Answered step by step

Verified Expert Solution

Question

1 Approved Answer

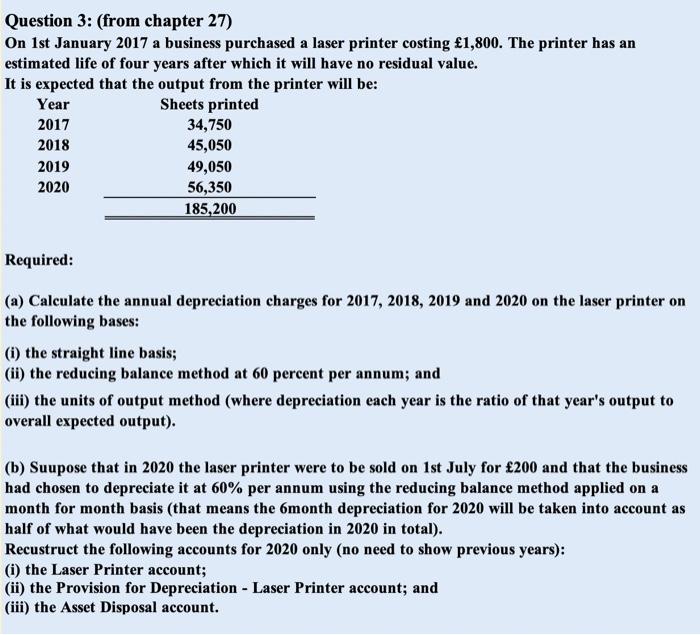

Question 3: (from chapter 27) On 1st January 2017 a business purchased a laser printer costing 1,800. The printer has an estimated life of

Question 3: (from chapter 27) On 1st January 2017 a business purchased a laser printer costing 1,800. The printer has an estimated life of four years after which it will have no residual value. It is expected that the output from the printer will be: Year 2017 Sheets printed 34,750 2018 45,050 2019 49,050 2020 56,350 185,200 Required: (a) Calculate the annual depreciation charges for 2017, 2018, 2019 and 2020 on the laser printer on the following bases: (i) the straight line basis; (ii) the reducing balance method at 60 percent per annum; and (iii) the units of output method (where depreciation each year is the ratio of that year's output to overall expected output). (b) Suupose that in 2020 the laser printer were to be sold on 1st July for 200 and that the business had chosen to depreciate it at 60% per annum using the reducing balance method applied on a month for month basis (that means the 6month depreciation for 2020 will be taken into account as half of what would have been the depreciation in 2020 in total). Recustruct the following accounts for 2020 only (no need to show previous years): (i) the Laser Printer account; (ii) the Provision for Depreciation - Laser Printer account; and (iii) the Asset Disposal account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started