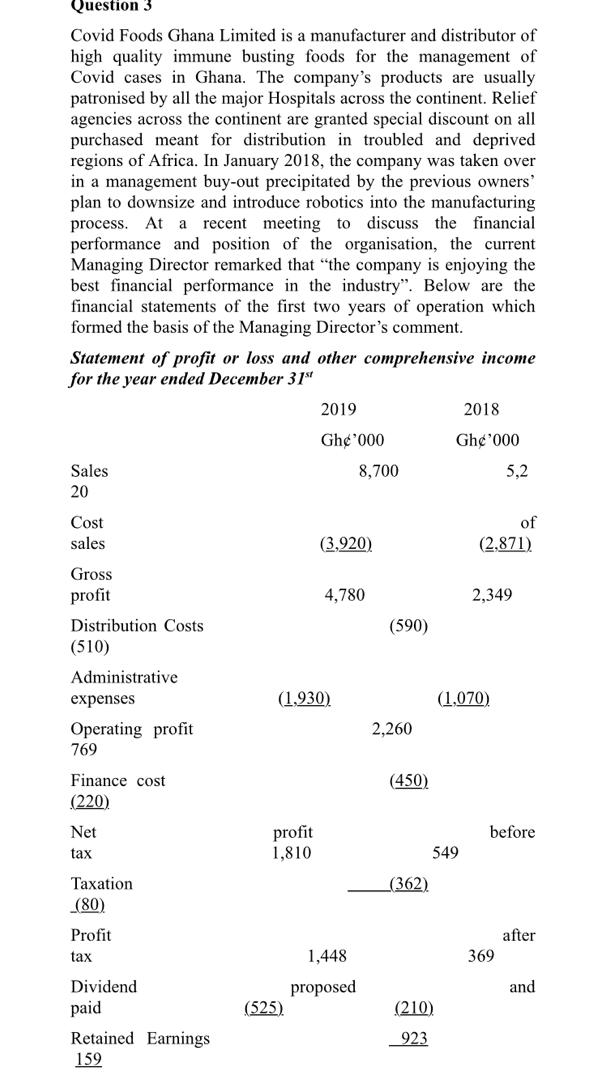

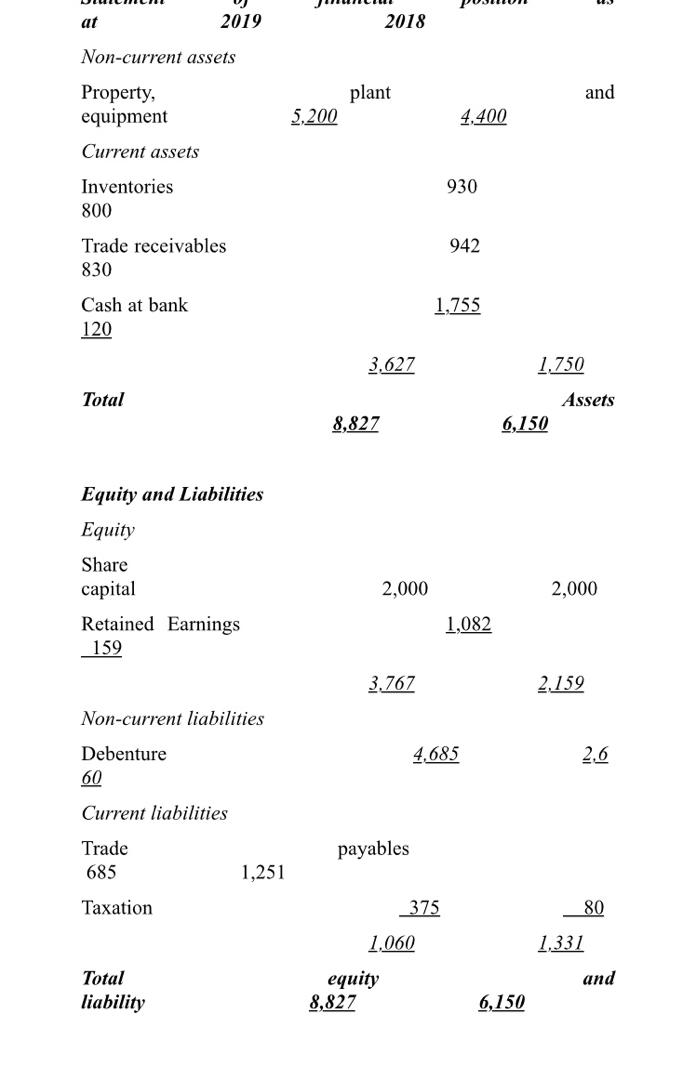

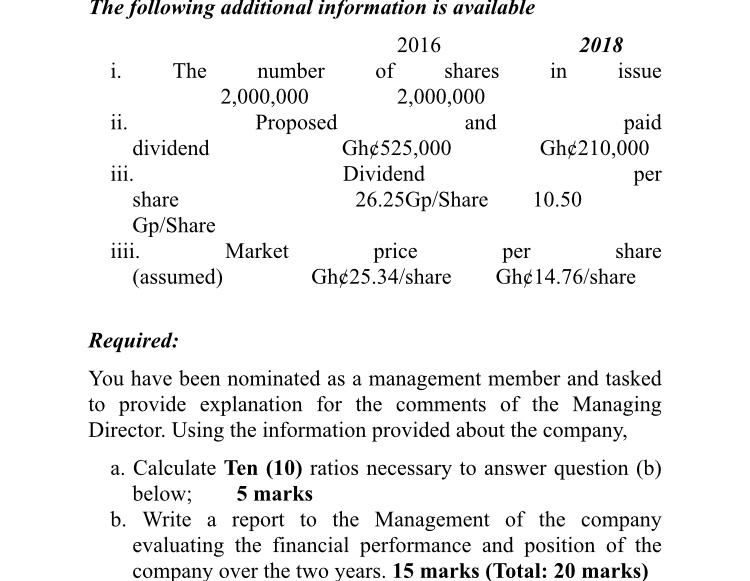

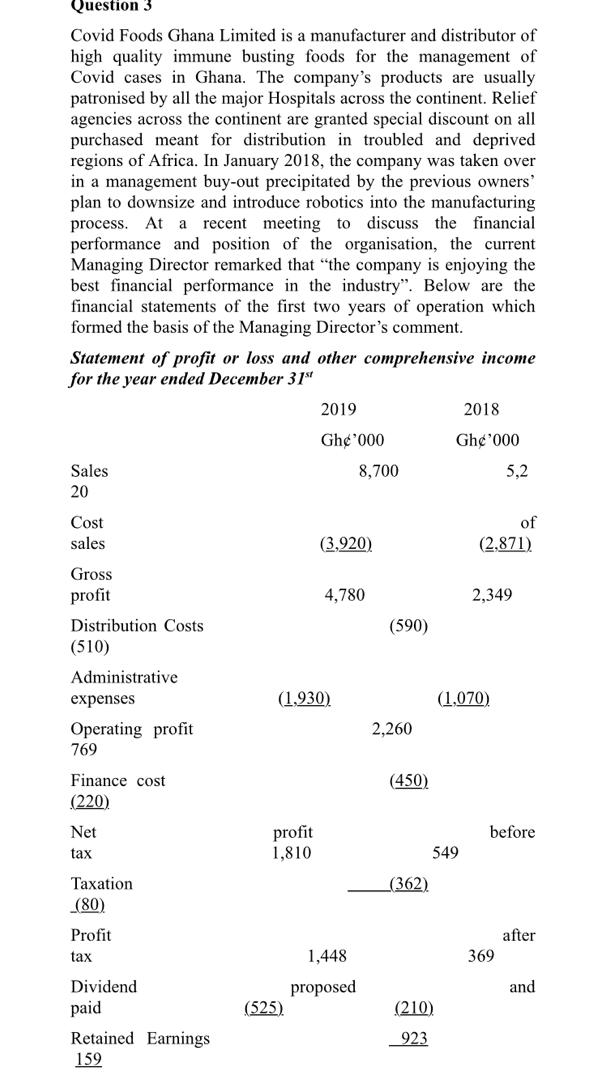

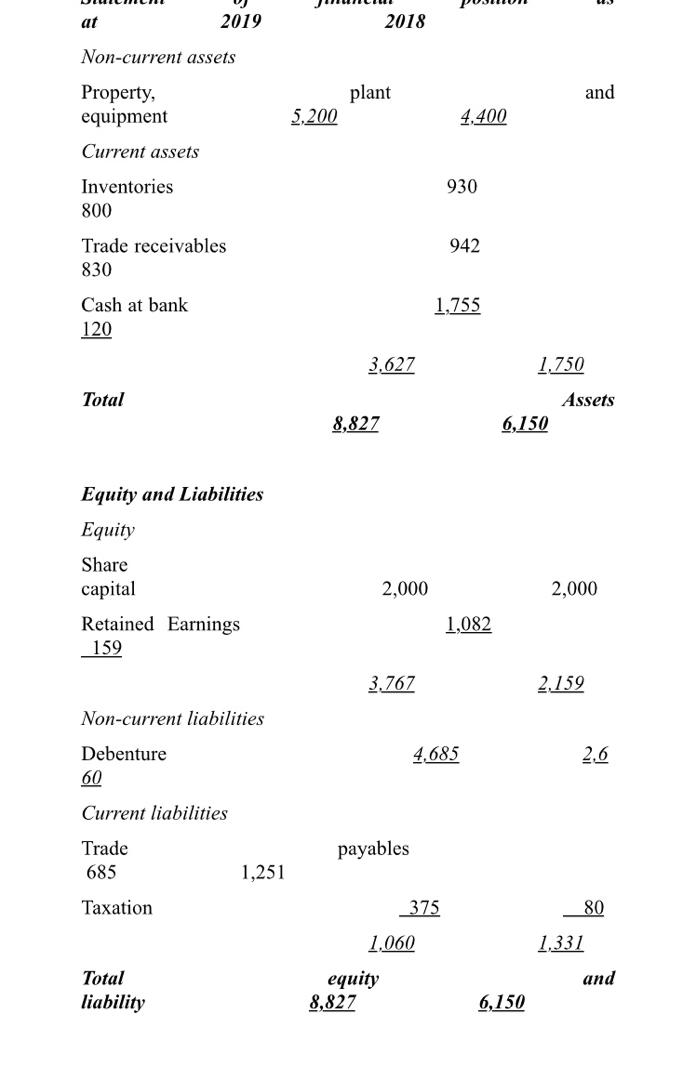

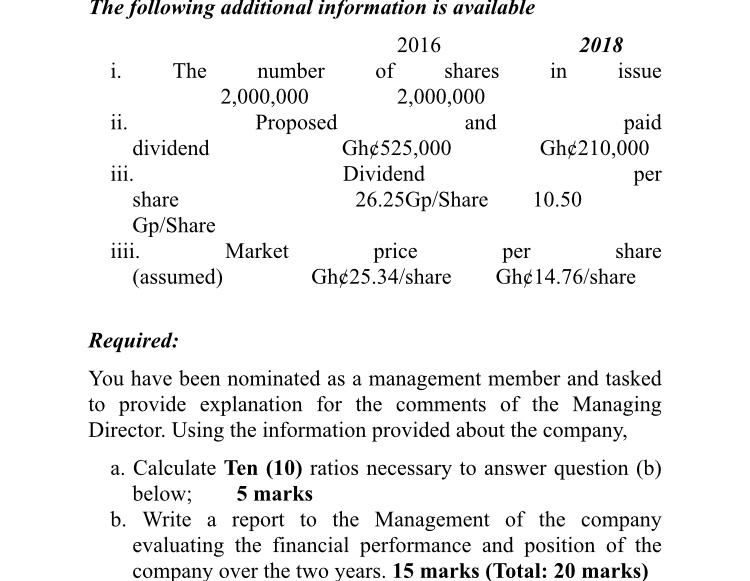

Question 3 Covid Foods Ghana Limited is a manufacturer and distributor of high quality immune busting foods for the management of Covid cases in Ghana. The company's products are usually patronised by all the major Hospitals across the continent. Relief agencies across the continent are granted special discount on all purchased meant for distribution in troubled and deprived regions of Africa. In January 2018, the company was taken over in a management buy-out precipitated by the previous owners' plan to downsize and introduce robotics into the manufacturing process. At a recent meeting to discuss the financial performance and position of the organisation, the current Managing Director remarked that the company is enjoying the best financial performance in the industry. Below are the financial statements of the first two years of operation which formed the basis of the Managing Director's comment. Statement of profit or loss and other comprehensive income for the year ended December 31" 2019 2018 Gh ^000 Gh ^000 8,700 5,2 Sales 20 Cost sales of (2,871) (3,920) 4,780 2,349 (590) Gross profit Distribution Costs (510) Administrative expenses Operating profit (1.930) (1.070) 2,260 769 (450) Finance cost (220) before Net tax profit 1,810 549 (362) Taxation (80) Profit tax after 369 1,448 and proposed (525) Dividend paid Retained Earnings 159 (210) 923 at 2019 2018 Non-current assets plant and Property, equipment 5.200 4.400 Current assets 930 Inventories 800 942 Trade receivables 830 1.755 Cash at bank 120 3.627 1.750 Total Assets 8,827 6,150 Equity and Liabilities Equity Share capital Retained Earnings 159 2,000 2,000 1,082 3.767 2.159 Non-current liabilities Debenture 60 4.685 2,6 Current liabilities Trade 685 payables 1.251 Taxation 375 80 1,060 1.331 and Total liability equity 8,827 6,150 The following additional information is available 2016 2018 i. The number of shares in issue 2,000,000 2,000,000 ii. Proposed and paid dividend Gh525,000 Gh210,000 iii. Dividend per share 26.25Gp/Share 10.50 Gp/Share iii. Market per share (assumed) Gh25.34/share Gh14.76/share price Required: You have been nominated as a management member and tasked to provide explanation for the comments of the Managing Director. Using the information provided about the company, a. Calculate Ten (10) ratios necessary to answer question (b) below; 5 marks b. Write a report to the Management of the company evaluating the financial performance and position of the company over the two years. 15 marks (Total: 20 marks)