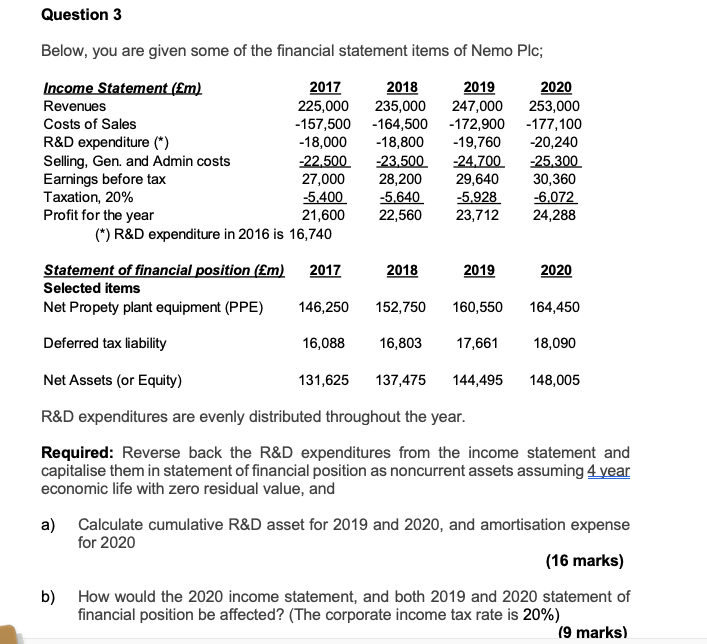

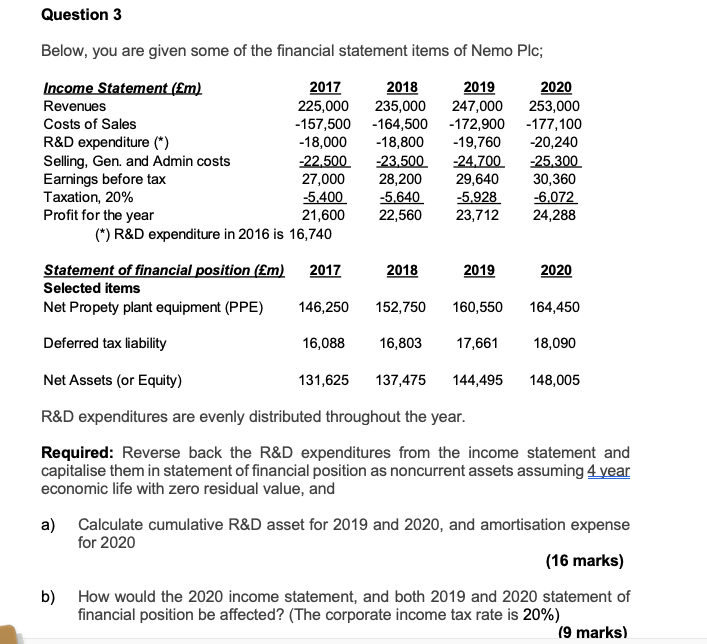

Question 3 Below, you are given some of the financial statement items of Nemo Plc; Income Statement (Em) 2017 2018 2019 2020 Revenues 225,000 235,000 247,000 253,000 Costs of Sales -157,500 -164,500 -172,900 -177,100 R&D expenditure (*) -18,000 -18,800 -19,760 -20,240 Selling, Gen. and Admin costs -22.500 -23.500 -24.700 -25.300 Earnings before tax 27,000 28,200 29,640 30,360 Taxation, 20% -5.400 -5,640 -5.928 -6,072 Profit for the year 21,600 22,560 23,712 24,288 (*) R&D expenditure in 2016 is 16,740 2017 2018 2019 2020 Statement of financial position (m) Selected items Net Propety plant equipment (PPE) 146,250 152,750 160,550 164,450 Deferred tax liability 16,088 16,803 17,661 18,090 Net Assets (or Equity) 131,625 137,475 144,495 148,005 R&D expenditures are evenly distributed throughout the year. Required: Reverse back the R&D expenditures from the income statement and capitalise them in statement of financial position as noncurrent assets assuming 4 year economic life with zero residual value, and a) Calculate cumulative R&D asset for 2019 and 2020, and amortisation expense for 2020 (16 marks) b) How would the 2020 income statement, and both 2019 and 2020 statement of financial position be affected? (The corporate income tax rate is 20%) (9 marks) Question 3 Below, you are given some of the financial statement items of Nemo Plc; Income Statement (Em) 2017 2018 2019 2020 Revenues 225,000 235,000 247,000 253,000 Costs of Sales -157,500 -164,500 -172,900 -177,100 R&D expenditure (*) -18,000 -18,800 -19,760 -20,240 Selling, Gen. and Admin costs -22.500 -23.500 -24.700 -25.300 Earnings before tax 27,000 28,200 29,640 30,360 Taxation, 20% -5.400 -5,640 -5.928 -6,072 Profit for the year 21,600 22,560 23,712 24,288 (*) R&D expenditure in 2016 is 16,740 2017 2018 2019 2020 Statement of financial position (m) Selected items Net Propety plant equipment (PPE) 146,250 152,750 160,550 164,450 Deferred tax liability 16,088 16,803 17,661 18,090 Net Assets (or Equity) 131,625 137,475 144,495 148,005 R&D expenditures are evenly distributed throughout the year. Required: Reverse back the R&D expenditures from the income statement and capitalise them in statement of financial position as noncurrent assets assuming 4 year economic life with zero residual value, and a) Calculate cumulative R&D asset for 2019 and 2020, and amortisation expense for 2020 (16 marks) b) How would the 2020 income statement, and both 2019 and 2020 statement of financial position be affected? (The corporate income tax rate is 20%) (9 marks)