Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3. Jeremy is setting up a window cleaning business. He set up a limited company - Jeremy Sparkles (JS) Ltd - and sell shares

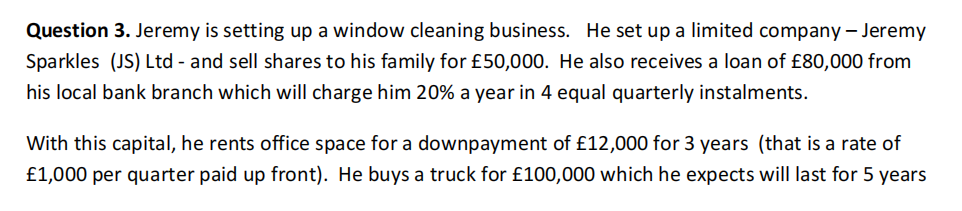

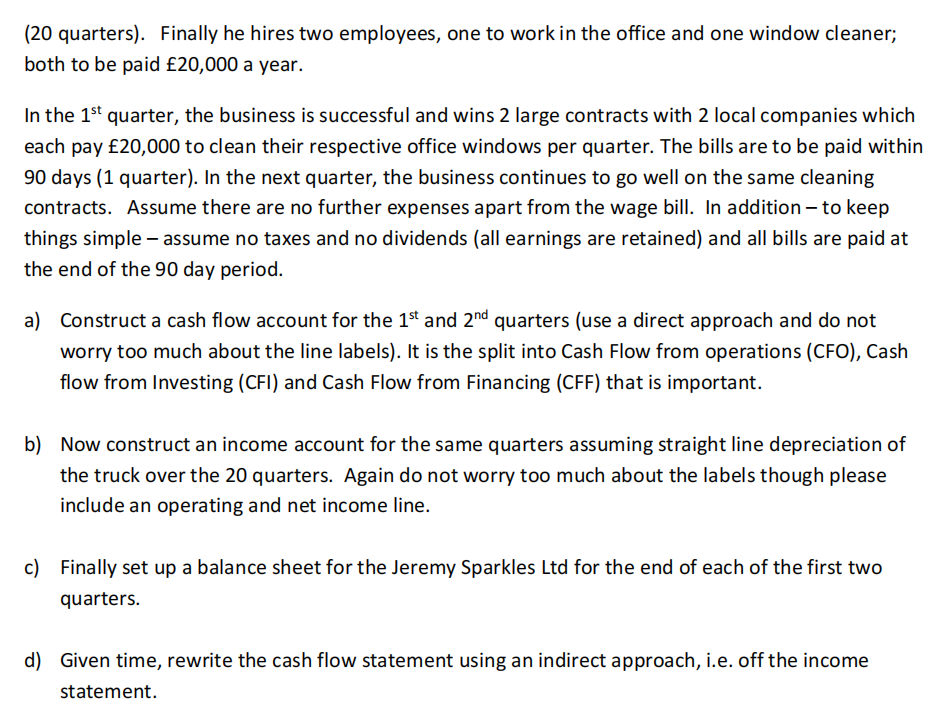

Question 3. Jeremy is setting up a window cleaning business. He set up a limited company - Jeremy Sparkles (JS) Ltd - and sell shares to his family for 50,000. He also receives a loan of 80,000 from his local bank branch which will charge him 20% a year in 4 equal quarterly instalments. With this capital, he rents office space for a downpayment of 12,000 for 3 years (that is a rate of 1,000 per quarter paid up front). He buys a truck for 100,000 which he expects will last for 5 years (20 quarters). Finally he hires two employees, one to work in the office and one window cleaner; both to be paid 20,000 a year. In the 1st quarter, the business is successful and wins 2 large contracts with 2 local companies which each pay 20,000 to clean their respective office windows per quarter. The bills are to be paid within 90 days (1 quarter). In the next quarter, the business continues to go well on the same cleaning contracts. Assume there are no further expenses apart from the wage bill. In addition - to keep things simple - assume no taxes and no dividends (all earnings are retained) and all bills are paid at the end of the 90 day period. a) Construct a cash flow account for the 1st and 2nd quarters (use a direct approach and do not worry too much about the line labels). It is the split into Cash Flow from operations (CFO), Cash flow from Investing (CFI) and Cash Flow from Financing (CFF) that is important. b) Now construct an income account for the same quarters assuming straight line depreciation of the truck over the 20 quarters. Again do not worry too much about the labels though please include an operating and net income line. c) Finally set up a balance sheet for the Jeremy Sparkles Ltd for the end of each of the first two quarters. d) Given time, rewrite the cash flow statement using an indirect approach, i.e. off the income statement

Question 3. Jeremy is setting up a window cleaning business. He set up a limited company - Jeremy Sparkles (JS) Ltd - and sell shares to his family for 50,000. He also receives a loan of 80,000 from his local bank branch which will charge him 20% a year in 4 equal quarterly instalments. With this capital, he rents office space for a downpayment of 12,000 for 3 years (that is a rate of 1,000 per quarter paid up front). He buys a truck for 100,000 which he expects will last for 5 years (20 quarters). Finally he hires two employees, one to work in the office and one window cleaner; both to be paid 20,000 a year. In the 1st quarter, the business is successful and wins 2 large contracts with 2 local companies which each pay 20,000 to clean their respective office windows per quarter. The bills are to be paid within 90 days (1 quarter). In the next quarter, the business continues to go well on the same cleaning contracts. Assume there are no further expenses apart from the wage bill. In addition - to keep things simple - assume no taxes and no dividends (all earnings are retained) and all bills are paid at the end of the 90 day period. a) Construct a cash flow account for the 1st and 2nd quarters (use a direct approach and do not worry too much about the line labels). It is the split into Cash Flow from operations (CFO), Cash flow from Investing (CFI) and Cash Flow from Financing (CFF) that is important. b) Now construct an income account for the same quarters assuming straight line depreciation of the truck over the 20 quarters. Again do not worry too much about the labels though please include an operating and net income line. c) Finally set up a balance sheet for the Jeremy Sparkles Ltd for the end of each of the first two quarters. d) Given time, rewrite the cash flow statement using an indirect approach, i.e. off the income statement Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started