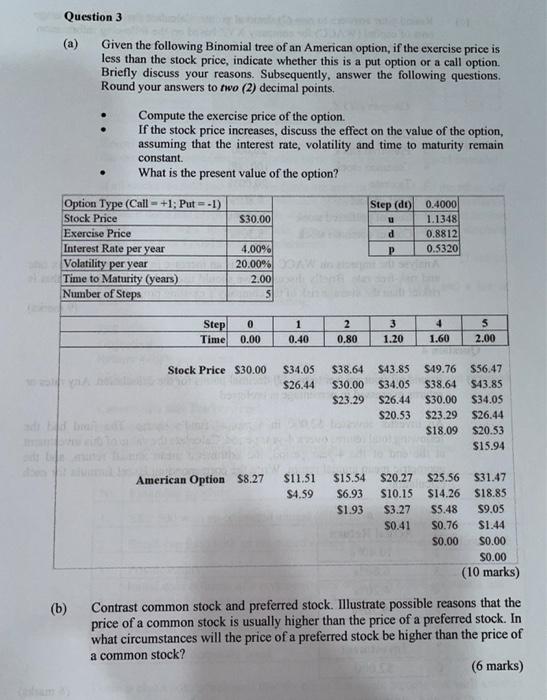

Question 3 (a) Given the following Binomial tree of an American option, if the exercise price is less than the stock price, indicate whether this is a put option or a call option. Briefly discuss your reasons. Subsequently, answer the following questions. Round your answers to two (2) decimal points Compute the exercise price of the option. If the stock price increases, discuss the effect on the value of the option, assuming that the interest rate, volatility and time to maturity remain constant What is the present value of the option? 30.00 Step (dt) u d Option Type (Call - +1; Put =-1) Stock Price Exercise Price Interest Rate per year Volatility per year Time to Maturity (years) Number of Steps 0.4000 1.1348 0.8812 0.5320 P 4.00% 20.00% 2.00 5 3 Step Time 0 0.00 1 0.40 2 0.80 4 1.60 5 2.00 1.20 Stock Price $30.00 $34.05 $26.44 $38.64 $43.85 $30.00 $34.05 $23.29 $26.44 $20.53 $49.76 $56.47 $38.64 S43.85 $30.00 $34.05 $23.29 $26.44 $18.09 $20.53 $15.94 American Option $8.27 $11.91 $4.59 $15.54 $6.93 $1.93 $20.27 S10.15 $3.27 S0.41 $25.56 $31.47 S14.26 $18.85 $5.48 $9.05 S0.76 $1.44 $0.00 S0.00 $0.00 (10 marks) (b) Contrast common stock and preferred stock. Illustrate possible reasons that the price of a common stock is usually higher than the price of a preferred stock. In what circumstances will the price of a preferred stock be higher than the price of a common stock? (6 marks) Question 3 (a) Given the following Binomial tree of an American option, if the exercise price is less than the stock price, indicate whether this is a put option or a call option. Briefly discuss your reasons. Subsequently, answer the following questions. Round your answers to two (2) decimal points Compute the exercise price of the option. If the stock price increases, discuss the effect on the value of the option, assuming that the interest rate, volatility and time to maturity remain constant What is the present value of the option? 30.00 Step (dt) u d Option Type (Call - +1; Put =-1) Stock Price Exercise Price Interest Rate per year Volatility per year Time to Maturity (years) Number of Steps 0.4000 1.1348 0.8812 0.5320 P 4.00% 20.00% 2.00 5 3 Step Time 0 0.00 1 0.40 2 0.80 4 1.60 5 2.00 1.20 Stock Price $30.00 $34.05 $26.44 $38.64 $43.85 $30.00 $34.05 $23.29 $26.44 $20.53 $49.76 $56.47 $38.64 S43.85 $30.00 $34.05 $23.29 $26.44 $18.09 $20.53 $15.94 American Option $8.27 $11.91 $4.59 $15.54 $6.93 $1.93 $20.27 S10.15 $3.27 S0.41 $25.56 $31.47 S14.26 $18.85 $5.48 $9.05 S0.76 $1.44 $0.00 S0.00 $0.00 (10 marks) (b) Contrast common stock and preferred stock. Illustrate possible reasons that the price of a common stock is usually higher than the price of a preferred stock. In what circumstances will the price of a preferred stock be higher than the price of a common stock? (6 marks)