Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 (20 marks) Spacedout Inc. requires $400,000,000 to fund two new long-haul Mars bound spacecraft. As part of this requirement, the CEO and CFO

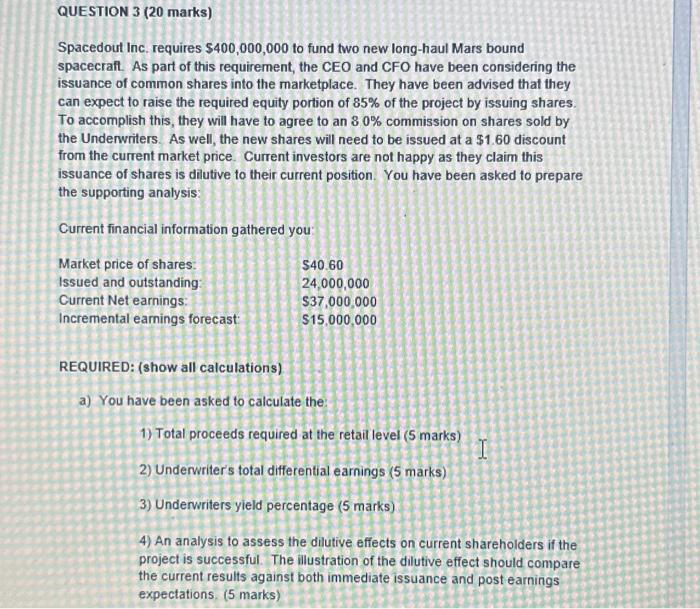

QUESTION 3 (20 marks) Spacedout Inc. requires $400,000,000 to fund two new long-haul Mars bound spacecraft. As part of this requirement, the CEO and CFO have been considering the issuance of common shares into the marketplace. They have been advised that they can expect to raise the required equity portion of 85% of the project by issuing shares. To accomplish this, they will have to agree to an 80% commission on shares sold by the Underwriters. As well, the new shares will need to be issued at a $1.60 discount from the current market price. Current investors are not happy as they claim this issuance of shares is dilutive to their current position. You have been asked to prepare the supporting analysis: Current financial information gathered you: Market price of shares: Issued and outstanding: Current Net earnings: Incremental earnings forecast: 540.60 24,000,000 $37,000,000 $15,000,000 REQUIRED: (show all calculations) a) You have been asked to calculate the: 1) Total proceeds required at the retail level (5 marks) 2) Underwriter's total differential earnings (5 marks) 3) Underwriters yield percentage (5 marks) 4) An analysis to assess the dilutive effects on current shareholders if the project is successful. The illustration of the dilutive effect should compare the current results against both immediate issuance and post earnings expectations. (5 marks) H

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started