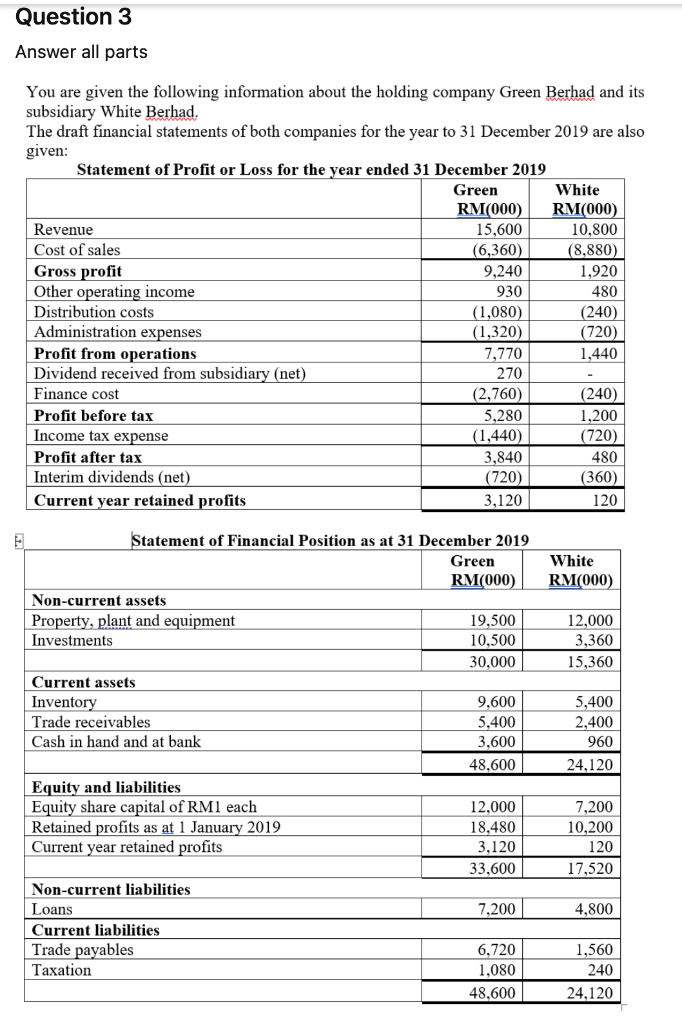

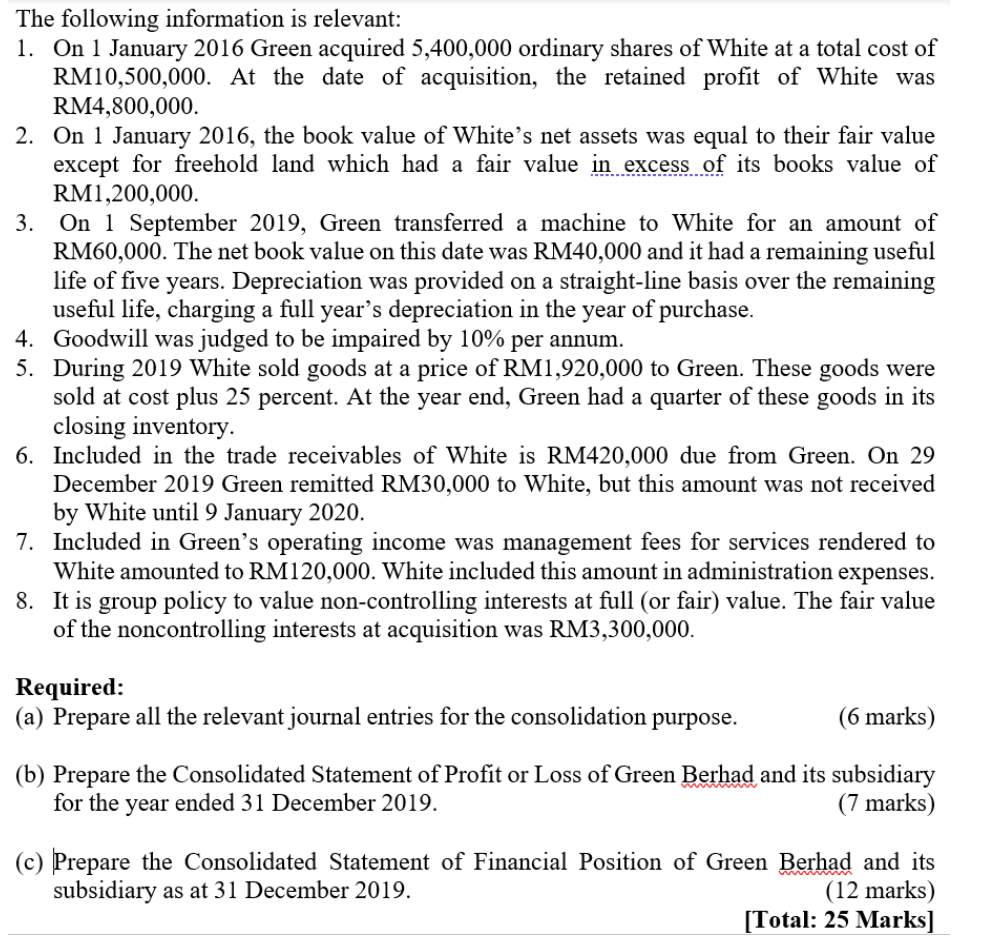

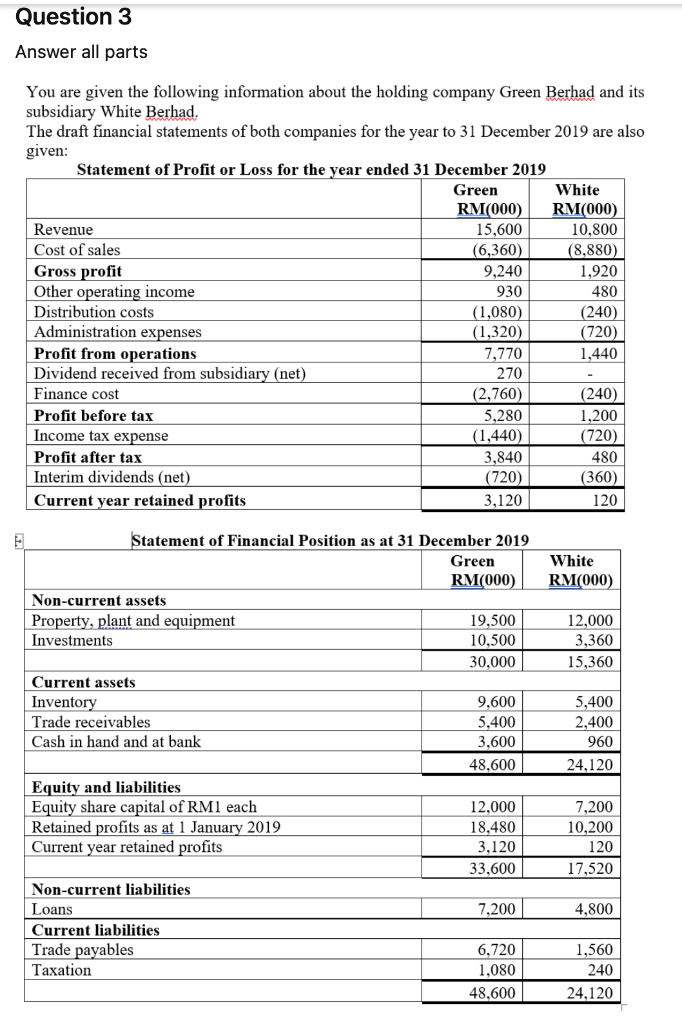

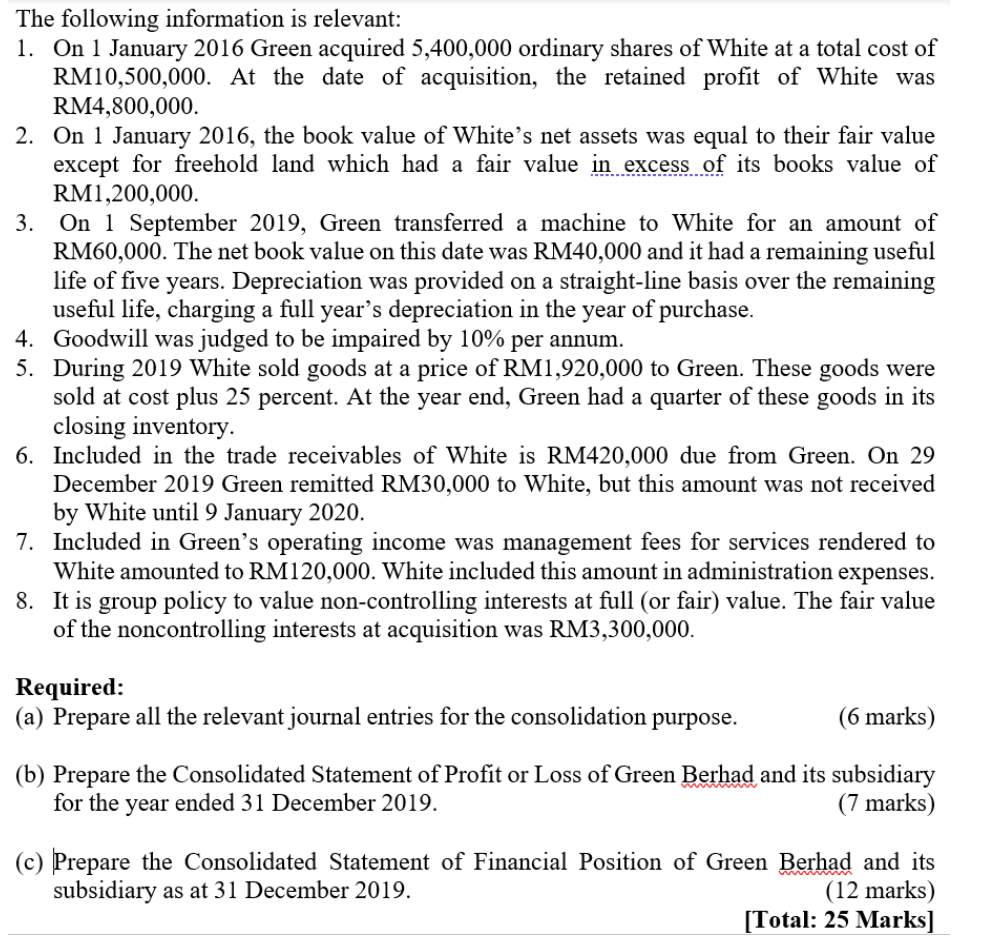

Question 3 Answer all parts You are given the following information about the holding company Green Berhad and its subsidiary White Berhad, The draft financial statements of both companies for the year to 31 December 2019 are also given: Statement of Profit or Loss for the year ended 31 December 2019 Green White RM(000) RM(000) Revenue 15,600 10,800 Cost of sales (6,360) (8,880) Gross profit 9,240 1,920 Other operating income 930 480 Distribution costs (1,080) (240) Administration expenses (1,320) (720) Profit from operations 7,770 Dividend received from subsidiary (net) 270 Finance cost (2,760) (240) Profit before tax 5,280 1,200 Income tax expense (1,440) (720) Profit after tax 3,840 480 Interim dividends (net) (720) (360) Current year retained profits 3,120 120 1,440 White RM(000) 12,000 3,360 15,360 Statement of Financial Position as at 31 December 2019 Green RM(000) Non-current assets Property, plant and equipment 19,500 Investments 10,500 30,000 Current assets Inventory 9,600 Trade receivables 5,400 Cash in hand and at bank 3,600 48,600 Equity and liabilities Equity share capital of RM1 each 12,000 Retained profits as at 1 January 2019 18.480 Current year retained profits 3,120 33,600 Non-current liabilities Loans 7,200 Current liabilities Trade payables 6,720 Taxation 1,080 48,600 5,400 2,400 960 24,120 7,200 10,200 120 17,520 4,800 1,560 240 24,120 The following information is relevant: 1. On 1 January 2016 Green acquired 5,400,000 ordinary shares of White at a total cost of RM10,500,000. At the date of acquisition, the retained profit of White was RM4,800,000. 2. On 1 January 2016, the book value of White's net assets was equal to their fair value except for freehold land which had a fair value in excess of its books value of RM1,200,000. 3. On 1 September 2019, Green transferred a machine to White for an amount of RM60,000. The net book value on this date was RM40,000 and it had a remaining useful life of five years. Depreciation was provided on a straight-line basis over the remaining useful life, charging a full year's depreciation in the year of purchase. 4. Goodwill was judged to be impaired by 10% per annum. 5. During 2019 White sold goods at a price of RM1,920,000 to Green. These goods were sold at cost plus 25 percent. At the year end, Green had a quarter of these goods in its closing inventory. 6. Included in the trade receivables of White is RM420,000 due from Green. On 29 December 2019 Green remitted RM30,000 to White, but this amount was not received by White until 9 January 2020. 7. Included in Green's operating income was management fees for services rendered to White amounted to RM120,000. White included this amount in administration expenses. 8. It is group policy to value non-controlling interests at full (or fair) value. The fair value of the noncontrolling interests at acquisition was RM3,300,000. Required: (a) Prepare all the relevant journal entries for the consolidation purpose. (6 marks) (b) Prepare the Consolidated Statement of Profit or Loss of Green Berhad and its subsidiary for the year ended 31 December 2019. (7 marks) (c) Prepare the Consolidated Statement of Financial Position of Green Berhad and its subsidiary as at 31 December 2019. (12 marks) [Total: 25 Marks]