Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 (34 marks) MACABEB Mmaphure Mudau, the ActingCFO of Matla Green Solutions (MGS), has sent you the following email: From: Mmaphure Mudau(imas.com To: finance(a)mas.com

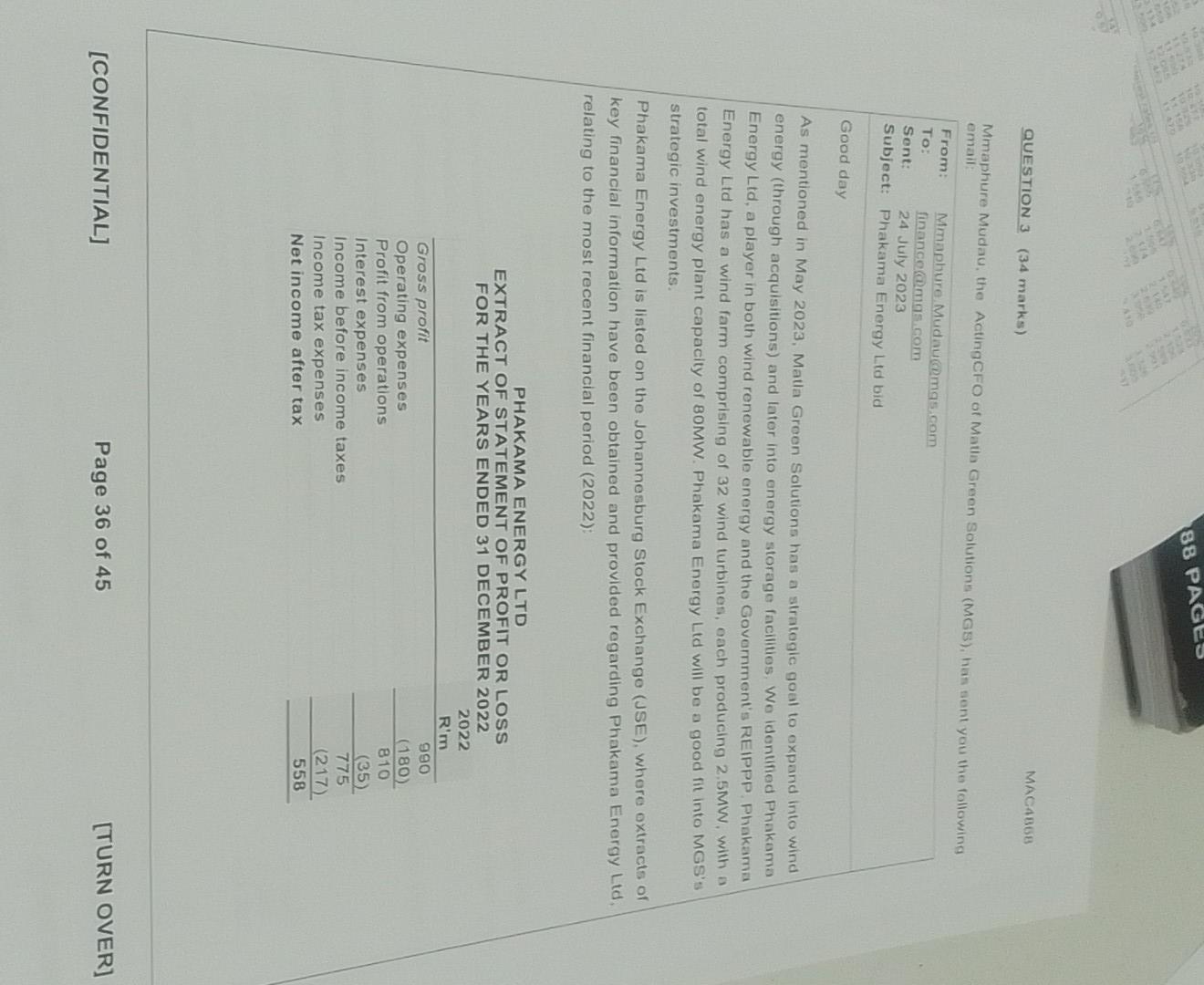

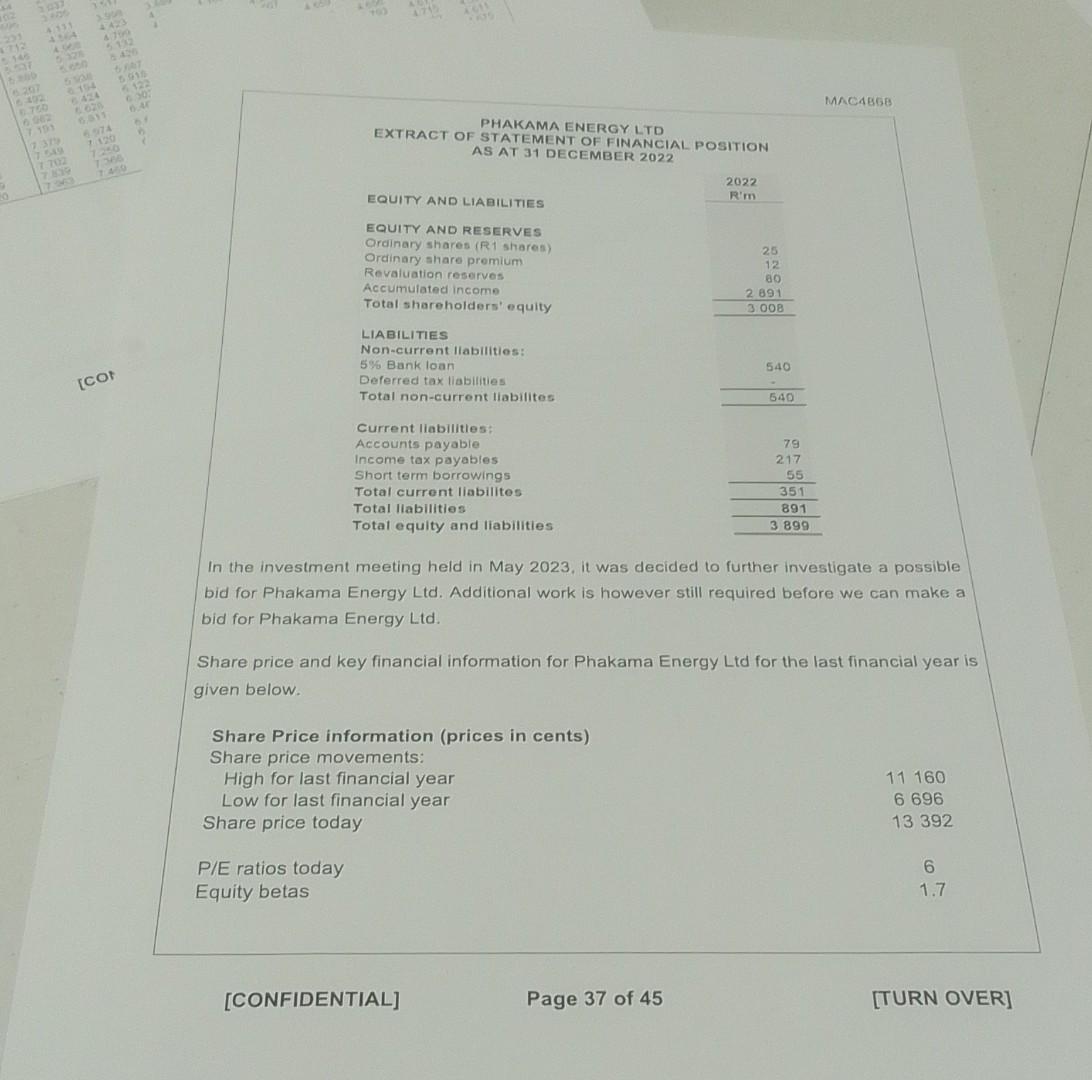

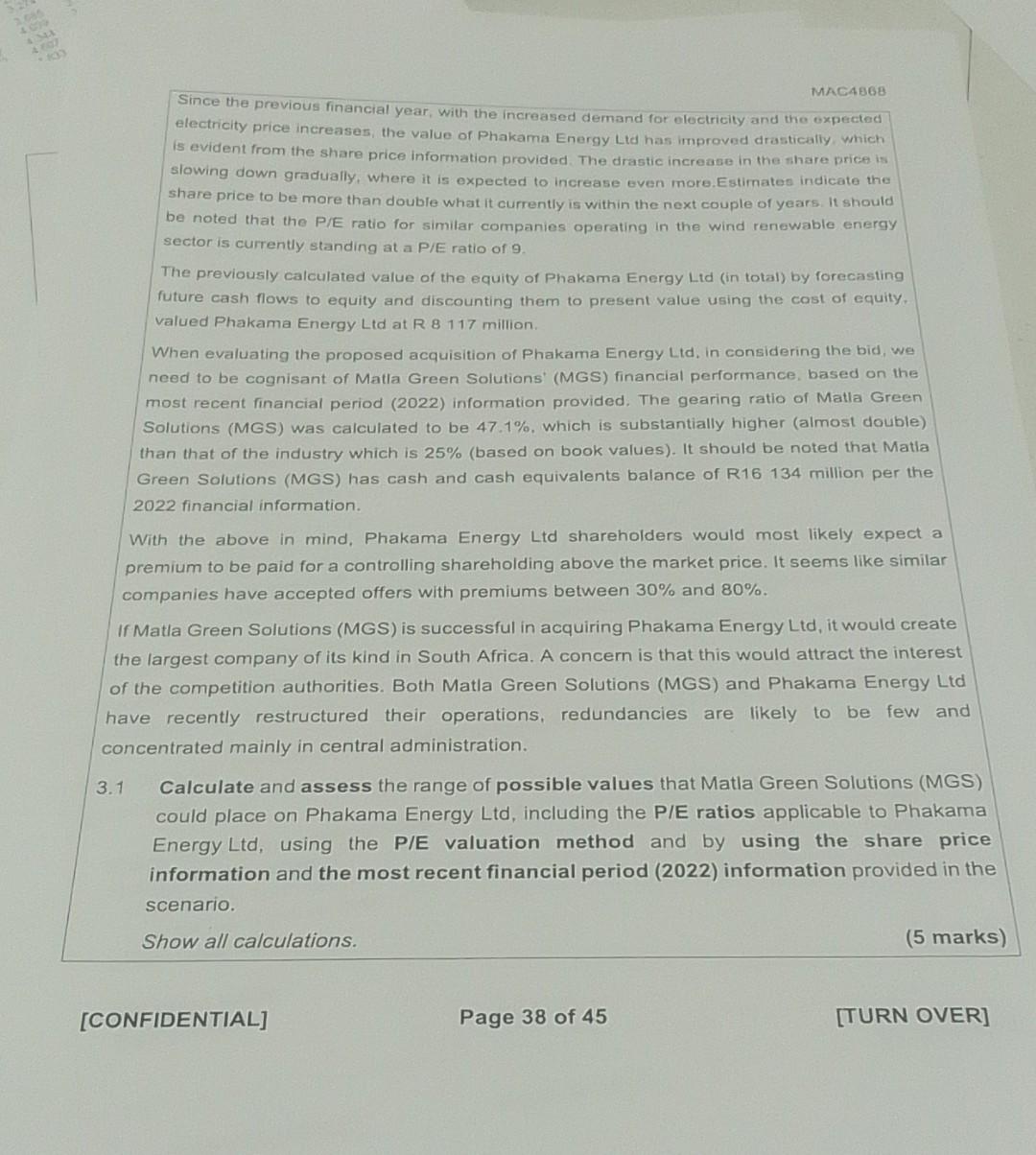

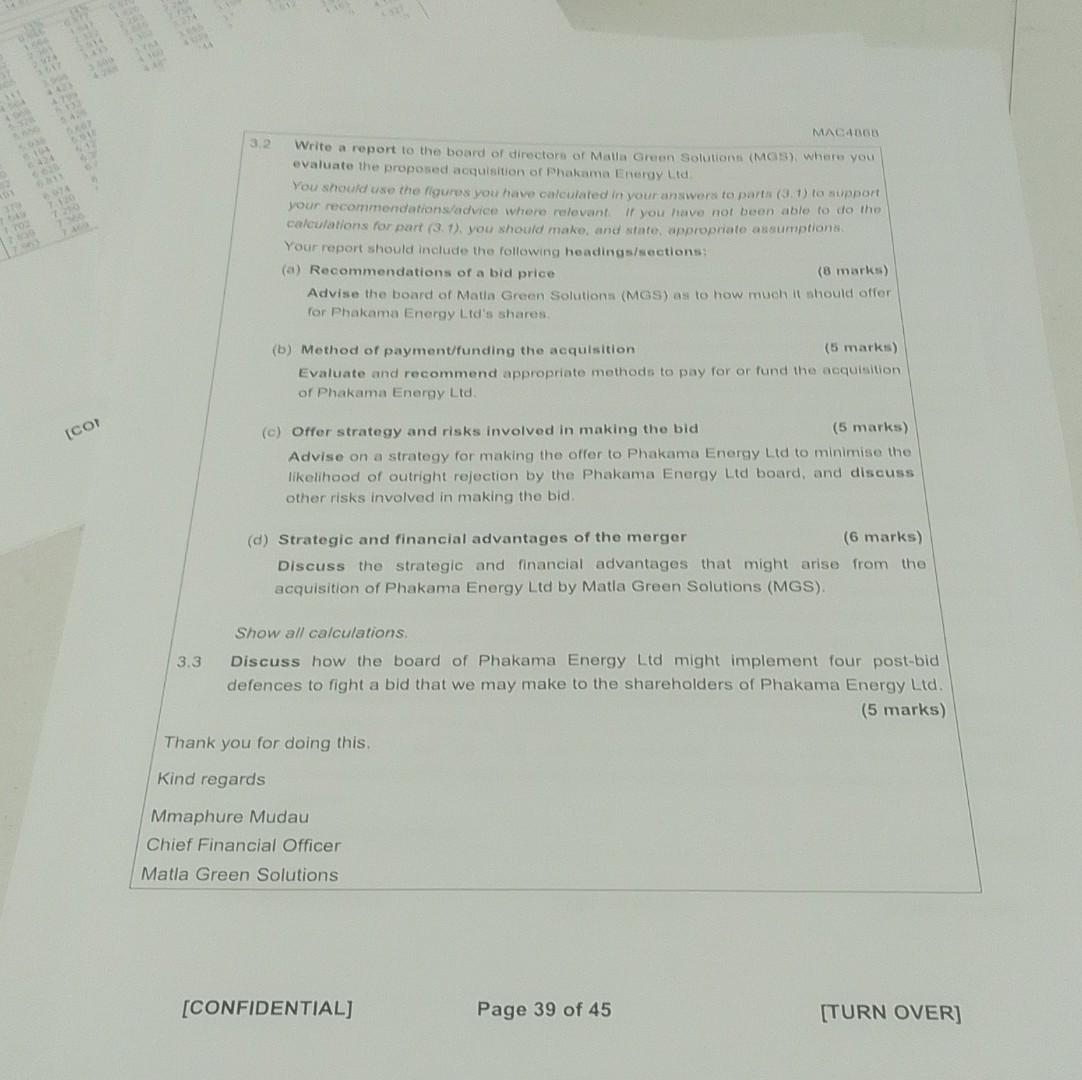

QUESTION 3 (34 marks) MACABEB Mmaphure Mudau, the ActingCFO of Matla Green Solutions (MGS), has sent you the following email: From: Mmaphure Mudau(imas.com To: finance(a)mas.com Sont: 24 July 2023 Subject: Phakama Energy Ltd bid Good day As mentioned in May 2023, Matla Green Solutions has a strategic goal to expand into wind energy (through acquisitions) and later into energy storage facilitios, We identified Phakama Energy Ltd, a player in both wind renewable energy and the Govemment's REIPPP. Phakama Energy Ltd has a wind farm comprising of 32 wind turbines, each producing 2.5MW, with a total wind energy plant capacity of BOMW. Phakama Energy Ltd will be a good fit into MGS's stratogic investments. Phakama Energy Ltd is listed on the Johannesburg Stock Exchange (JSE), where oxtracts of key financial information have been obtained and provided regarding Phakama Energy Ltd, relating to the most recent financial poriod (2022): MACAOBB 3.2 Write a report to the board of directore of Matla Green Solutione (MC\$), where you evaluate the proposed acquisition of Phakama Energy Lid You should use the figures you have calculated in your answera to parta (3.1) to sipport your recommendationsadvice iwhere relevant If you have not been able to do tho calculations for part (3,1), you should make, and state, appropriate assumptions. Your report should include the following headings/sections: (a) Recommendations of a bid price (8 marks) Advise the board of Matla Green Solutions (MGS) as to how mueh it should offer for Phakama Energy Lid's shares. (b) Method of payment/funding the acquisition (5 marks) Evaluate and recommend appropriate methods to pay for or fund the acquisition of Phakama Energy Lid. (c) Offer strategy and risks involved in making the bid (5 marks) Advise on a strategy for making the offer to Phakama Energy L.td to minimise the likelihood of outright rejection by the Phakama Energy Ltd board, and discuss other risks involved in making the bid. (d) Strategic and financial advantages of the merger (6 marks) Discuss the strategic and financial advantages that might arise from the acquisition of Phakama Energy Ltd by Matla Green Solutions (MGS). Show all calculations: Discuss how the board of Phakama Energy Ltd might implement four post-b defences to fight a bid that we may make to the shareholders of Phakama Energy (5 mark ou for doing this. lards re Mudau PHAKAMA ENERGY LTD EXTRACT OF STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 In the investment meeting held in May 2023, it was decided to further investigate a possible bid for Phakama Energy Ltd. Additional work is however still required before we can make a bid for Phakama Energy Ltd. Share price and key financial information for Phakama Energy Ltd for the last financial year is given below. MACAB6B Since the previous financial year, with the increased demand for electricity and the expected electricity price increases, the value of Phakama Energy Ltd has improved drastically, which is evident from the share price information provided. The drastic increase in the share price is slowing down gradually, where it is expected to increase even more. Estimates indicate the share price to be more than double what it currently is within the next couple of years. It should be noted that the P/E ratio for similar companies operating in the wind renewable energy sector is currently standing at a P/E ratio of 9 . The previously calculated value of the equity of Phakama Energy Lid (in total) by forecasting future cash flows to equity and discounting them to present value using the cost of equity. valued Phakama Energy Ltd at R 8117 million. When evaluating the proposed acquisition of Phakama Energy Ltd, in considering the bid, we need to be cognisant of Matla Green Solutions' (MGS) financial performance, based on the most recent financial period (2022) information provided. The gearing ratio of Matla Green Solutions (MGS) was calculated to be 47.1%, which is substantially higher (almost double) than that of the industry which is 25% (based on book values). It should be noted that Matla Green Solutions (MGS) has cash and cash equivalents balance of R16 134 million per the 2022 financial information. With the above in mind, Phakama Energy Ltd shareholders would most likely expect a premium to be paid for a controlling shareholding above the market price. It seems like similar companies have accepted offers with premiums between 30% and 80%. If Matla Green Solutions (MGS) is successful in acquiring Phakama Energy Ltd, it would create the largest company of its kind in South Africa. A concern is that this would attract the interest of the competition authorities. Both Matla Green Solutions (MGS) and Phakama Energy Ltd have recently restructured their operations, redundancies are likely to be few and concentrated mainly in central administration. 3.1 Calculate and assess the range of possible values that Matla Green Solutions (MGS could place on Phakama Energy Ltd, including the P/E ratios applicable to Phakam Energy Ltd, using the P/E valuation method and by using the share pric information and the most recent financial period (2022) information provided in scenario. Show all calculations. (5 mar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started