Question

I need help filling out 2018 Form 4562 for the following business. Included a pic of what I have so far, but I'm not sure

I need help filling out 2018 Form 4562 for the following business. Included a pic of what I have so far, but I'm not sure it's right.

Business: Boxer Bubbles

Dog grooming services $ 20,000

Expenses:

Advertising $4,000

Supplies $ 1,200

Depreciation ??

Business license $150

Fuel for van $1,200

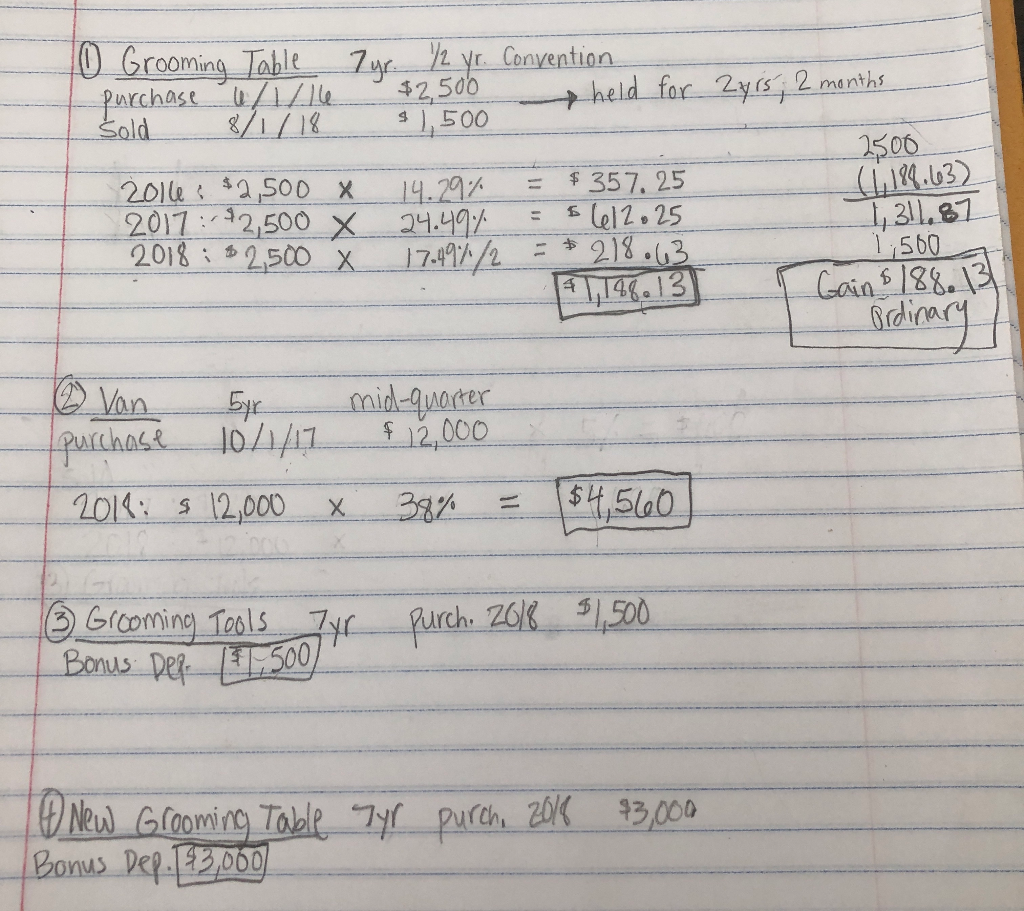

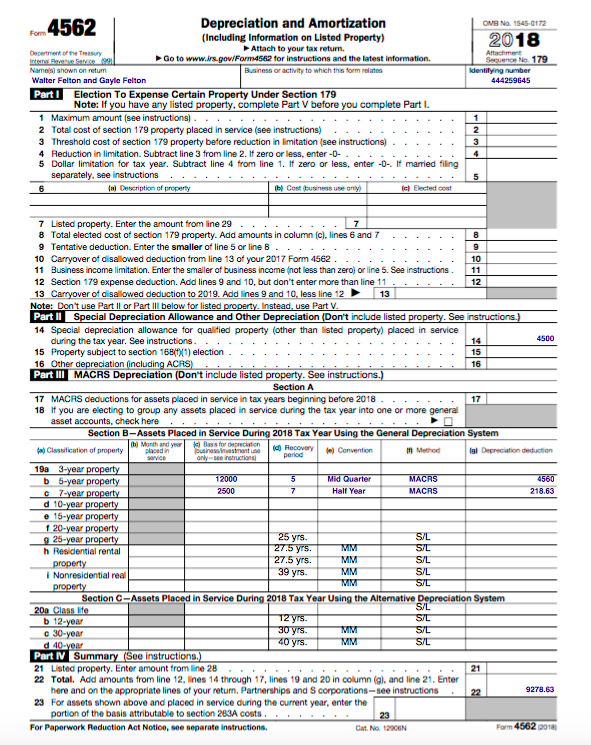

Assets: Gayle has been grooming dogs since 2016, but did not have any net income from the activity, so she did not report it on previous returns. However, this year she is earning more and has an asset sale so she has provided the following information: Calculate accumulated depreciation and recapture (if applicable)

- Grooming table 7-year half year convention purchased 6/1/16 $2,500

did not take any section 179 or bonus sold 8/1/18 for $1,500

- Used Van for mobile grooming service 5-year life mid quarter convention purchased 10/1/17 $12,000

- Grooming tools 7-year life purchased in 2018 $ 1,500 took bonus depreciation

- New grooming table 7-year life purchased in 2018 $3,000 took bonus depreciation

0 Grooming Tay. Cenventian s),500 8/1/18 old 2506 = $357.25 201le, sasoo x 2011 :,"21500 14.20% 24.MY ,211.87 1560 dian Vanrmid-quater Purchase 2014 s 12,000 X 33-- Bonus eo Depreciation and Amortization (Including Information on Listed Property) Attach to your tax return Go to www.irs.gow/Form4562 for instructions and the latest information r4562 2018 Sequence No 179 Depertment of the Teasury Namea) shown on retum Walter Felton and Gayle Feltor Buainess or activity to which this form neates Identifying number 444259645 PartI Election To Expense Certain Property Under Section 179 Note: If you have any listed property. complete Part V before you complete Part L 1 Maximum amount (see instructions) 2 Total cost of section 179 property placed in service (see instructions) 3 Threshold cost of section 179 property before reduction in limitation (see instructions) 4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter-0- 5 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing separately, see instructions b Cost (busness use anly) a) Elected cost of 7 Listed property. Enter the amount from line 29 8 Total elected cost of section 179 property. Add amounts in column (c), ines 6 and 7 9 Tentative deduction. Enter the smaller of line 5 or line 8 10 Carryover of disallowed deduction from line 13 of your 2017 Form 4562 11 Business income limitation. Enter the smaller of business income not less than zeroj or line 5. See instructions. 11 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 13 Carryover of aisallowed deduction to 2019. Add lines 9 and 10. less line 12 | 13 10 See PartiSpecial D allowance for qualified property (other than 14 Special during the tax year. See instructions depreclation allowance for qualified property (other than isted property) placed in service 4500 15 Property subject to section 168() election .. . 15 Part III MACRS Depreciation (Don't include listed property. See instructions. Section A 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here Section B-Assets Placed in Service During 2018 Tax Year Using the General Depreciation System )Classification of property place If Method Mid Quarter b 5-year property 2500 Half Year MACRS 218.63 e 1-year property 1 20-year property 9 25-year property 27.5 39 yrs. property i Nonresidential real Section C-Assets Placed in Service During 2018 Tax Year Using the Altermative Depreciation System S/L 30-year Part 22 Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g). and line 21. Enter 23 Summary (See Instructions Listedproperty. Enter amount from line 28 21 here and on the appropriate lines of your retun, Partnerships and S corporations-see instructions For assets shown above and placed in service during the ourrent year, enter the portion of the basis attributable to section 283A costs 9278.63 Form 4562 201 For Paperwork Reduction Act Notice, see separate instructions. Cat No 12906N 0 Grooming Tay. Cenventian s),500 8/1/18 old 2506 = $357.25 201le, sasoo x 2011 :,"21500 14.20% 24.MY ,211.87 1560 dian Vanrmid-quater Purchase 2014 s 12,000 X 33-- Bonus eo Depreciation and Amortization (Including Information on Listed Property) Attach to your tax return Go to www.irs.gow/Form4562 for instructions and the latest information r4562 2018 Sequence No 179 Depertment of the Teasury Namea) shown on retum Walter Felton and Gayle Feltor Buainess or activity to which this form neates Identifying number 444259645 PartI Election To Expense Certain Property Under Section 179 Note: If you have any listed property. complete Part V before you complete Part L 1 Maximum amount (see instructions) 2 Total cost of section 179 property placed in service (see instructions) 3 Threshold cost of section 179 property before reduction in limitation (see instructions) 4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter-0- 5 Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing separately, see instructions b Cost (busness use anly) a) Elected cost of 7 Listed property. Enter the amount from line 29 8 Total elected cost of section 179 property. Add amounts in column (c), ines 6 and 7 9 Tentative deduction. Enter the smaller of line 5 or line 8 10 Carryover of disallowed deduction from line 13 of your 2017 Form 4562 11 Business income limitation. Enter the smaller of business income not less than zeroj or line 5. See instructions. 11 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 13 Carryover of aisallowed deduction to 2019. Add lines 9 and 10. less line 12 | 13 10 See PartiSpecial D allowance for qualified property (other than 14 Special during the tax year. See instructions depreclation allowance for qualified property (other than isted property) placed in service 4500 15 Property subject to section 168() election .. . 15 Part III MACRS Depreciation (Don't include listed property. See instructions. Section A 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here Section B-Assets Placed in Service During 2018 Tax Year Using the General Depreciation System )Classification of property place If Method Mid Quarter b 5-year property 2500 Half Year MACRS 218.63 e 1-year property 1 20-year property 9 25-year property 27.5 39 yrs. property i Nonresidential real Section C-Assets Placed in Service During 2018 Tax Year Using the Altermative Depreciation System S/L 30-year Part 22 Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g). and line 21. Enter 23 Summary (See Instructions Listedproperty. Enter amount from line 28 21 here and on the appropriate lines of your retun, Partnerships and S corporations-see instructions For assets shown above and placed in service during the ourrent year, enter the portion of the basis attributable to section 283A costs 9278.63 Form 4562 201 For Paperwork Reduction Act Notice, see separate instructions. Cat No 12906N

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started