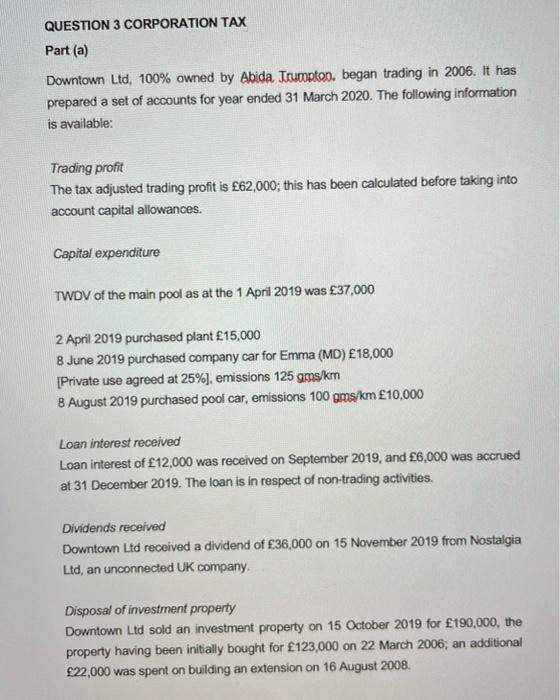

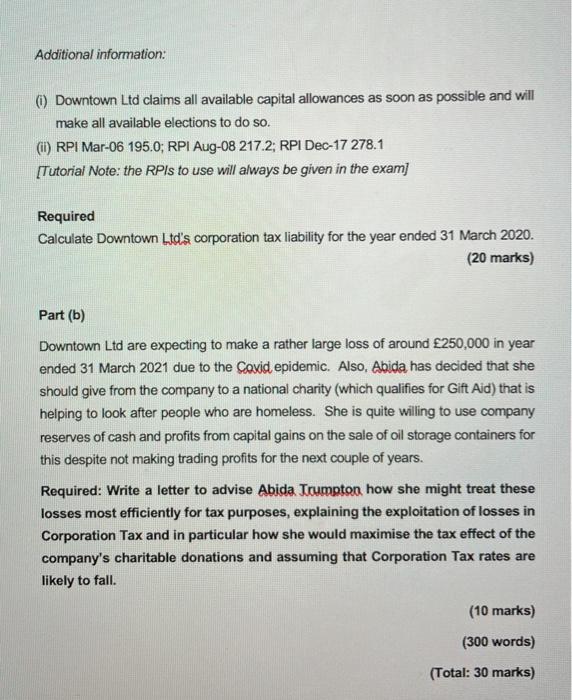

QUESTION 3 CORPORATION TAX Part (a) Downtown Ltd, 100% owned by Abida Trumpton, began trading in 2006. It has prepared a set of accounts for year ended 31 March 2020. The following information is available: Trading profit The tax adjusted trading profit is 62,000; this has been calculated before taking into account capital allowances. Capital expenditure TWDV of the main pool as at the 1 April 2019 was 37,000 2 April 2019 purchased plant 15,000 8 June 2019 purchased company car for Emma (MD) 18,000 [Private use agreed at 25%), emissions 125 gms/km 8 August 2019 purchased pool car, emissions 100 gms/km 10,000 Loan interest received Loan interest of 12,000 was received on September 2019, and 6,000 was accrued at 31 December 2019. The loan is in respect of non-trading activities. Dividends received Downtown Ltd received a dividend of 36,000 on 15 November 2019 from Nostalgia Ltd, an unconnected UK company. Disposal of investment property Downtown Ltd sold an investment property on 15 October 2019 for 190,000, the property having been initially bought for 123,000 on 22 March 2006; an additional 22,000 was spent on building an extension on 16 August 2008 Additional information: (Downtown Ltd claims all available capital allowances as soon as possible and will make all available elections to do so. (II) RPI Mar-06 195.0; RPI Aug-08 217.2; RPI Dec-17 278.1 [Tutorial Note: the RPIs to use will always be given in the exam] Required Calculate Downtown Ltd's corporation tax liability for the year ended 31 March 2020. (20 marks) Part (b) Downtown Ltd are expecting to make a rather large loss of around 250,000 in year ended 31 March 2021 due to the Coxid epidemic. Also, Abida has decided that she should give from the company to a national charity (which qualifies for Gift Aid) that is helping to look after people who are homeless. She is quite willing to use company reserves of cash and profits from capital gains on the sale of oil storage containers for this despite not making trading profits for the next couple of years. Required: Write a letter to advise Abida Trumpton how she might treat these losses most efficiently for tax purposes, explaining the exploitation of losses in Corporation Tax and in particular how she would maximise the tax effect of the company's charitable donations and assuming that Corporation Tax rates are likely to fall. (10 marks) (300 words) (Total: 30 marks)