Answered step by step

Verified Expert Solution

Question

1 Approved Answer

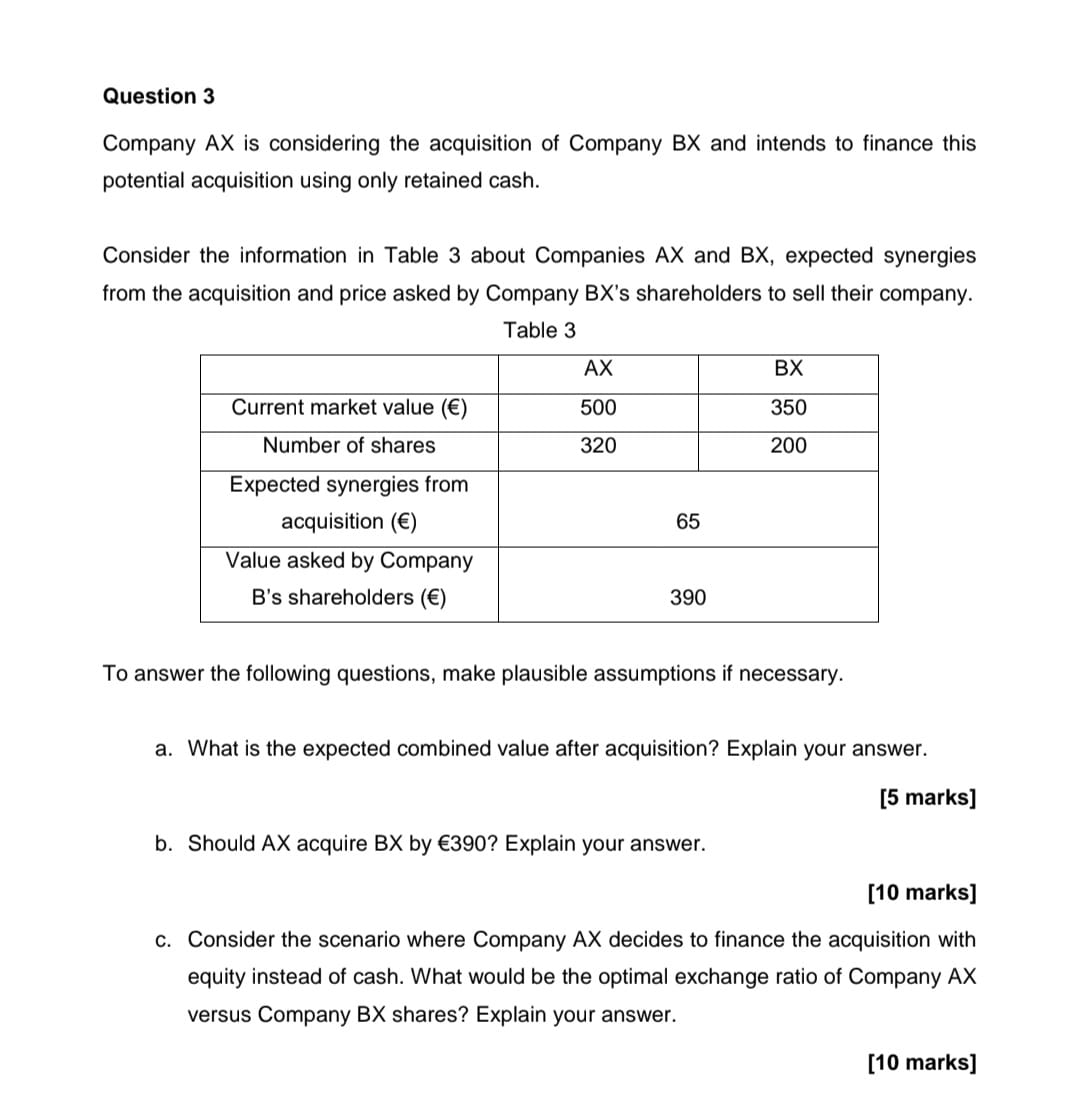

Question 3 Company A x is considering the acquisition of Company B x and intends to finance this potential acquisition using only retained cash. Consider

Question

Company is considering the acquisition of Company and intends to finance this

potential acquisition using only retained cash.

Consider the information in Table about Companies AX and BX expected synergies

from the acquisition and price asked by Company BXs shareholders to sell their company.

Table

To answer the following questions, make plausible assumptions if necessary.

a What is the expected combined value after acquisition? Explain your answer.

marks

b Should acquire BX by Explain your answer.

marks

c Consider the scenario where Company decides to finance the acquisition with

equity instead of cash. What would be the optimal exchange ratio of Company

versus Company BX shares? Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started