Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When Parson Company acquired all of Soaper Company's stock on July 1, 2022, Soaper's inventory was undervalued by $160,000,000, plant assets with a 10 -year

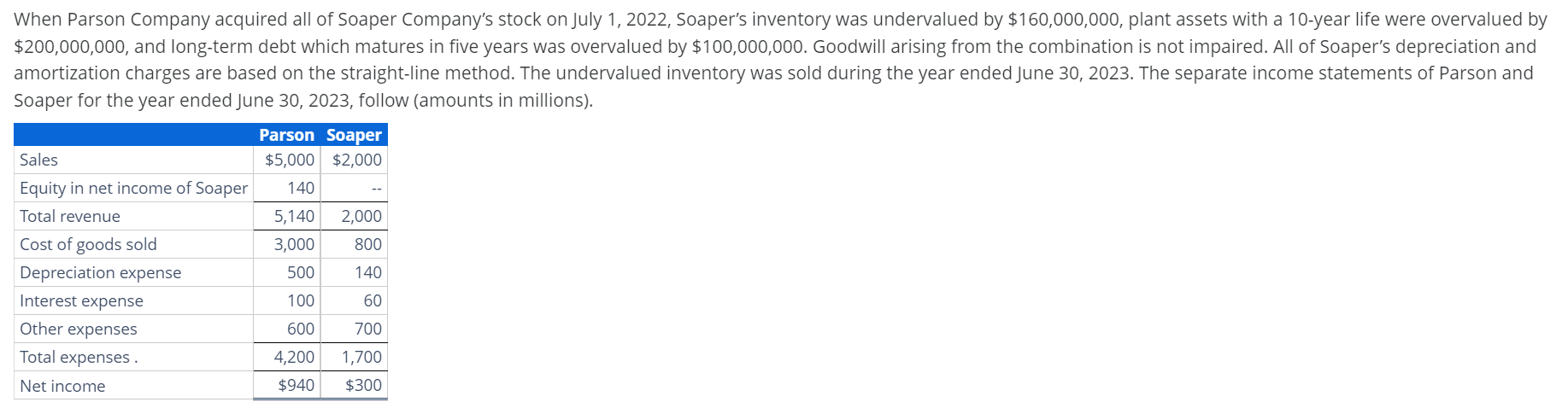

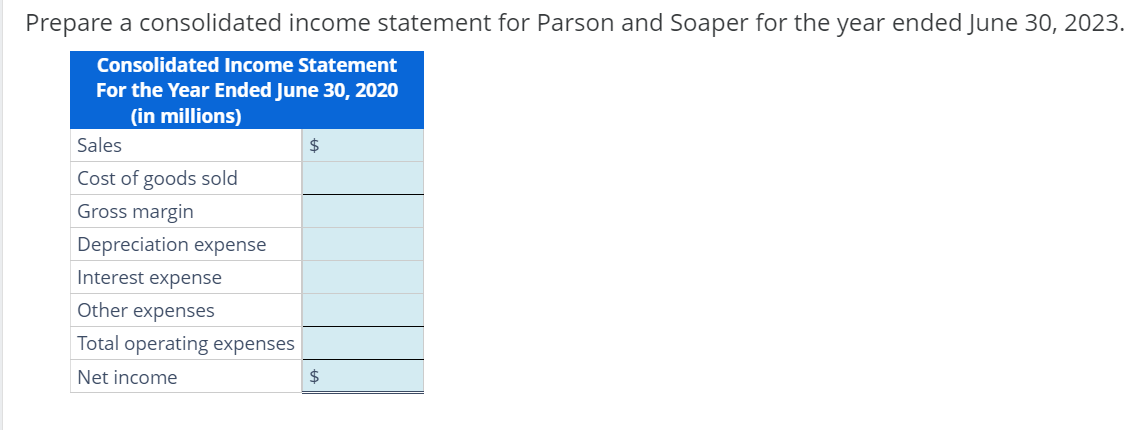

When Parson Company acquired all of Soaper Company's stock on July 1, 2022, Soaper's inventory was undervalued by $160,000,000, plant assets with a 10 -year life were overvalued by $200,000,000, and long-term debt which matures in five years was overvalued by $100,000,000. Goodwill arising from the combination is not impaired. All of Soaper's depreciation and amortization charges are based on the straight-line method. The undervalued inventory was sold during the year ended June 30, 2023. The separate income statements of Parson and Soaper for the year ended June 30, 2023, follow (amounts in millions). Prepare a consolidated income statement for Parson and Soaper for the year ended June 30, 2023. \begin{tabular}{|l|l|} ConsolidatedIncomeStatementFortheYearEndedJune(inmillions) \\ \hline Sales & $ \\ \hline Cost of goods sold & \\ \hline Gross margin & \\ \hline Depreciation expense & \\ \hline Interest expense & \\ \hline Other expenses & \\ \hline Total operating expenses & \\ \hline Net income & $ \\ \hline \end{tabular}

When Parson Company acquired all of Soaper Company's stock on July 1, 2022, Soaper's inventory was undervalued by $160,000,000, plant assets with a 10 -year life were overvalued by $200,000,000, and long-term debt which matures in five years was overvalued by $100,000,000. Goodwill arising from the combination is not impaired. All of Soaper's depreciation and amortization charges are based on the straight-line method. The undervalued inventory was sold during the year ended June 30, 2023. The separate income statements of Parson and Soaper for the year ended June 30, 2023, follow (amounts in millions). Prepare a consolidated income statement for Parson and Soaper for the year ended June 30, 2023. \begin{tabular}{|l|l|} ConsolidatedIncomeStatementFortheYearEndedJune(inmillions) \\ \hline Sales & $ \\ \hline Cost of goods sold & \\ \hline Gross margin & \\ \hline Depreciation expense & \\ \hline Interest expense & \\ \hline Other expenses & \\ \hline Total operating expenses & \\ \hline Net income & $ \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started