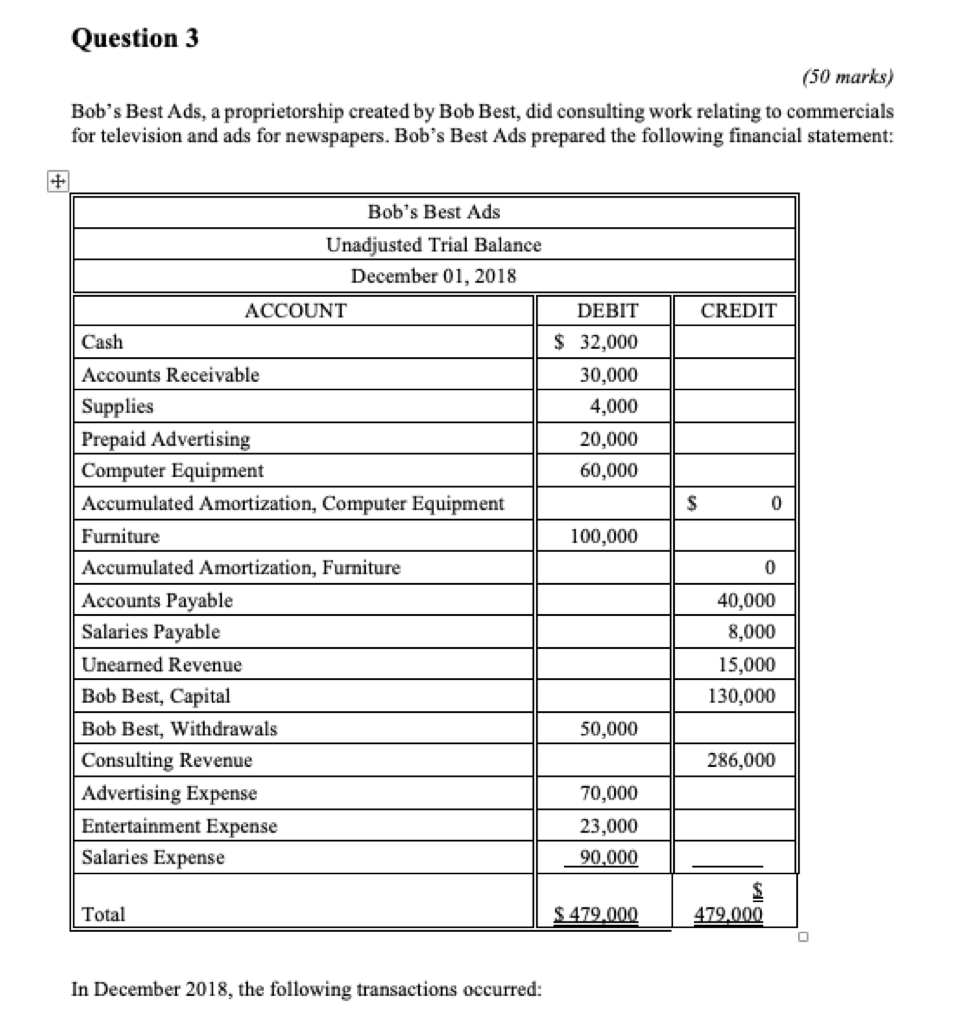

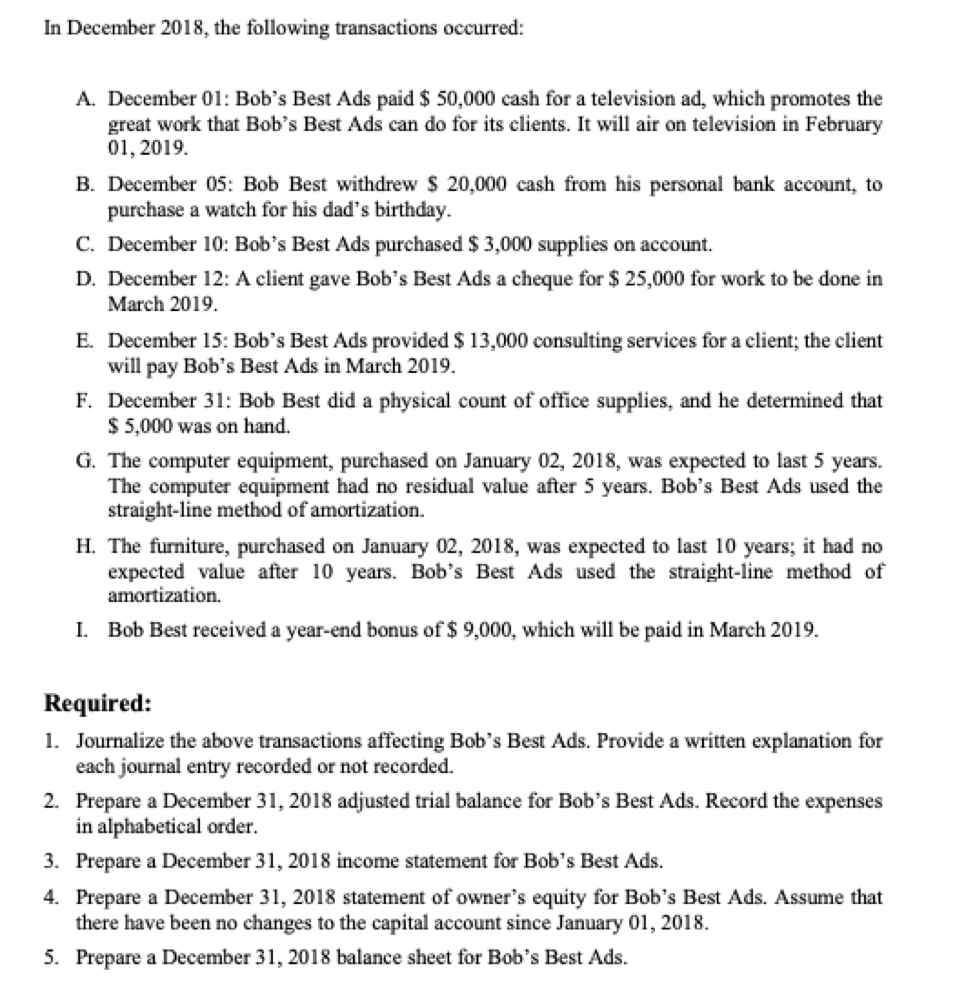

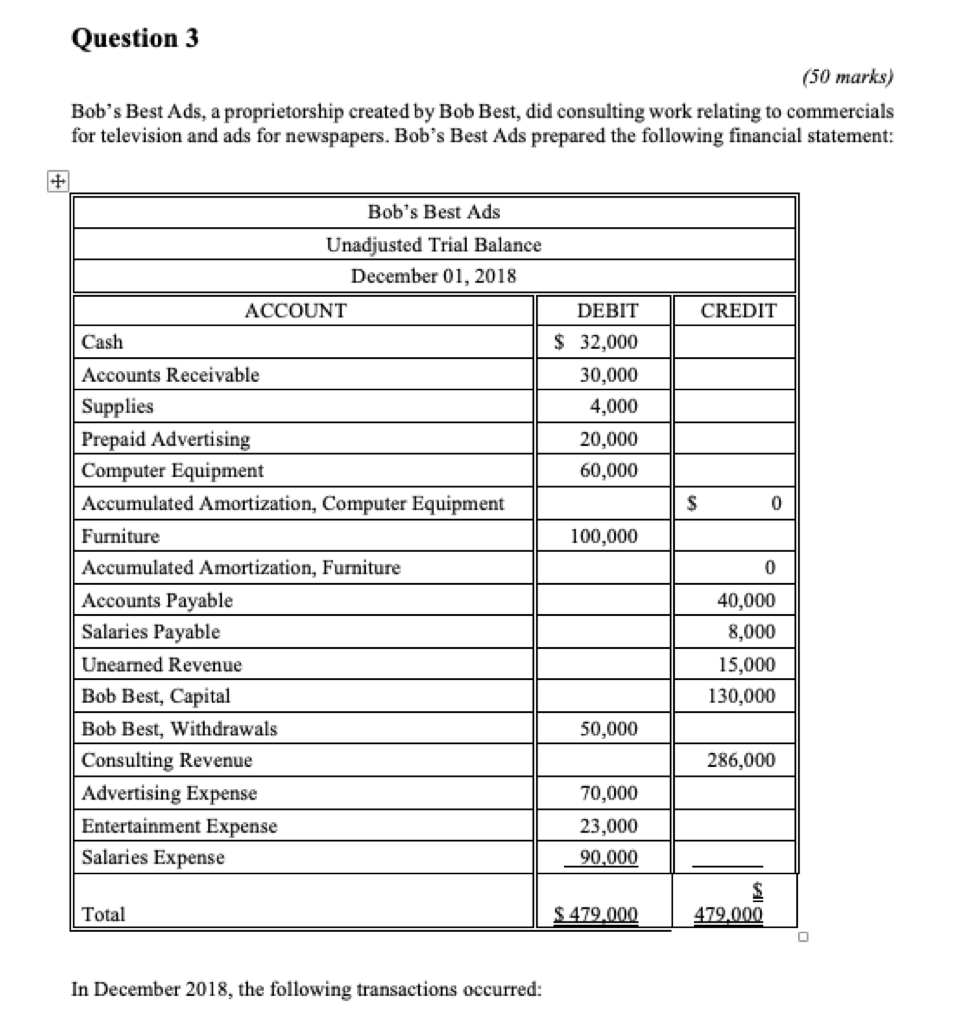

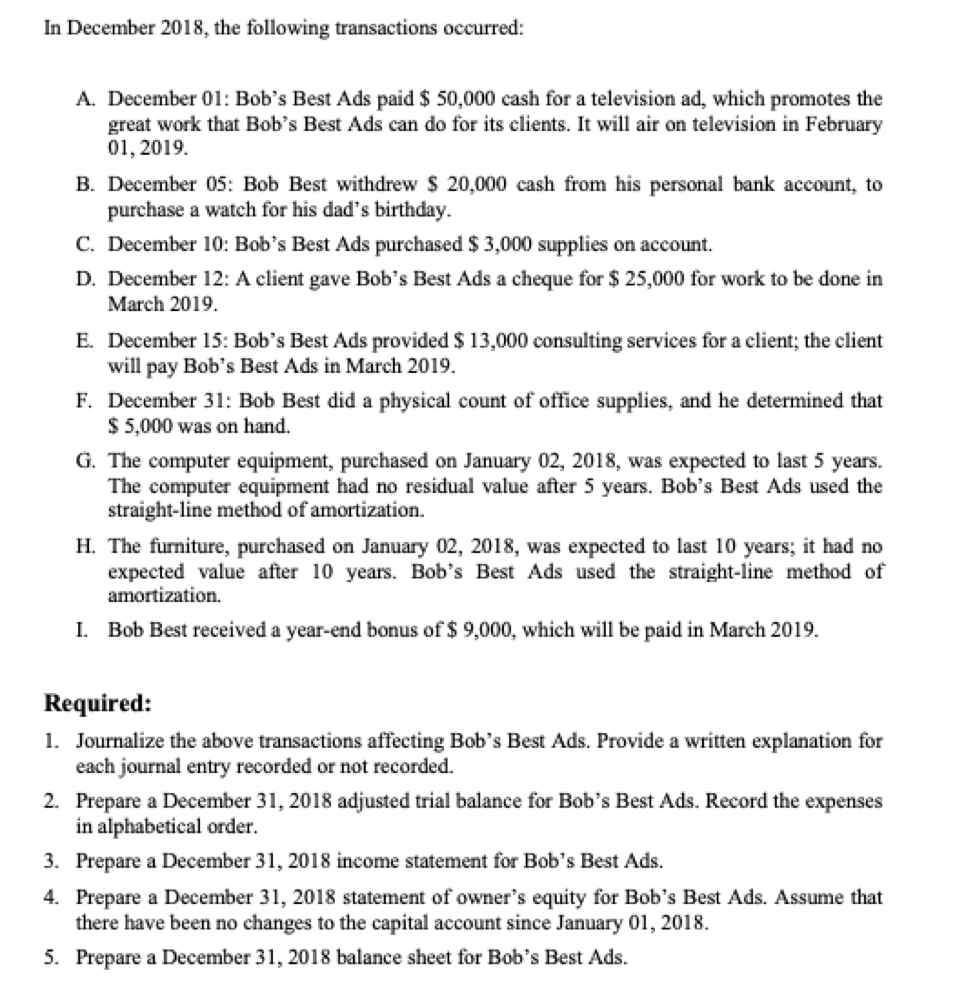

Question 3 (50 marks) Bob's Best Ads, a proprietorship created by Bob Best, did consulting work relating to commercials for television and ads for newspapers. Bob's Best Ads prepared the following financial statement: CREDIT DEBIT $ 32,000 30,000 4,000 20,000 60.000 Bob's Best Ads Unadjusted Trial Balance December 01, 2018 ACCOUNT Cash Accounts Receivable Supplies Prepaid Advertising Computer Equipment Accumulated Amortization, Computer Equipment Furniture Accumulated Amortization, Furniture Accounts Payable Salaries Payable Unearned Revenue Bob Best, Capital Bob Best, Withdrawals Consulting Revenue Advertising Expense Entertainment Expense Salaries Expense 100,000 0 40,000 8,000 15,000 130,000 50,000 286,000 70,000 23.000 90,000 Total $479.000 479.000 In December 2018, the following transactions occurred: In December 2018, the following transactions occurred: A. December 01: Bob's Best Ads paid $ 50,000 cash for a television ad, which promotes the great work that Bob's Best Ads can do for its clients. It will air on television in February 01, 2019 B. December 05: Bob Best withdrew $ 20,000 cash from his personal bank account, to purchase a watch for his dad's birthday. C. December 10: Bob's Best Ads purchased $3,000 supplies on account. D. December 12: A client gave Bob's Best Ads a cheque for $ 25,000 for work to be done in March 2019. E. December 15: Bob's Best Ads provided $ 13,000 consulting services for a client; the client will pay Bob's Best Ads in March 2019. F. December 31: Bob Best did a physical count of office supplies, and he determined that $ 5,000 was on hand. G. The computer equipment, purchased on January 02, 2018, was expected to last 5 years. The computer equipment had no residual value after 5 years. Bob's Best Ads used the straight-line method of amortization. H. The furniture, purchased on January 02, 2018, was expected to last 10 years; it had no expected value after 10 years. Bob's Best Ads used the straight-line method of amortization. I. Bob Best received a year-end bonus of $ 9,000, which will be paid in March 2019. Required: 1. Journalize the above transactions affecting Bob's Best Ads. Provide a written explanation for each journal entry recorded or not recorded. 2. Prepare a December 31, 2018 adjusted trial balance for Bob's Best Ads. Record the expenses in alphabetical order. 3. Prepare a December 31, 2018 income statement for Bob's Best Ads. 4. Prepare a December 31, 2018 statement of owner's equity for Bob's Best Ads. Assume that there have been no changes to the capital account since January 01, 2018. 5. Prepare a December 31, 2018 balance sheet for Bob's Best Ads