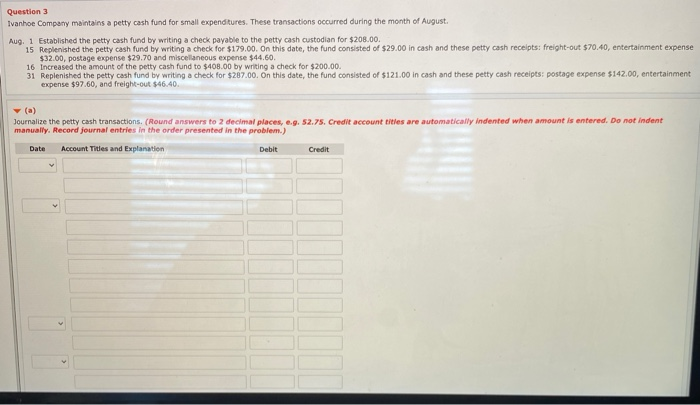

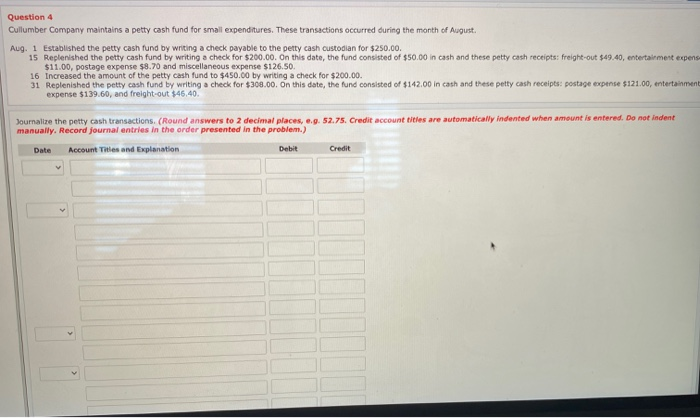

Question 3 Ivanhoe Company maintains a petty cash fund for small expenditures. These transactions occurred during the month of August. Aug. 1 Established the petty cash fund by writing a check payable to the petty cash custodian for $200.00 15 Replenished the petty cash fund by writing a check for $179.00. On this date, the fund consisted of $29.00 in cash and these petty cash receipts: freight-out $70.40, entertainment expense $32.00, postage expense $29.70 and miscellaneous expense $44.60 16 Increased the amount of the petty cash fund to $408.00 by writing a check for $200.00 31 Replenished the petty cash fund by writing a check for $287.00. On this date, the fund consisted of $121.00 in cash and these petty cash receipts: postage expense $142.00, entertainment expense $97.60, and freight-out $46.40. (a) Journalize the petty cash transactions. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation Debit Date Credit Question 4 Cullumber Company maintains a petty cash fund for small expenditures. These transactions occurred during the month of August. Aug. 1 Established the petty cash fund by writing a check payable to the petty cash custodian for $250.00 15 Replenished the petty cash fund by writing a check for $200.00. On this date, the fund consisted of $50.00 in cash and these petty cash receipts: freight-out $49.40, entertainment expens $11.00, postage expense $8.70 and miscellaneous expense $126.50. 16 Increased the amount of the petty cash fund to $450.00 by writing a check for $200.00 31 Replenished the petty cash fund by writing a check for $308.00. On this date, the fund consisted of $142.00 in cash and these petty cash receipts: postage expense $121.00, entertainment expense $139.60, and freight-out $46,40 Journalize the petty cash transactions. (Round answers to 2 decimal places, ... 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation Debit Credit Date v