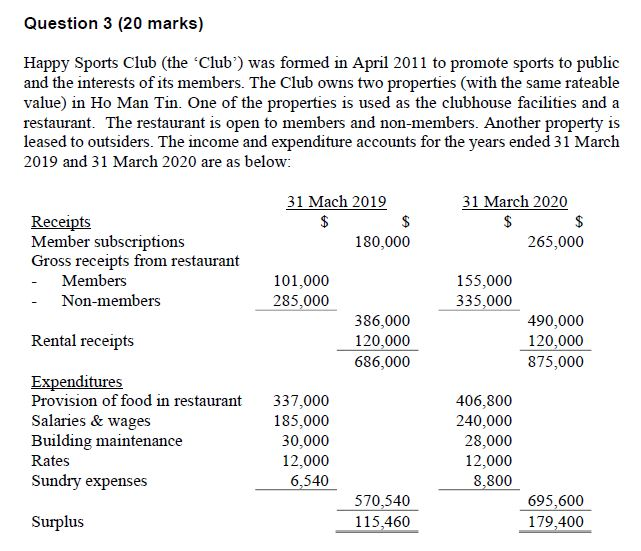

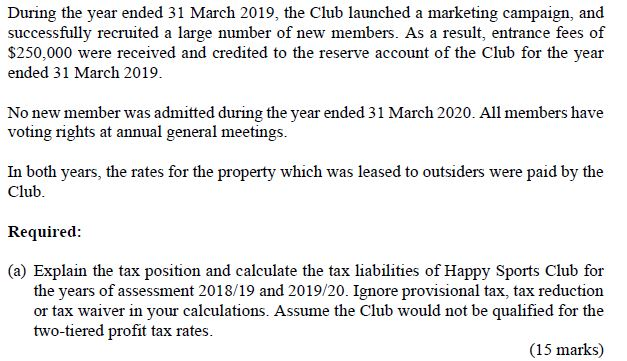

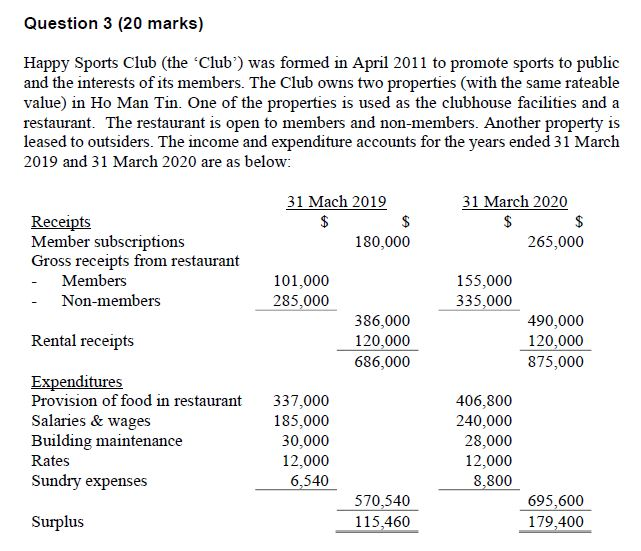

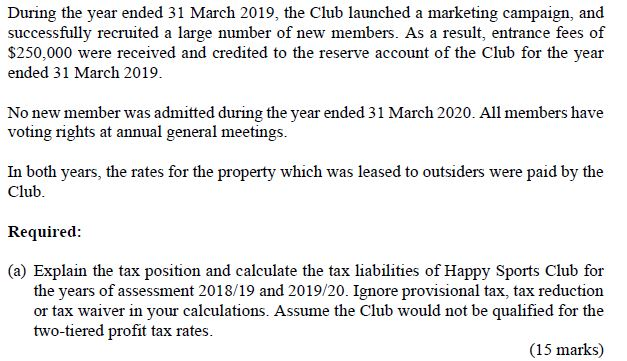

Question 3 (20 marks) Happy Sports Club (the 'Club') was formed in April 2011 to promote sports to public and the interests of its members. The Club owns two properties (with the same rateable value) in Ho Man Tin. One of the properties is used as the clubhouse facilities and a restaurant. The restaurant is open to members and non-members. Another property is leased to outsiders. The income and expenditure accounts for the years ended 31 March 2019 and 31 March 2020 are as below: 31 Mach 2019 31 March 2020 $ $ 265,000 180,000 Receipts Member subscriptions Gross receipts from restaurant - Members - Non-members 101,000 285,000 155,000 335.000 Rental receipts 386,000 120,000 686,000 490,000 120,000 875,000 Expenditures Provision of food in restaurant Salaries & wages Building maintenance Rates Sundry expenses 337,000 185,000 30,000 12,000 6,540 406,800 240,000 28,000 12,000 8,800 570,540 115,460 695,600 179,400 Surplus During the year ended 31 March 2019, the Club launched a marketing campaign, and successfully recruited a large number of new members. As a result, entrance fees of $250,000 were received and credited to the reserve account of the Club for the year ended 31 March 2019. No new member was admitted during the year ended 31 March 2020. All members have voting rights at annual general meetings. In both years, the rates for the property which was leased to outsiders were paid by the Club. Required: (a) Explain the tax position and calculate the tax liabilities of Happy Sports Club for the years of assessment 2018/19 and 2019/20. Ignore provisional tax, tax reduction or tax waiver in your calculations. Assume the Club would not be qualified for the two-tiered profit tax rates. (15 marks) Question 3 (20 marks) Happy Sports Club (the 'Club') was formed in April 2011 to promote sports to public and the interests of its members. The Club owns two properties (with the same rateable value) in Ho Man Tin. One of the properties is used as the clubhouse facilities and a restaurant. The restaurant is open to members and non-members. Another property is leased to outsiders. The income and expenditure accounts for the years ended 31 March 2019 and 31 March 2020 are as below: 31 Mach 2019 31 March 2020 $ $ 265,000 180,000 Receipts Member subscriptions Gross receipts from restaurant - Members - Non-members 101,000 285,000 155,000 335.000 Rental receipts 386,000 120,000 686,000 490,000 120,000 875,000 Expenditures Provision of food in restaurant Salaries & wages Building maintenance Rates Sundry expenses 337,000 185,000 30,000 12,000 6,540 406,800 240,000 28,000 12,000 8,800 570,540 115,460 695,600 179,400 Surplus During the year ended 31 March 2019, the Club launched a marketing campaign, and successfully recruited a large number of new members. As a result, entrance fees of $250,000 were received and credited to the reserve account of the Club for the year ended 31 March 2019. No new member was admitted during the year ended 31 March 2020. All members have voting rights at annual general meetings. In both years, the rates for the property which was leased to outsiders were paid by the Club. Required: (a) Explain the tax position and calculate the tax liabilities of Happy Sports Club for the years of assessment 2018/19 and 2019/20. Ignore provisional tax, tax reduction or tax waiver in your calculations. Assume the Club would not be qualified for the two-tiered profit tax rates. (15 marks)