up to a maximum of three children Disability relief 25% of income from business or employment Old age relief C1,500 per year Aged dependent relief C1,000 per year up to a maximum of 2 relatives Individual annual income tax rates First C4,8240% Next C1,3205% Next C1,56010% Next C36,000-17.5\% Next C196,740-25\% Next C359,556-30\% Exceeding C600,00035%

QUESTION 3 (20 marks) a. List any five means by which an asset may be realised for the purposes of calculating gains or losses on the realisation of assets and liabilities. b. Mr Dan Daniels bought 20 plots of land at Frafraha (Madina) in 1988 at the cost of GHS123,450. He spent on the average GHSI,234 each year on clearing weeds and minor maintenance on the land. In June 2022, he decided to sell the land to enable him to pay his children's school fees and also expand his wife's business. He therefore engaged a surveyor who charged him GHS3,500 for his services. He also engaged a laywer who charged him GHS4,000 for the documentation. He engaged a sales agent who facilitated the sale for a commission of 0.50% of the total sale price. Mr Pius Fie bought the land for GHS567,890. Mr Dan Daniels is also a cement dealer and submitted his returns to the Ghana Revenue Authority in March 2023 showing a profit of GHS100,000 for the year 2022. The following were taken into account in determining the profit: Depreciation GHS 15,678 Taxes paid GHS 1,234 Penalty of GHS2,560 for late payment of PAYE Capital allowance was agreed at GHS14,567. You are required to determine Mr Dan Daniels' tax liability for the 2022 year of assessment. Personal reliefs Marriage/ responsibility - C1,200 per year Child education - C600 per child per year up to a maximum of three children Disability relief 25% of income from business or employment Old age relief C1,500 per year Aged dependent relief C1,000 per year up to a maximum of 2 relatives Individual annual income tax rates First C4,8240% Next C1,3205% Next C1,56010% Next C36,000-17.5\% Next C196,740-25\% Next C359,556-30\% Exceeding C600,00035% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started