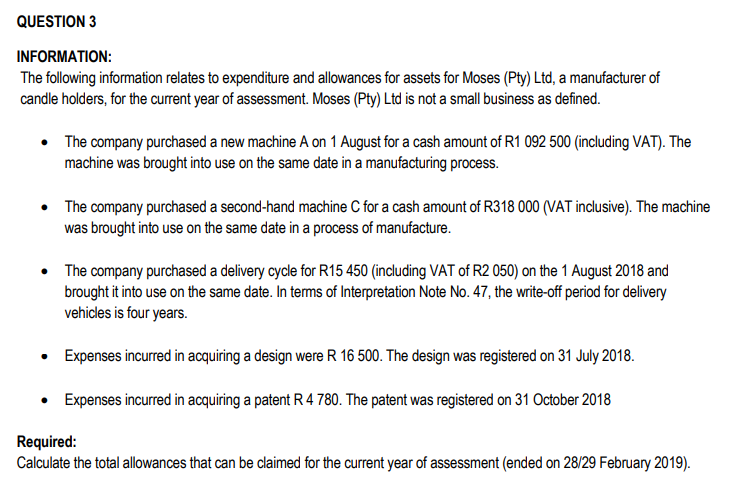

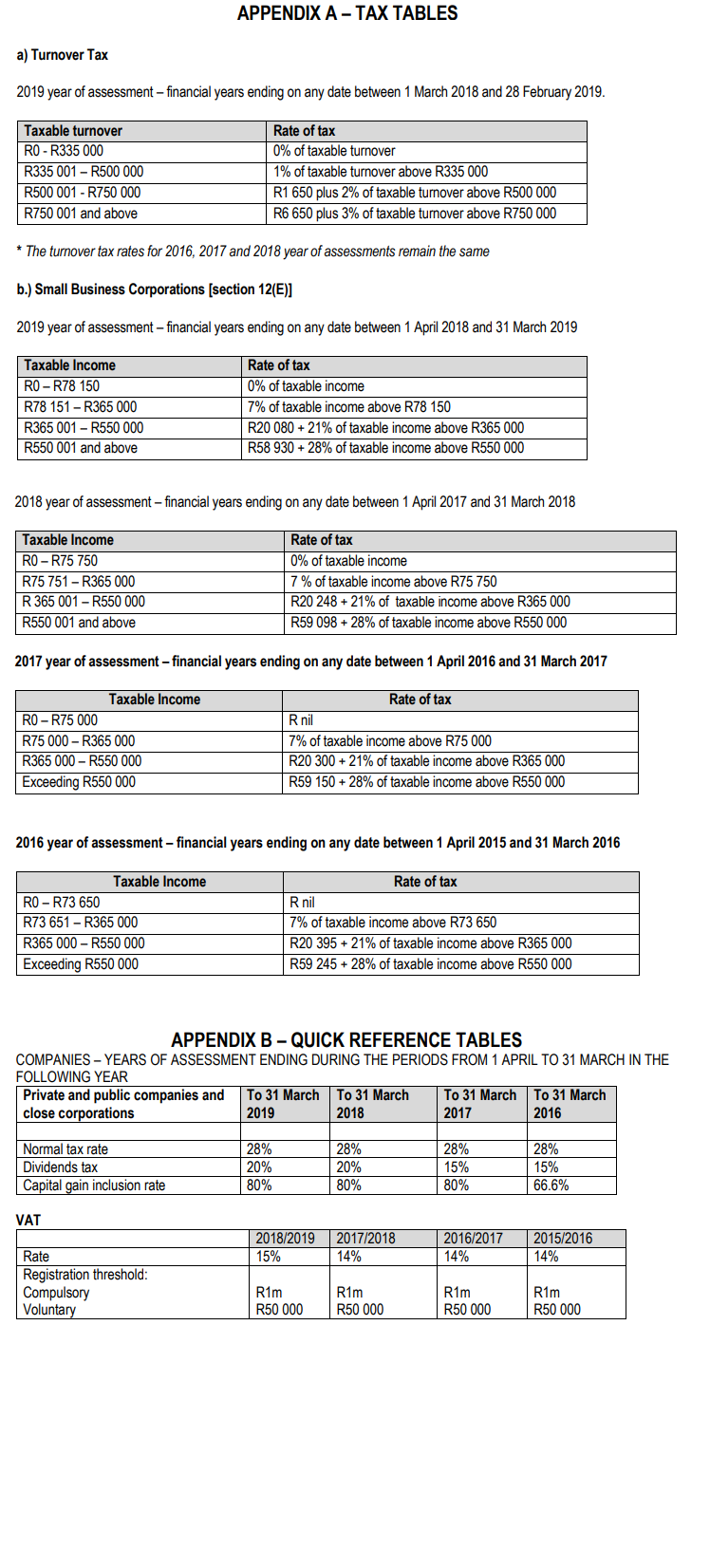

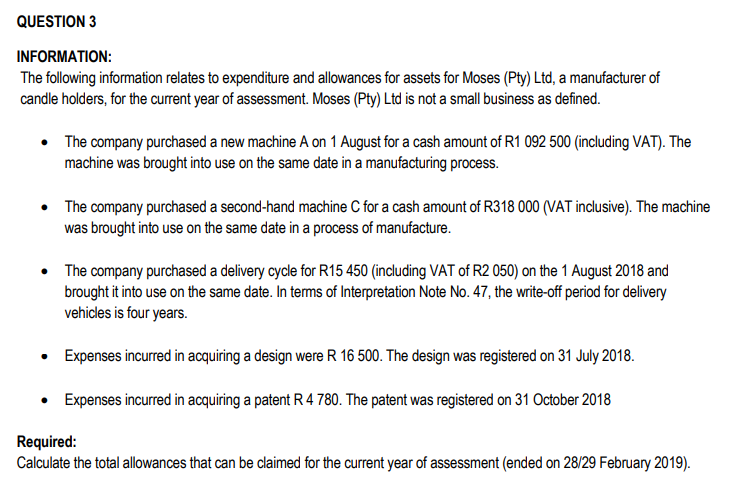

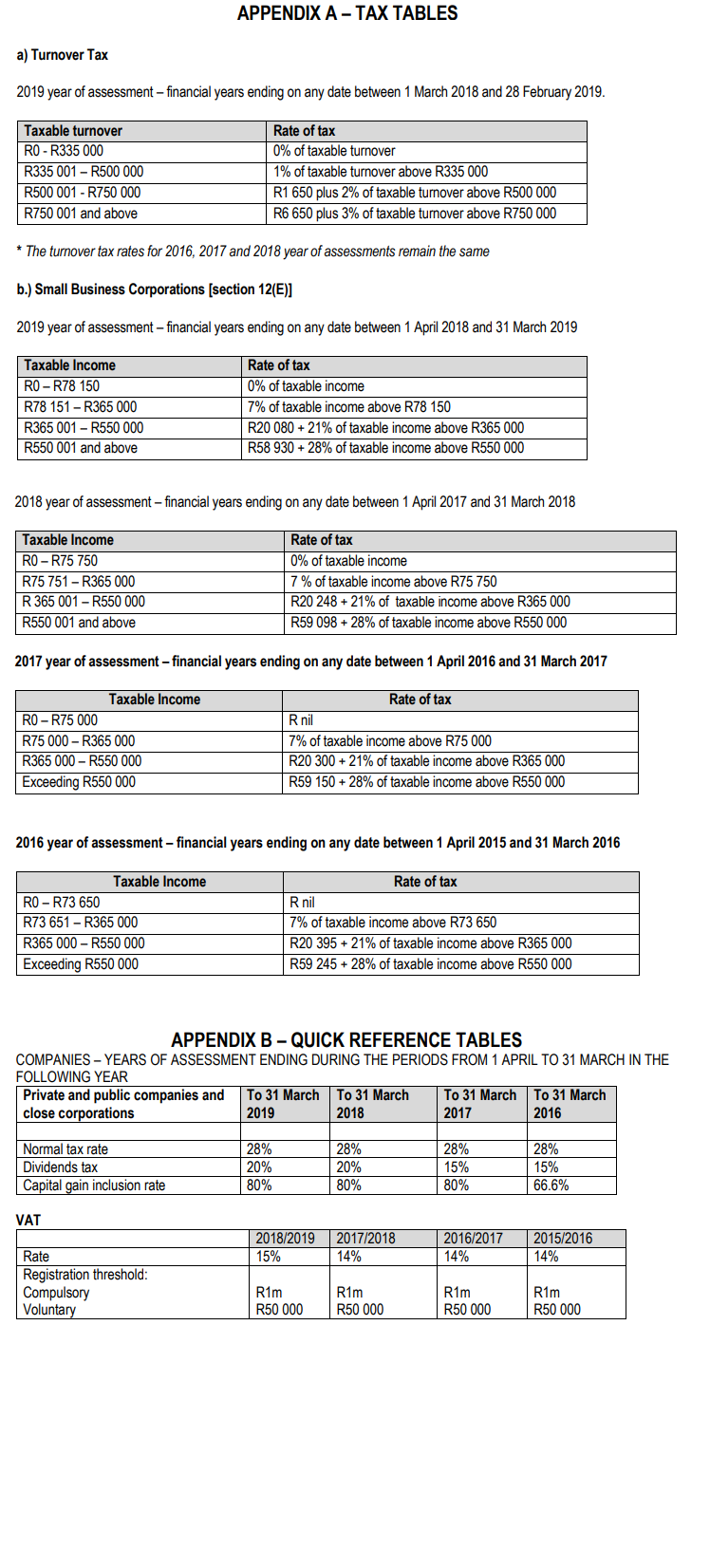

QUESTION 3 INFORMATION: The following information relates to expenditure and allowances for assets for Moses (Pty) Ltd, a manufacturer of candle holders, for the current year of assessment. Moses (Pty) Ltd is not a small business as defined. The company purchased a new machine A on 1 August for a cash amount of R1 092 500 (including VAT). The machine was brought into use on the same date in a manufacturing process. The company purchased a second-hand machine C for a cash amount of R318 000 (VAT inclusive). The machine was brought into use on the same date in a process of manufacture. The company purchased a delivery cycle for R15 450 (including VAT of R2 050) on the 1 August 2018 and brought it into use on the same date. In terms of Interpretation Note No. 47, the write-off period for delivery vehicles is four years. Expenses incurred in acquiring a design were R 16 500. The design was registered on 31 July 2018. Expenses incurred in acquiring a patent R 4780. The patent was registered on 31 October 2018 Required: Calculate the total allowances that can be claimed for the current year of assessment (ended on 28/29 February 2019). APPENDIX A-TAX TABLES a) Turnover Tax 2019 year of assessment - financial years ending on any date between 1 March 2018 and 28 February 2019. Taxable turnover RO - R335 000 R335 001 - R500 000 R500 001 - R750 000 R750 001 and above Rate of tax 0% of taxable turnover 1% of taxable turnover above R335 000 R1 650 plus 2% of taxable turnover above R500 000 R6 650 plus 3% of taxable turnover above R750 000 * The turnover tax rates for 2016, 2017 and 2018 year of assessments remain the same b.) Small Business Corporations (section 12(E)] 2019 year of assessment - financial years ending on any date between 1 April 2018 and 31 March 2019 Taxable income RO - R78 150 R78 151 - R365 000 R365 001 - R550 000 R550 001 and above Rate of tax 0% of taxable income 7% of taxable income above R78 150 R20 080 + 21% of taxable income above R365 000 R58 930 + 28% of taxable income above R550 000 2018 year of assessment - financial years ending on any date between 1 April 2017 and 31 March 2018 Taxable income RO-R75 750 R75 751 - R365 000 R 365 001 - R550 000 R550 001 and above Rate of tax 0% of taxable income 7% of taxable income above R75 750 R20 248 +21% of taxable income above R365 000 R59 098 + 28% of taxable income above R550 000 2017 year of assessment - financial years ending on any date between 1 April 2016 and 31 March 2017 Taxable income RO-R75 000 R75 000 - R365 000 R365 000 - R550 000 Exceeding R550 000 Rate of tax R nil 7% of taxable income above R75 000 R20 300 + 21% of taxable income above R365 000 R59 150 + 28% of taxable income above R550 000 2016 year of assessment - financial years ending on any date between 1 April 2015 and 31 March 2016 Taxable income RO - R73 650 R73 651 -R365 000 R365 000 - R550 000 Exceeding R550 000 Rate of tax R nil 7% of taxable income above R73 650 R20 395 + 21% of taxable income above R365 000 R59 245 +28% of taxable income above R550 000 APPENDIX B-QUICK REFERENCE TABLES COMPANIES - YEARS OF ASSESSMENT ENDING DURING THE PERIODS FROM 1 APRIL TO 31 MARCH IN THE FOLLOWING YEAR Private and public companies and To 31 MarchTo 31 March To 31 March To 31 March close corporations 2019 2018 2017 2016 Normal tax rate Dividends tax Capital gain inclusion rate 28% 20% 80% 28% 20% 80% 28% 15% 80% 28% 15% 66.6% VAT 2018/2019 15% 2017/2018 14% 2016/2017 14% 2015/2016 14% Rate Registration threshold: Compulsory Voluntary R1m R50 000 R1m R50 000 R1m R50 000 R1m R50 000