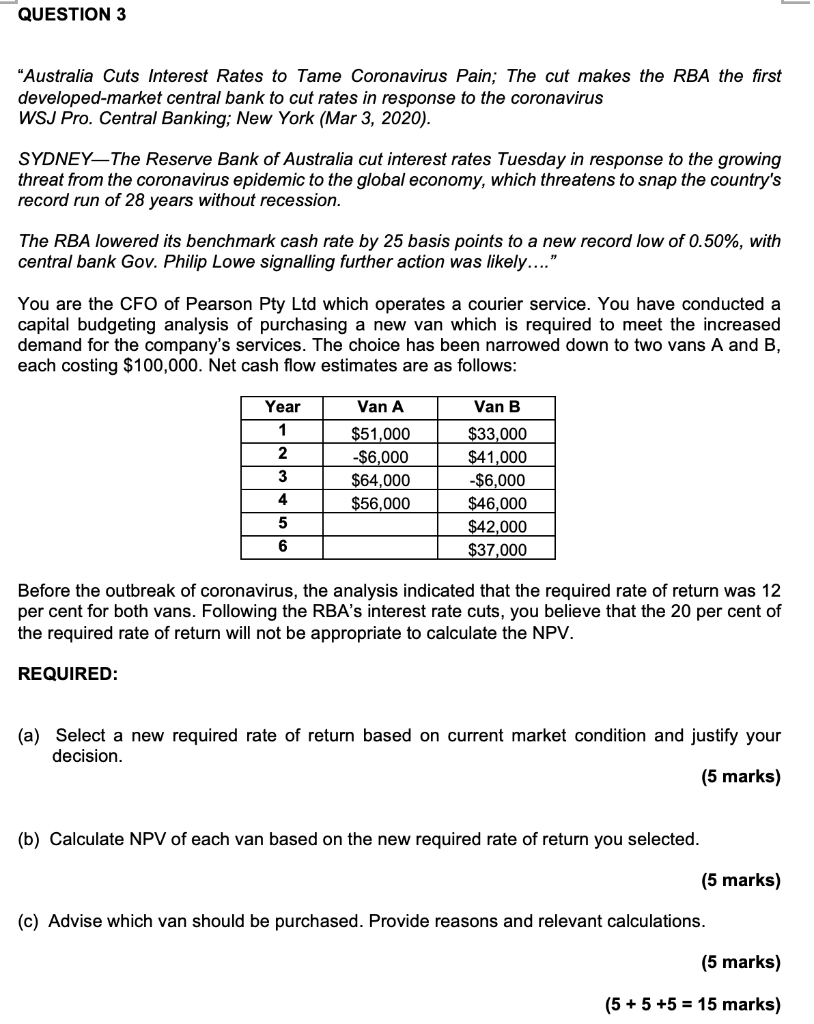

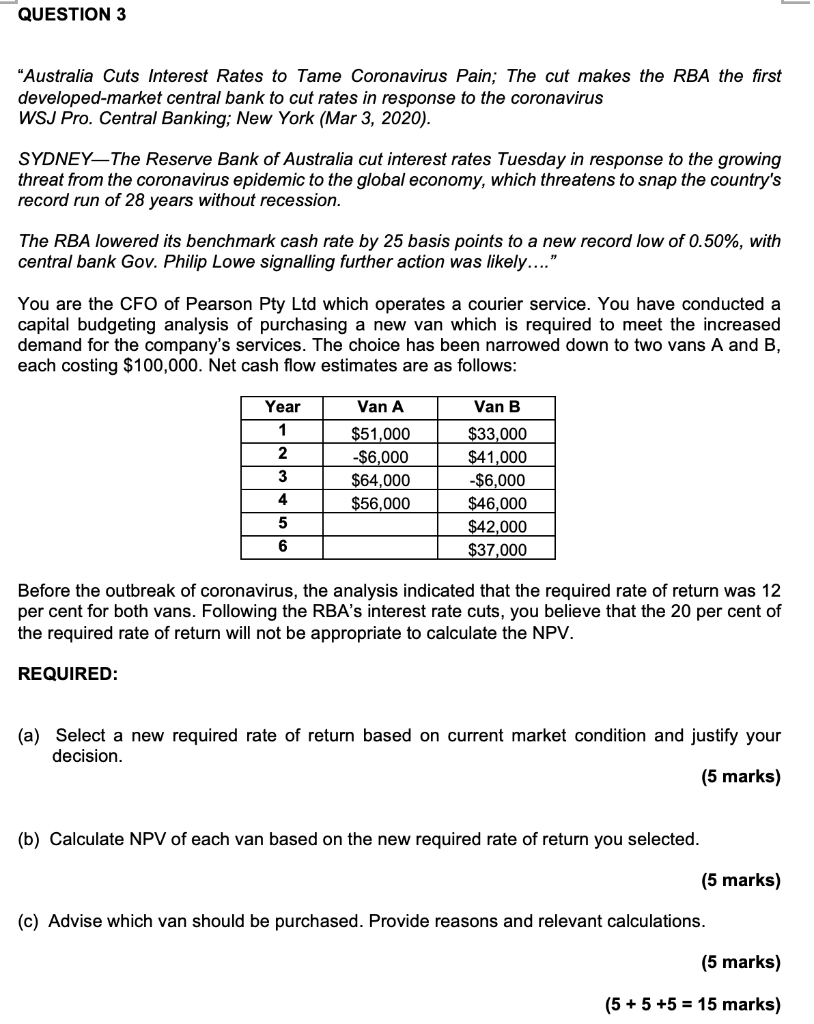

QUESTION 3 "Australia Cuts Interest Rates to Tame Coronavirus Pain; The cut makes the RBA the first developed-market central bank to cut rates in response to the coronavirus WSJ Pro. Central Banking; New York (Mar 3, 2020). SYDNEY-The Reserve Bank of Australia cut interest rates Tuesday in response to the growing threat from the coronavirus epidemic to the global economy, which threatens to snap the country's record run of 28 years without recession. The RBA lowered its benchmark cash rate by 25 basis points to a new record low of 0.50%, with central bank Gov. Philip Lowe signalling further action was likely...." You are the CFO of Pearson Pty Ltd which operates a courier service. You have conducted a capital budgeting analysis of purchasing a new van which is required to meet the increased demand for the company's services. The choice has been narrowed down to two vans A and B, each costing $100,000. Net cash flow estimates are as follows: Van A Year 1 2 3 4 $51,000 -$6,000 $64,000 $56,000 Van B $33,000 $41,000 -$6,000 $46,000 $42,000 $37,000 5 6 Before the outbreak of coronavirus, the analysis indicated that the required rate of return was 12 per cent for both vans. Following the RBA's interest rate cuts, you believe that the 20 per cent of the required rate of return will not be appropriate to calculate the NPV. REQUIRED: (a) Select a new required rate of return based on current market condition and justify your decision. (5 marks) (b) Calculate NPV of each van based on the new required rate of return you selected. (5 marks) (c) Advise which van should be purchased. Provide reasons and relevant calculations. (5 marks) (5 + 5 +5 = 15 marks) QUESTION 3 "Australia Cuts Interest Rates to Tame Coronavirus Pain; The cut makes the RBA the first developed-market central bank to cut rates in response to the coronavirus WSJ Pro. Central Banking; New York (Mar 3, 2020). SYDNEY-The Reserve Bank of Australia cut interest rates Tuesday in response to the growing threat from the coronavirus epidemic to the global economy, which threatens to snap the country's record run of 28 years without recession. The RBA lowered its benchmark cash rate by 25 basis points to a new record low of 0.50%, with central bank Gov. Philip Lowe signalling further action was likely...." You are the CFO of Pearson Pty Ltd which operates a courier service. You have conducted a capital budgeting analysis of purchasing a new van which is required to meet the increased demand for the company's services. The choice has been narrowed down to two vans A and B, each costing $100,000. Net cash flow estimates are as follows: Van A Year 1 2 3 4 $51,000 -$6,000 $64,000 $56,000 Van B $33,000 $41,000 -$6,000 $46,000 $42,000 $37,000 5 6 Before the outbreak of coronavirus, the analysis indicated that the required rate of return was 12 per cent for both vans. Following the RBA's interest rate cuts, you believe that the 20 per cent of the required rate of return will not be appropriate to calculate the NPV. REQUIRED: (a) Select a new required rate of return based on current market condition and justify your decision. (5 marks) (b) Calculate NPV of each van based on the new required rate of return you selected. (5 marks) (c) Advise which van should be purchased. Provide reasons and relevant calculations. (5 marks) (5 + 5 +5 = 15 marks)