Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Consider a European call option and a European put option that have the same under - lying stock, the same strike price K

Question

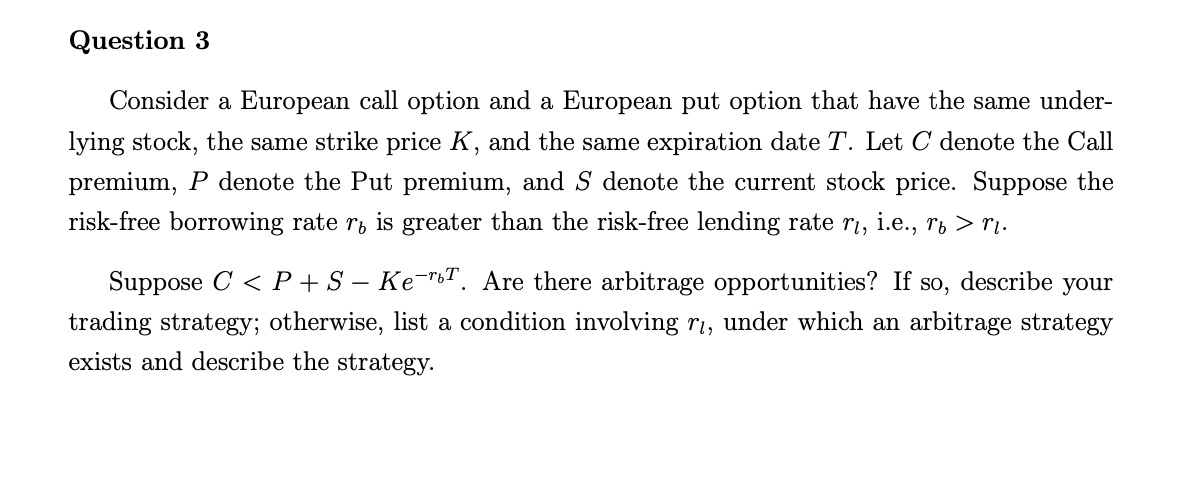

Consider a European call option and a European put option that have the same under

lying stock, the same strike price and the same expiration date Let denote the Call

premium, denote the Put premium, and denote the current stock price. Suppose the

riskfree borrowing rate greater than the riskfree lending rate

Suppose Are there arbitrage opportunities? describe your

trading strategy; otherwise, list a condition involving under which arbitrage strategy

exists and describe the strategy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started