Answered step by step

Verified Expert Solution

Question

1 Approved Answer

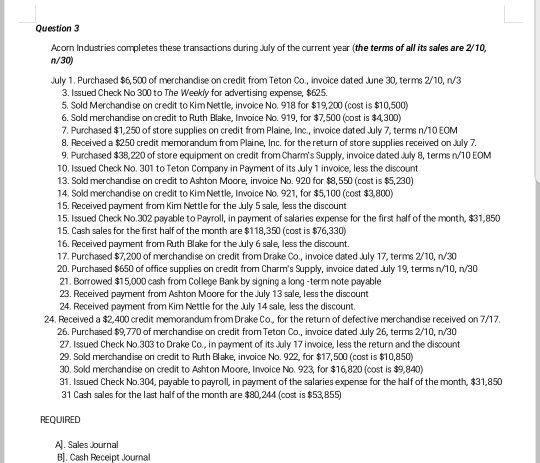

Question 3 Acorn Industries completes these transactions during July of the current year (the terms of all its sales are 2/10 n/30) uly 1. Purchased

Question 3 Acorn Industries completes these transactions during July of the current year (the terms of all its sales are 2/10 n/30) uly 1. Purchased $6,500 of merchandise on credit from Teton Co, invoice dated une 30, terms 2/10, v3 3. Issued Check No 300 to The Weekly for advertising expense, $625. 5. Sold Merchandise on credit to Kim Nettle, invoce No. 918 for $19,200 (cost is $10,500) 6. Sold merchandise on credit to Ruth Blake, Invoice No. 919, for $7,500 (cost is $4,300) 7. Purchased $1,250 of store supplies on credit from Plaine, Inc., invoice dated uly 7, terms n/10 EOM 8. Received a $250 credit memorandum from Plaine, Inc. for the return of store supplies received on July 7. 9. Purchased $38,220 of store equipment on credit fromCharm's Supply, invoice dated July 8, terms n/10 EOM 10. Issued Check No. 301 to Teton Company in Payment of its July 1 invoice, less the discount 13. Sold merchandise on credit to Ashton Moore, invoioe No. 920 for $8,550 (cost is $5,230) 14. Sold merchandise on credit to Kim Nettle, Ivoice No. 921, for $5,100 (cost $3,800) 15. Received payment from Kim Nettle for the July 5 sale, less the discount 15. Issued Check No.302 payable to Payroll, in payment of salaries expense for the first half of the month, $31,850 15. Cash sales for the first half of the month are $118,350 (cost is $76,330) 16. Received payment from auth Blake for the July 6 sale, less the disoount. 17 Purchased $7,200 of merchandise on credit from Drake Co, invoice dated July 17, terms 2/10, nv30 20. Purchased $650 of office supplies on credit from Charm's Supply, invoice dated July 19, terms n10, n/30 21. Borrowed $15,000 cash from College Bank by signing a long-term note payable 23. Received payment from Ashton Moore for the July 13 sale, less the discount 24. Received payment from Kim Nettle for the uly 14 sale, less the discount. 24. Received a $2,400 credit memorandum from Drake Co, for the return of defective merchandise received on 7/17 26. Purchased $9,770 of merchandise on credit from Teton Co., invoice dated July 26, terms 2/10, n/30 27. Issued Check No.303 to Drake Co, in payment of its July 17 invoice, less the return and the discount 29. Sold merchandise on credit to Ruth Blake, invoice No. 922, for $17,500 (cost is $10,850) 30. Sold merchandise on credit to Ashton Moore, Invoice No. 923 for $16,820 (cost is $9,840) 31. Issued Check No.304, payable to payroll, in payment of the salaries expense for the half of the month, $31,850 31 Cash sales for the last half of the month are $80,244 (oost is $53,855) REQUIRED A. Sales Journal Bl. Cash Receipt Journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started