Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Employee Benefits (16 marks) Part A (8 marks) The employees of Thunderbirds Ltd are entitled to 13 weeks' long service leave after

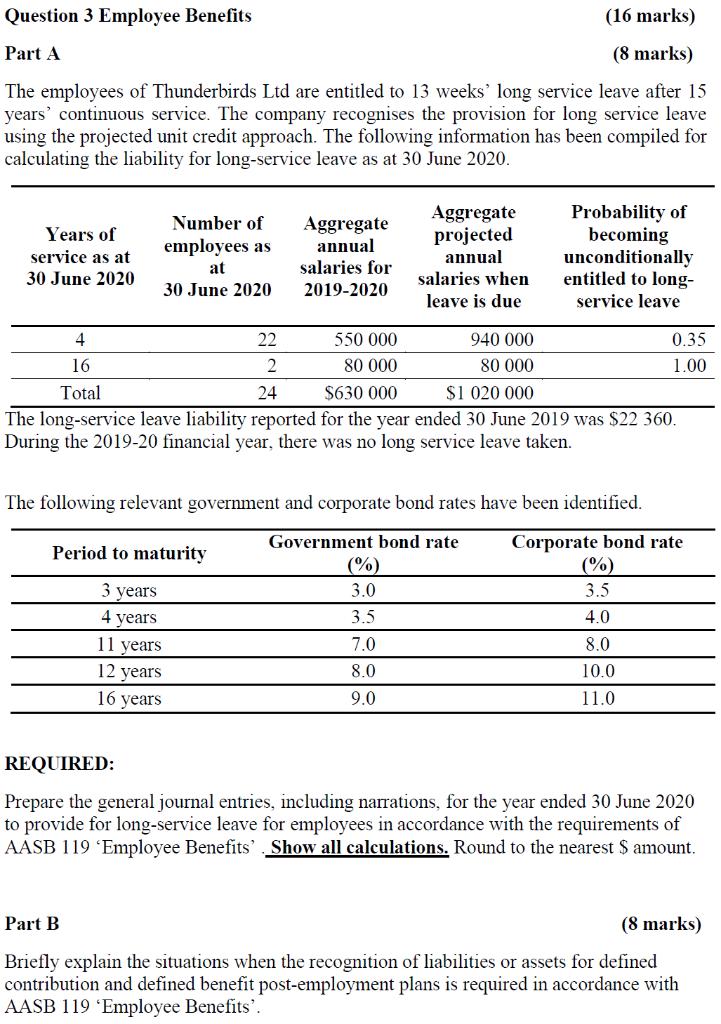

Question 3 Employee Benefits (16 marks) Part A (8 marks) The employees of Thunderbirds Ltd are entitled to 13 weeks' long service leave after 15 years' continuous service. The company recognises the provision for long service leave using the projected unit credit approach. The following information has been compiled for calculating the liability for long-service leave as at 30 June 2020. Years of service as at 30 June 2020 Number of employees as at 30 June 2020 Aggregate annual salaries for 2019-2020 Aggregate projected annual salaries when leave is due Period to maturity 3 years 4 years 11 years 12 years 16 years 4 22 550 000 16 2 80 000 Total 24 $630 000 The long-service leave liability reported for the year ended 30 June 2019 was $22 360. During the 2019-20 financial year, there was no long service leave taken. Probability of becoming unconditionally entitled to long- service leave 940 000 80 000 $1 020 000 0.35 1.00 The following relevant government and corporate bond rates have been identified. Government bond rate Corporate bond rate (%) (%) 3.0 3.5 3.5 4.0 7.0 8.0 8.0 10.0 9.0 11.0 REQUIRED: Prepare the general journal entries, including narrations, for the year ended 30 June 2020 to provide for long-service leave for employees in accordance with the requirements of AASB 119 'Employee Benefits' Show all calculations. Round to the nearest $ amount. Part B (8 marks) Briefly explain the situations when the recognition of liabilities or assets for defined contribution and defined benefit post-employment plans is required in accordance with AASB 119 'Employee Benefits'.

Step by Step Solution

★★★★★

3.62 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

A General journal entries for the year ended 30 June 2020 to provide for longservice leave ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started