Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jack Wade owns an unincorporated business appropriately named Wade Enterprises. Mr. Wade has decided that he no longer needs to spend all of the

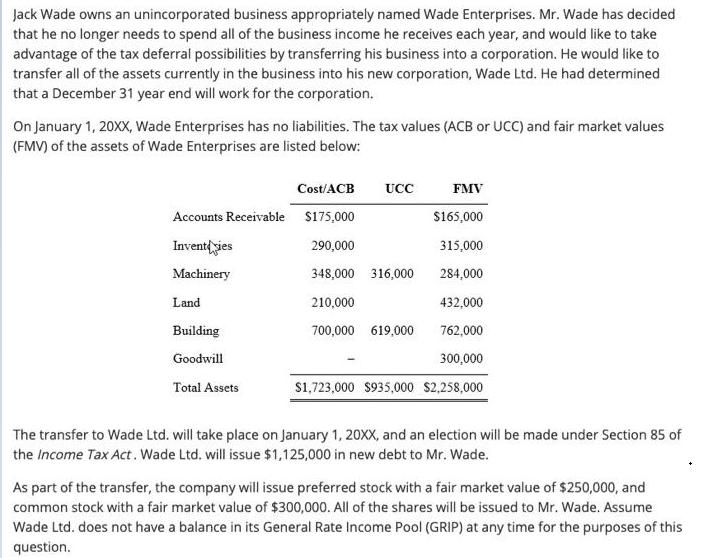

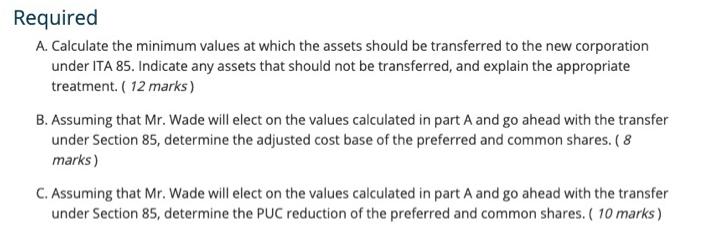

Jack Wade owns an unincorporated business appropriately named Wade Enterprises. Mr. Wade has decided that he no longer needs to spend all of the business income he receives each year, and would like to take advantage of the tax deferral possibilities by transferring his business into a corporation. He would like to transfer all of the assets currently in the business into his new corporation, Wade Ltd. He had determined that a December 31 year end will work for the corporation. On January 1, 20XX, Wade Enterprises has no liabilities. The tax values (ACB or UCC) and fair market values (FMV) of the assets of Wade Enterprises are listed below: Cost/ACB UCC FMV Accounts Receivable $175,000 $165,000 Invent(sies 290,000 315,000 Machinery 348,000 316,000 284,000 Land 210,000 432,000 Building 700,000 619,000 762,000 Goodwill 300,000 Total Assets s1,723,000 $935,000 S2,258,000 The transfer to Wade Ltd. will take place on January 1, 20XX, and an election will be made under Section 85 of the Income Tax Act. Wade Ltd. will issue $1,125,000 in new debt to Mr. Wade. As part of the transfer, the company will issue preferred stock with a fair market value of $250,000, and common stock with a fair market value of $300,000. All of the shares will be issued to Mr. Wade. Assume Wade Ltd. does not have a balance in its General Rate Income Pool (GRIP) at any time for the purposes of this question. Required A. Calculate the minimum values at which the assets should be transferred to the new corporation under ITA 85. Indicate any assets that should not be transferred, and explain the appropriate treatment. ( 12 marks) B. Assuming that Mr. Wade will elect on the values calculated in part A and go ahead with the transfer under Section 85, determine the adjusted cost base of the preferred and common shares. ( 8 marks) C. Assuming that Mr. Wade will elect on the values calculated in part A and go ahead with the transfer under Section 85, determine the PUC reduction of the preferred and common shares. ( 10 marks) Jack Wade owns an unincorporated business appropriately named Wade Enterprises. Mr. Wade has decided that he no longer needs to spend all of the business income he receives each year, and would like to take advantage of the tax deferral possibilities by transferring his business into a corporation. He would like to transfer all of the assets currently in the business into his new corporation, Wade Ltd. He had determined that a December 31 year end will work for the corporation. On January 1, 20XX, Wade Enterprises has no liabilities. The tax values (ACB or UCC) and fair market values (FMV) of the assets of Wade Enterprises are listed below: Cost/ACB UCC FMV Accounts Receivable $175,000 $165,000 Invent(sies 290,000 315,000 Machinery 348,000 316,000 284,000 Land 210,000 432,000 Building 700,000 619,000 762,000 Goodwill 300,000 Total Assets s1,723,000 $935,000 S2,258,000 The transfer to Wade Ltd. will take place on January 1, 20XX, and an election will be made under Section 85 of the Income Tax Act. Wade Ltd. will issue $1,125,000 in new debt to Mr. Wade. As part of the transfer, the company will issue preferred stock with a fair market value of $250,000, and common stock with a fair market value of $300,000. All of the shares will be issued to Mr. Wade. Assume Wade Ltd. does not have a balance in its General Rate Income Pool (GRIP) at any time for the purposes of this question. Required A. Calculate the minimum values at which the assets should be transferred to the new corporation under ITA 85. Indicate any assets that should not be transferred, and explain the appropriate treatment. ( 12 marks) B. Assuming that Mr. Wade will elect on the values calculated in part A and go ahead with the transfer under Section 85, determine the adjusted cost base of the preferred and common shares. ( 8 marks) C. Assuming that Mr. Wade will elect on the values calculated in part A and go ahead with the transfer under Section 85, determine the PUC reduction of the preferred and common shares. ( 10 marks) Jack Wade owns an unincorporated business appropriately named Wade Enterprises. Mr. Wade has decided that he no longer needs to spend all of the business income he receives each year, and would like to take advantage of the tax deferral possibilities by transferring his business into a corporation. He would like to transfer all of the assets currently in the business into his new corporation, Wade Ltd. He had determined that a December 31 year end will work for the corporation. On January 1, 20XX, Wade Enterprises has no liabilities. The tax values (ACB or UCC) and fair market values (FMV) of the assets of Wade Enterprises are listed below: Cost/ACB UCC FMV Accounts Receivable $175,000 $165,000 Invent(sies 290,000 315,000 Machinery 348,000 316,000 284,000 Land 210,000 432,000 Building 700,000 619,000 762,000 Goodwill 300,000 Total Assets s1,723,000 $935,000 S2,258,000 The transfer to Wade Ltd. will take place on January 1, 20XX, and an election will be made under Section 85 of the Income Tax Act. Wade Ltd. will issue $1,125,000 in new debt to Mr. Wade. As part of the transfer, the company will issue preferred stock with a fair market value of $250,000, and common stock with a fair market value of $300,000. All of the shares will be issued to Mr. Wade. Assume Wade Ltd. does not have a balance in its General Rate Income Pool (GRIP) at any time for the purposes of this question. Required A. Calculate the minimum values at which the assets should be transferred to the new corporation under ITA 85. Indicate any assets that should not be transferred, and explain the appropriate treatment. ( 12 marks) B. Assuming that Mr. Wade will elect on the values calculated in part A and go ahead with the transfer under Section 85, determine the adjusted cost base of the preferred and common shares. ( 8 marks) C. Assuming that Mr. Wade will elect on the values calculated in part A and go ahead with the transfer under Section 85, determine the PUC reduction of the preferred and common shares. ( 10 marks)

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The annual lease payment under different option as follows Pmt A x i 1 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started