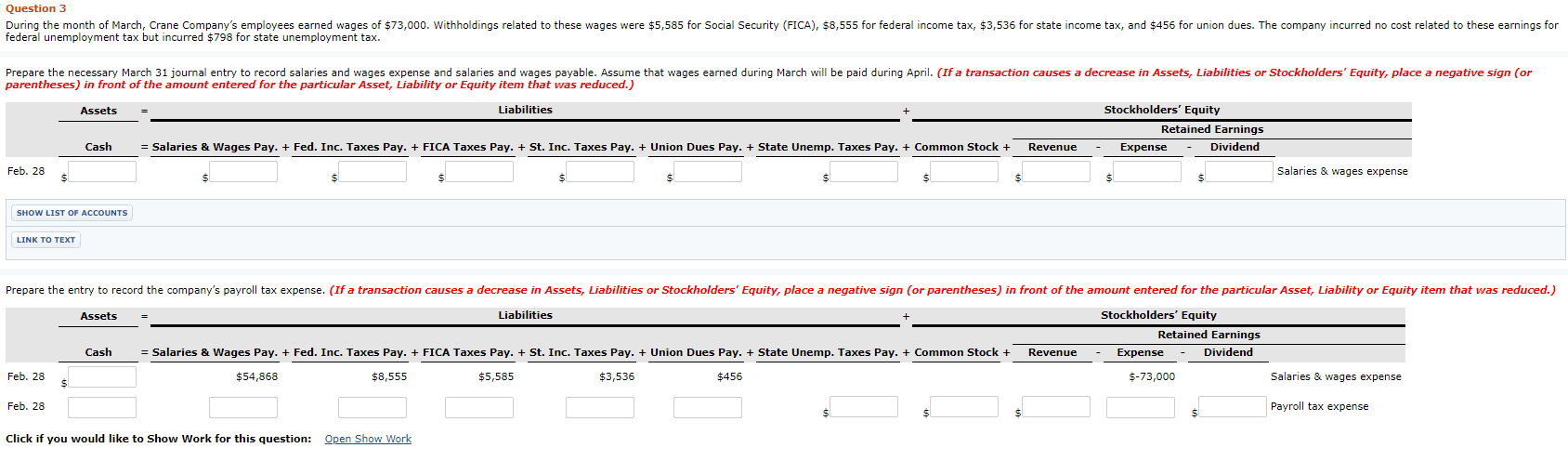

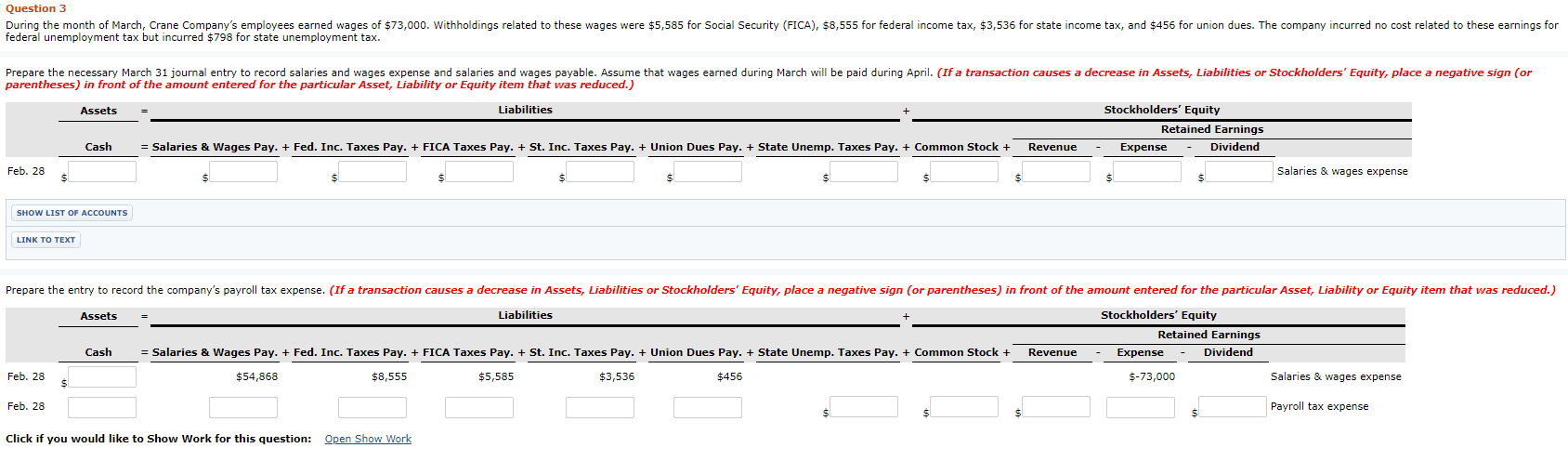

Question 3 During the month of March, Crane Company's employees earned wages of $73,000. Withholdings related to these wages were $5,585 for Social Security (FICA), $8,555 for federal income tax, $3,536 for state income tax, and $456 for union dues. The company incurred no cost related to these earnings for federal unemployment tax but incurred $798 for state unemployment tax. Prepare the necessary March 3:1 journal entry to record salaries and wages expense and salaries and wages payable. Assume that wages earned during March will be paid during April. (Ifa transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Liabilities Stockholders' Equity Assets + Retained Earnings = Salaries & Wages Pay. + Fed. Inc. Taxes Pay. FICA Taxes Pay. + St. Inc. Taxes Pay. Cash Union Dues Pay. State Unemp. Taxes Pay. + Common Stock + Dividend Revenue Expense -_ Feb. 28 Salaries & wages expense SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the entry to record the company's payroll tax expense. (Ifa transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Liabilities Assets Retained Earnings = Salaries & Wages Pay. + Fed. Inc. Taxes Pay. + FICA Taxes Pay. St. Inc. Taxes Pay. Cash State Unemp. Taxes Pay. + Common Stock Dividend Union Dues Pay. Revenue Expense Feb. 28 $54,868 $8,555 $5,585 $3,536 $456 s-73,000 Salaries & wages expense Payroll tax expense Feb. 28 $ Open Show Work Click if you would like to Show Work for this question: Question 3 During the month of March, Crane Company's employees earned wages of $73,000. Withholdings related to these wages were $5,585 for Social Security (FICA), $8,555 for federal income tax, $3,536 for state income tax, and $456 for union dues. The company incurred no cost related to these earnings for federal unemployment tax but incurred $798 for state unemployment tax. Prepare the necessary March 3:1 journal entry to record salaries and wages expense and salaries and wages payable. Assume that wages earned during March will be paid during April. (Ifa transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Liabilities Stockholders' Equity Assets + Retained Earnings = Salaries & Wages Pay. + Fed. Inc. Taxes Pay. FICA Taxes Pay. + St. Inc. Taxes Pay. Cash Union Dues Pay. State Unemp. Taxes Pay. + Common Stock + Dividend Revenue Expense -_ Feb. 28 Salaries & wages expense SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the entry to record the company's payroll tax expense. (Ifa transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Liabilities Assets Retained Earnings = Salaries & Wages Pay. + Fed. Inc. Taxes Pay. + FICA Taxes Pay. St. Inc. Taxes Pay. Cash State Unemp. Taxes Pay. + Common Stock Dividend Union Dues Pay. Revenue Expense Feb. 28 $54,868 $8,555 $5,585 $3,536 $456 s-73,000 Salaries & wages expense Payroll tax expense Feb. 28 $ Open Show Work Click if you would like to Show Work for this