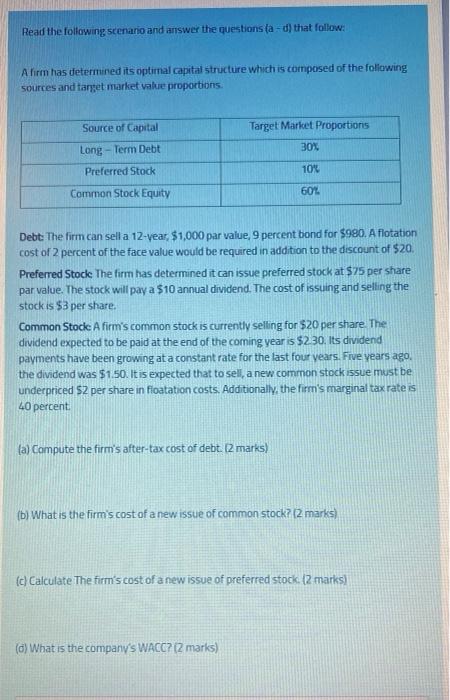

Read the following scenario and answer the questions (a -d) that follow: Afirm has determined its optimal capital structure which is composed of the following sources and target market value proportions. Source of Capital Long-Term Debt Target Market Proportions 30% Preferred Stock 10% Common Stock Equity 60% Debt: The firm can sell a 12-year, $1,000 par value, 9 percent bond for $980. A flotation cost of 2 percent of the face value would be required in addition to the discount of $20. Preferred Stock The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share. Common Stock A firm's common stock is currently selling for $20 per share. The dividend expected to be paid at the end of the coming year is $2.30. Its dividend payments have been growing at a constant rate for the last four years. Five years ago. the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $2 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent (a) Compute the firm's after-tax cost of debt. 2 marks) (b) What is the firm's cost of a new issue of common stock? (2 marks) (c) Calculate the firm's cost of a new issue of preferred stock. (2 marks) (c) What is the company's WACC? [2 marks) Read the following scenario and answer the questions (a -d) that follow: Afirm has determined its optimal capital structure which is composed of the following sources and target market value proportions. Source of Capital Long-Term Debt Target Market Proportions 30% Preferred Stock 10% Common Stock Equity 60% Debt: The firm can sell a 12-year, $1,000 par value, 9 percent bond for $980. A flotation cost of 2 percent of the face value would be required in addition to the discount of $20. Preferred Stock The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share. Common Stock A firm's common stock is currently selling for $20 per share. The dividend expected to be paid at the end of the coming year is $2.30. Its dividend payments have been growing at a constant rate for the last four years. Five years ago. the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $2 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent (a) Compute the firm's after-tax cost of debt. 2 marks) (b) What is the firm's cost of a new issue of common stock? (2 marks) (c) Calculate the firm's cost of a new issue of preferred stock. (2 marks) (c) What is the company's WACC? [2 marks)