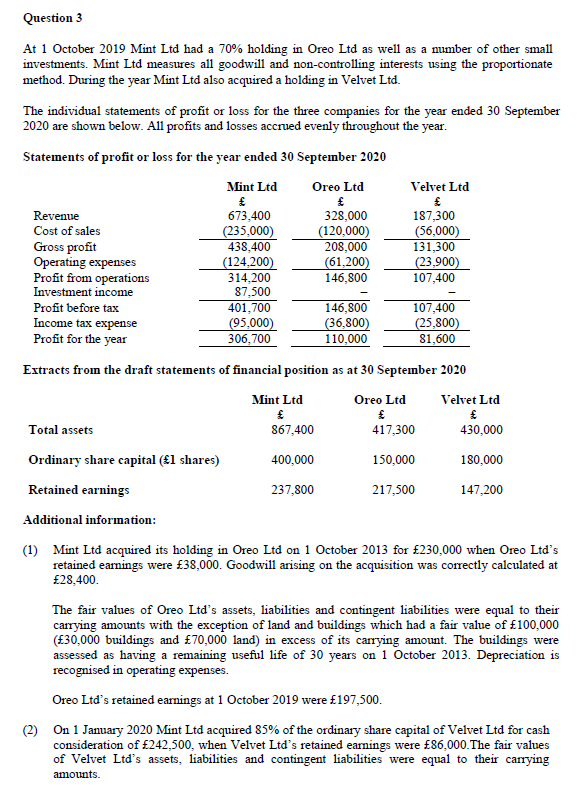

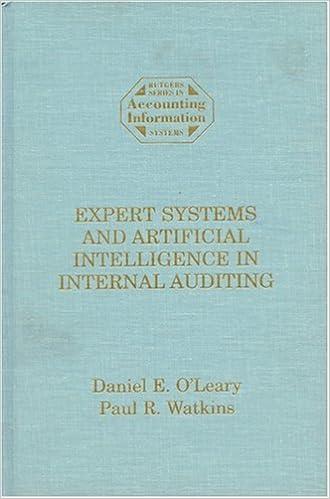

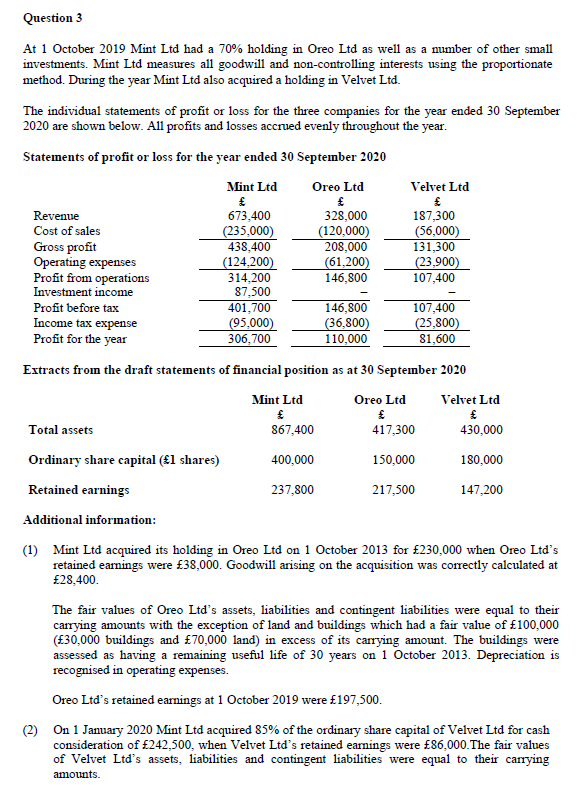

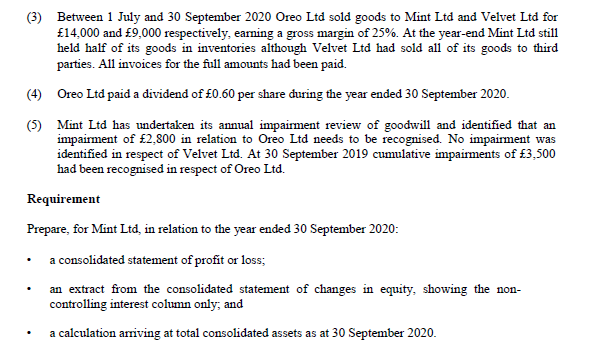

Question 3 At 1 October 2019 Mint Ltd had a 70% holding in Oreo Ltd as well as a number of other small investments. Mint Ltd measures all goodwill and non-controlling interests using the proportionate method. During the year Mint Ltd also acquired a holding in Velvet Ltd. The individual statements of profit or loss for the three companies for the year ended 30 September 2020 are shown below. All profits and losses accrued evenly throughout the year. Statements of profit or loss for the year ended 30 September 2020 Revenue Cost of sales Gross profit Operating expenses Profit from operations Investment income Profit before tax Income tax expense Profit for the year Mint Ltd 673,400 (235,000) 438,400 (124.200) 314,200 87,500 401,700 (95.000 306,700 Oreo Ltd 328,000 (120,000) 208,000 (61,200) 146,800 Velvet Ltd $ 187,300 (56,000) 131,300 (23,900) 107,400 146,800 (36,800) 110,000 107,400 (25,800) 81,600 Extracts from the draft stateinents of financial position as at 30 September 2020 Mint Ltd 867,400 Oreo Ltd 417,300 Velvet Ltd 430,000 Total assets Ordinary share capital (1 shares) 400,000 150,000 180,000 Retained earnings 237,800 217,500 147,200 Additional information: (1) Mint Ltd acquired its holding in Oreo Ltd on 1 October 2013 for 230,000 when Oreo Ltd's retained earnings were 38,000. Goodwill arising on the acquisition was correctly calculated at 28.400 The fair values of Oreo Ltd's assets, liabilities and contingent liabilities were equal to their carrying amounts with the exception of land and buildings which had a fair value of 100,000 (30,000 buildings and 70,000 land) in excess of its carrying amount. The buildings were assessed as having a remaining useful life of 30 years on 1 October 2013. Depreciation is recognised in operating expenses. Oreo Ltd's retained earnings at 1 October 2019 were 197,500. (2) On 1 January 2020 Mint Ltd acquired 85% of the ordinary share capital of Velvet Ltd for cash consideration of 242,500, when Velvet Ltd's retained earnings were 86,000. The fair values of Velvet Ltd's assets, liabilities and contingent liabilities were equal to their carrying amounts. (3) Between 1 July and 30 September 2020 Oreo Ltd sold goods to Mint Ltd and Velvet Ltd for 14,000 and 9,000 respectively, earning a gross margin of 25%. At the year-end Mint Ltd still held half of its goods in inventories although Velvet Ltd had sold all of its goods to third parties. All invoices for the full amounts had been paid. (4) Oreo Ltd paid a dividend of 0.60 per share during the year ended 30 September 2020. (5) Mint Ltd has undertaken its annual impairment review of goodwill and identified that an impairment of 2,800 in relation to Oreo Ltd needs to be recognised. No impairment was identified in respect of Velvet Ltd. At 30 September 2019 cumulative impairments of 3,500 had been recognised in respect of Oreo Ltd. Requirement Prepare for Mint Ltd, in relation to the year ended 30 September 2020: a consolidated statement of profit or loss; an extract from the consolidated statement of changes in equity, showing the non- controlling interest column only; and a calculation arriving at total consolidated assets as at 30 September 2020. Question 3 At 1 October 2019 Mint Ltd had a 70% holding in Oreo Ltd as well as a number of other small investments. Mint Ltd measures all goodwill and non-controlling interests using the proportionate method. During the year Mint Ltd also acquired a holding in Velvet Ltd. The individual statements of profit or loss for the three companies for the year ended 30 September 2020 are shown below. All profits and losses accrued evenly throughout the year. Statements of profit or loss for the year ended 30 September 2020 Revenue Cost of sales Gross profit Operating expenses Profit from operations Investment income Profit before tax Income tax expense Profit for the year Mint Ltd 673,400 (235,000) 438,400 (124.200) 314,200 87,500 401,700 (95.000 306,700 Oreo Ltd 328,000 (120,000) 208,000 (61,200) 146,800 Velvet Ltd $ 187,300 (56,000) 131,300 (23,900) 107,400 146,800 (36,800) 110,000 107,400 (25,800) 81,600 Extracts from the draft stateinents of financial position as at 30 September 2020 Mint Ltd 867,400 Oreo Ltd 417,300 Velvet Ltd 430,000 Total assets Ordinary share capital (1 shares) 400,000 150,000 180,000 Retained earnings 237,800 217,500 147,200 Additional information: (1) Mint Ltd acquired its holding in Oreo Ltd on 1 October 2013 for 230,000 when Oreo Ltd's retained earnings were 38,000. Goodwill arising on the acquisition was correctly calculated at 28.400 The fair values of Oreo Ltd's assets, liabilities and contingent liabilities were equal to their carrying amounts with the exception of land and buildings which had a fair value of 100,000 (30,000 buildings and 70,000 land) in excess of its carrying amount. The buildings were assessed as having a remaining useful life of 30 years on 1 October 2013. Depreciation is recognised in operating expenses. Oreo Ltd's retained earnings at 1 October 2019 were 197,500. (2) On 1 January 2020 Mint Ltd acquired 85% of the ordinary share capital of Velvet Ltd for cash consideration of 242,500, when Velvet Ltd's retained earnings were 86,000. The fair values of Velvet Ltd's assets, liabilities and contingent liabilities were equal to their carrying amounts. (3) Between 1 July and 30 September 2020 Oreo Ltd sold goods to Mint Ltd and Velvet Ltd for 14,000 and 9,000 respectively, earning a gross margin of 25%. At the year-end Mint Ltd still held half of its goods in inventories although Velvet Ltd had sold all of its goods to third parties. All invoices for the full amounts had been paid. (4) Oreo Ltd paid a dividend of 0.60 per share during the year ended 30 September 2020. (5) Mint Ltd has undertaken its annual impairment review of goodwill and identified that an impairment of 2,800 in relation to Oreo Ltd needs to be recognised. No impairment was identified in respect of Velvet Ltd. At 30 September 2019 cumulative impairments of 3,500 had been recognised in respect of Oreo Ltd. Requirement Prepare for Mint Ltd, in relation to the year ended 30 September 2020: a consolidated statement of profit or loss; an extract from the consolidated statement of changes in equity, showing the non- controlling interest column only; and a calculation arriving at total consolidated assets as at 30 September 2020