Answered step by step

Verified Expert Solution

Question

1 Approved Answer

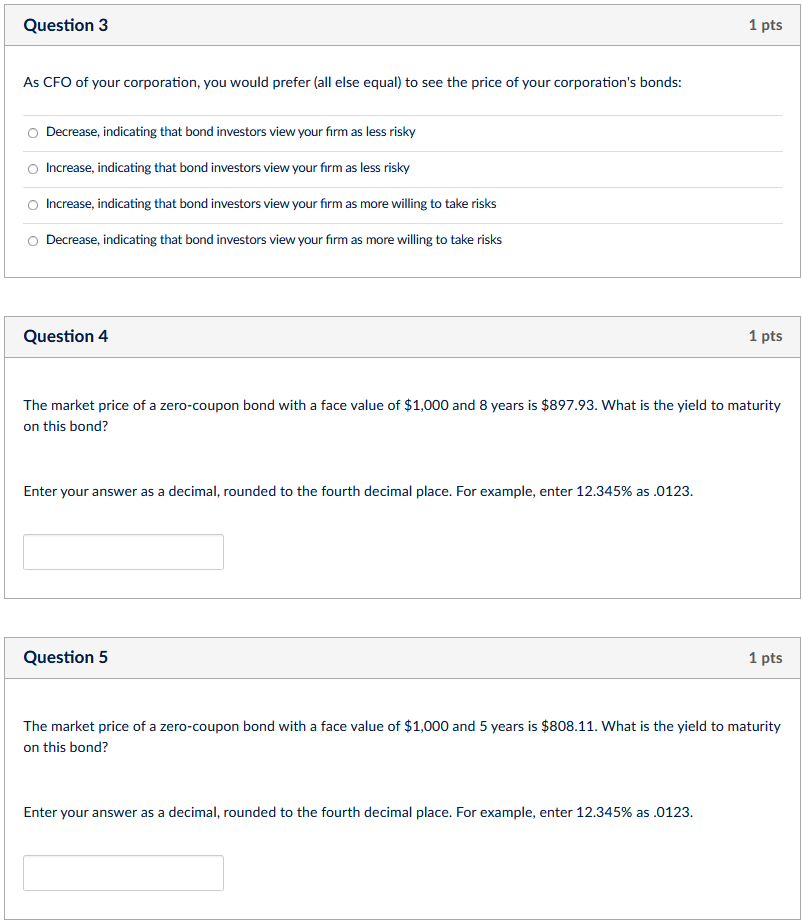

Question 3 As CFO of your corporation, you would prefer ( all else equal ) to see the price of your corporation's bonds: Decrease, indicating

Question

As CFO of your corporation, you would prefer all else equal to see the price of your corporation's bonds:

Decrease, indicating that bond investors view your firm as less risky

Increase, indicating that bond investors view your firm as less risky

Increase, indicating that bond investors view your firm as more willing to take risks

Decrease, indicating that bond investors view your firm as more willing to take risks

Question

The market price of a zerocoupon bond with a face value of $ and years is $ What is the yield to maturity

on this bond?

Enter your answer as a decimal, rounded to the fourth decimal place. For example, enter as

Question

The market price of a zerocoupon bond with a face value of $ and years is $ What is the yield to maturity

on this bond?

Enter your answer as a decimal, rounded to the fourth decimal place. For example, enter as

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started