Answered step by step

Verified Expert Solution

Question

1 Approved Answer

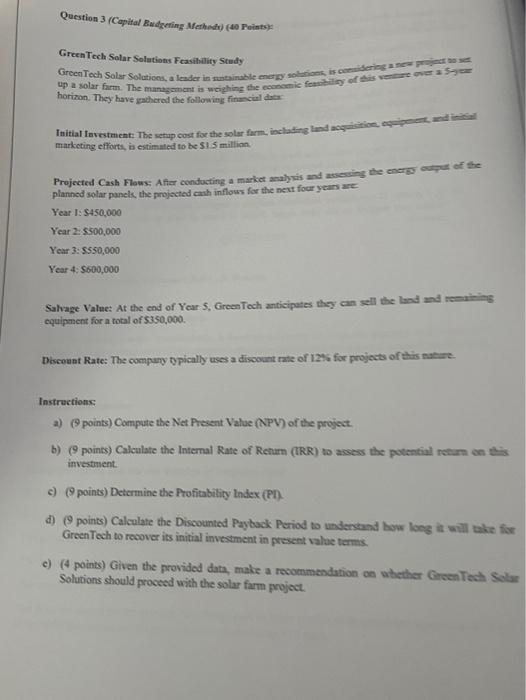

Question 3 (Capital Budgeting Methods) (40 Points): Green Tech Solar Solutions Feasibility Study care over a 5-year Green Tech Solar Solutions, a leader in sustainable

Question 3 (Capital Budgeting Methods) (40 Points): Green Tech Solar Solutions Feasibility Study care over a 5-year Green Tech Solar Solutions, a leader in sustainable energy solutions, is considering a new project to set up a solar farm. The management is weighing the economic feasibility of this v horizon. They have gathered the following financial data: Initial Investment: The setup cost for the solar farm, including land acquisition, marketing efforts, is estimated to be $1.5 million. Projected Cash Flows: After conducting a market analysis and assessing the energy output of the planned solar panels, the projected cash inflows for the next four years are: Year 1: $450,000 Year 2: $500,000 Year 3: $550,000 Year 4: $600,000 Salvage Value: At the end of Year 5, GreenTech anticipates they can sell the land and remaining equipment for a total of $350,000. Discount Rate: The company typically uses a discount rate of 12% for projects of this nature. Instructions: a) (9 points) Compute the Net Present Value (NPV) of the project. b) (9 points) Calculate the Internal Rate of Return (IRR) to assess the potential return on this investment. c) (9 points) Determine the Profitability Index (PI) d) (9 points) Calculate the Discounted Payback Period to understand how long it will take for Green Tech to recover its initial investment in present value terms. e) (4 points) Given the provided data, make a recommendation on whether Green Tech Solar Solutions should proceed with the solar farm project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started