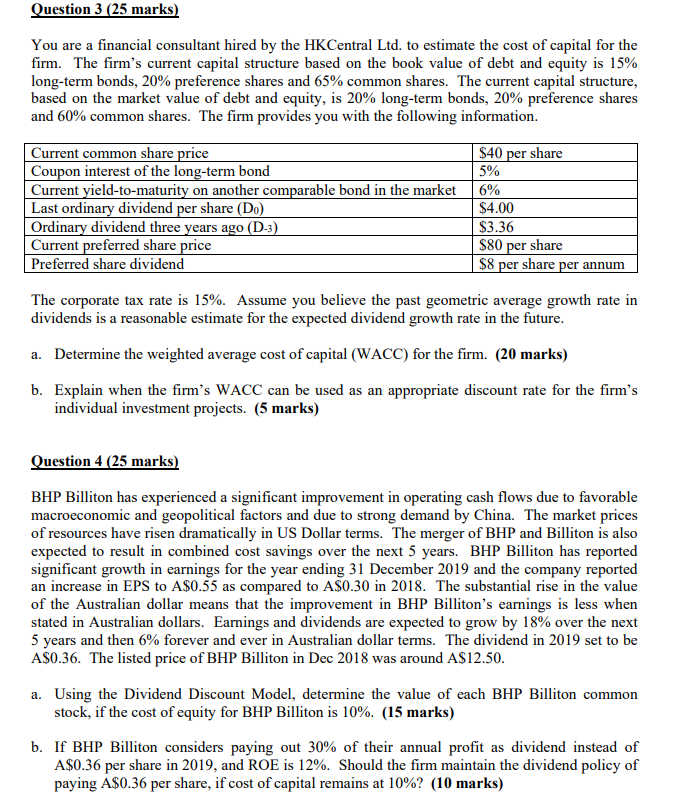

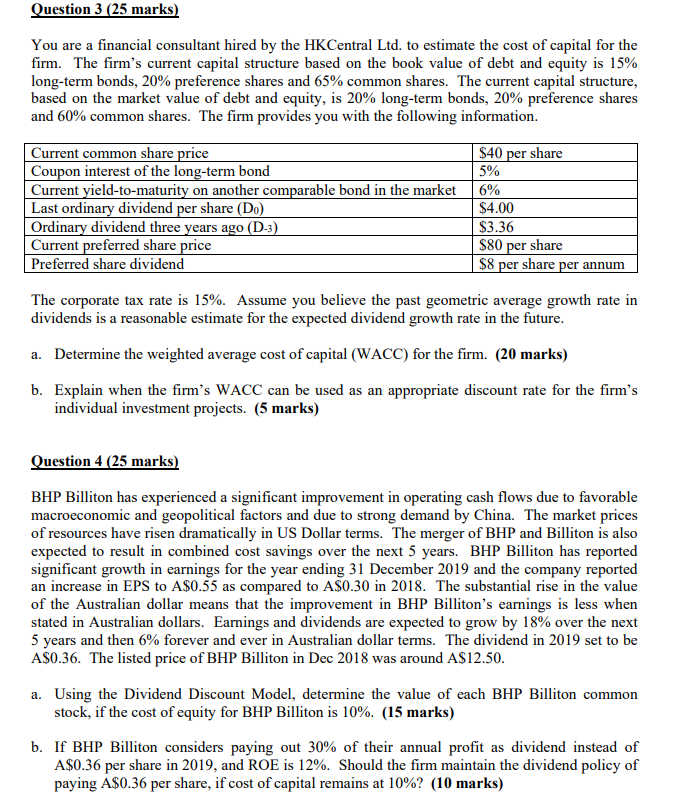

Question 3 (25 marks) You are a financial consultant hired by the HKCentral Ltd. to estimate the cost of capital for the firm. The firm's current capital structure based on the book value of debt and equity is 15% long-term bonds, 20% preference shares and 65% common shares. The current capital structure, based on the market value of debt and equity, is 20% long-term bonds, 20% preference shares and 60% common shares. The firm provides you with the following information. Current common share price Coupon interest of the long-term bond Current yield-to-maturity on another comparable bond in the market Last ordinary dividend per share (Do) Ordinary dividend three years ago (D-3) Current preferred share price Preferred share dividend $40 per share 5% 6% $4.00 $3.36 $80 per share $8 per share per annum The corporate tax rate is 15%. Assume you believe the past geometric average growth rate in dividends is a reasonable estimate for the expected dividend growth rate in the future. a. Determine the weighted average cost of capital (WACC) for the firm. (20 marks) b. Explain when the firm's WACC can be used as an appropriate discount rate for the firm's individual investment projects. (5 marks) Question 4 (25 marks) BHP Billiton has experienced a significant improvement in operating cash flows due to favorable macroeconomic and geopolitical factors and due to strong demand by China. The market prices of resources have risen dramatically in US Dollar terms. The merger of BHP and Billiton is also expected to result in combined cost savings over the next 5 years. BHP Billiton has reported significant growth in earnings for the year ending 31 December 2019 and the company reported an increase in EPS to A$0.55 as compared to A$0.30 in 2018. The substantial rise in the value of the Australian dollar means that the improvement in BHP Billiton's earnings is less when stated in Australian dollars. Earnings and dividends are expected to grow by 18% over the next 5 years and then 6% forever and ever in Australian dollar terms. The dividend in 2019 set to be A$0.36. The listed price of BHP Billiton in Dec 2018 was around A$12.50. a. Using the Dividend Discount Model, determine the value of each BHP Billiton common stock, if the cost of equity for BHP Billiton is 10%. (15 marks) b. If BHP Billiton considers paying out 30% of their annual profit as dividend instead of A$0.36 per share in 2019, and ROE is 12%. Should the firm maintain the dividend policy of paying A$0.36 per share, if cost of capital remains at 10%? (10 marks)