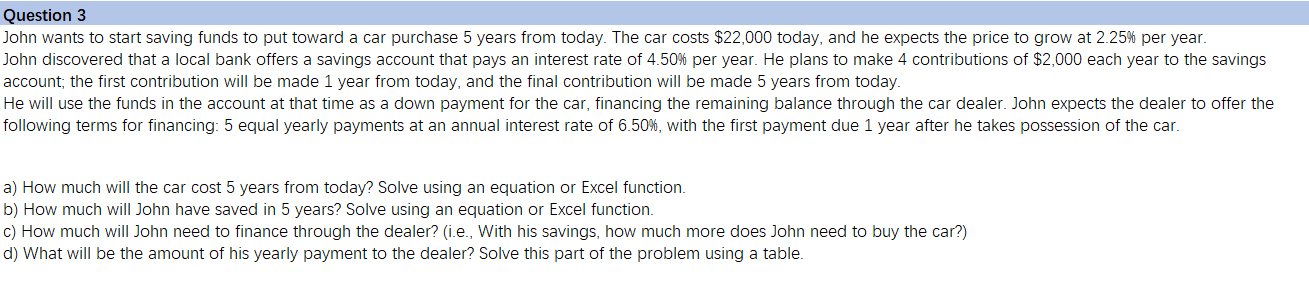

Question 3 John wants to start saving funds to put toward a car purchase 5 years from today. The car costs $22,000 today, and he expects the price to grow at 2.25% per year. John discovered that a local bank offers a savings account that pays an interest rate of 4.50% per year. He plans to make 4 contributions of $2,000 each year to the savings account; the first contribution will be made 1 year from today, and the final contribution will be made 5 years from today. He will use the funds in the account at that time as a down payment for the car, financing the remaining balance through the car dealer. John expects the dealer to offer the following terms for financing: 5 equal yearly payments at an annual interest rate of 6.50%, with the first payment due 1 year after he takes possession of the car. a) How much will the car cost 5 years from today? Solve using an equation or Excel function. b) How much will John have saved in 5 years? Solve using an equation or Excel function. c) How much will John need to finance through the dealer? (i.e., With his savings, how much more does John need to buy the car?) d) What will be the amount of his yearly payment to the dealer? Solve this part of the problem using a table. Question 3 John wants to start saving funds to put toward a car purchase 5 years from today. The car costs $22,000 today, and he expects the price to grow at 2.25% per year. John discovered that a local bank offers a savings account that pays an interest rate of 4.50% per year. He plans to make 4 contributions of $2,000 each year to the savings account; the first contribution will be made 1 year from today, and the final contribution will be made 5 years from today. He will use the funds in the account at that time as a down payment for the car, financing the remaining balance through the car dealer. John expects the dealer to offer the following terms for financing: 5 equal yearly payments at an annual interest rate of 6.50%, with the first payment due 1 year after he takes possession of the car. a) How much will the car cost 5 years from today? Solve using an equation or Excel function. b) How much will John have saved in 5 years? Solve using an equation or Excel function. c) How much will John need to finance through the dealer? (i.e., With his savings, how much more does John need to buy the car?) d) What will be the amount of his yearly payment to the dealer? Solve this part of the problem using a table