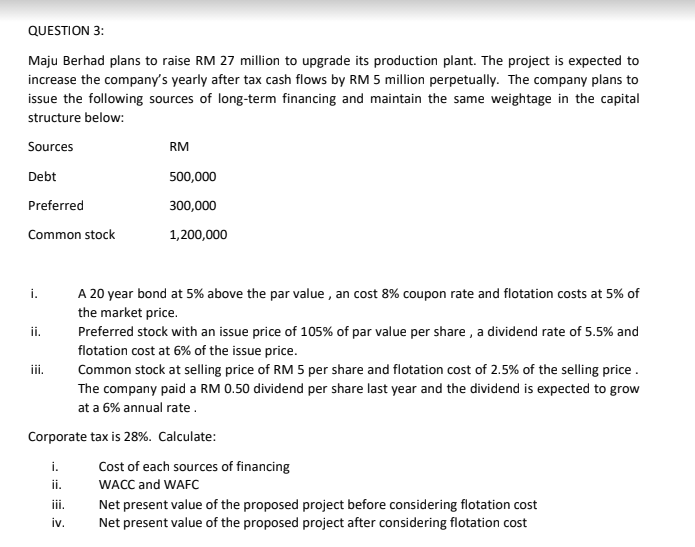

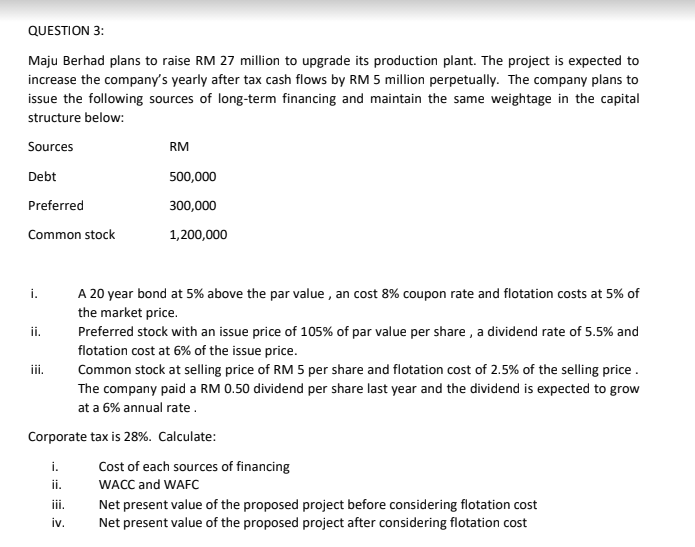

QUESTION 3: Maju Berhad plans to raise RM 27 million to upgrade its production plant. The project is expected to increase the company's yearly after tax cash flows by RM 5 million perpetually. The company plans to issue the following sources of long-term financing and maintain the same weightage in the capital structure below: Sources RM Debt 500,000 Preferred 300,000 Common stock 1,200,000 ii. iii. i. A 20 year bond at 5% above the par value , an cost 8% coupon rate and flotation costs at 5% of the market price. Preferred stock with an issue price of 105% of par value per share , a dividend rate of 5.5% and flotation cost at 6% of the issue price. Common stock at selling price of RM 5 per share and flotation cost of 2.5% of the selling price. The company paid a RM 0.50 dividend per share last year and the dividend is expected to grow at a 6% annual rate Corporate tax is 28%. Calculate: Cost of each sources of financing WACC and WAFC Net present value of the proposed project before considering flotation cost Net present value of the proposed project after considering flotation cost i. ii. iii. iv. QUESTION 3: Maju Berhad plans to raise RM 27 million to upgrade its production plant. The project is expected to increase the company's yearly after tax cash flows by RM 5 million perpetually. The company plans to issue the following sources of long-term financing and maintain the same weightage in the capital structure below: Sources RM Debt 500,000 Preferred 300,000 Common stock 1,200,000 ii. iii. i. A 20 year bond at 5% above the par value , an cost 8% coupon rate and flotation costs at 5% of the market price. Preferred stock with an issue price of 105% of par value per share , a dividend rate of 5.5% and flotation cost at 6% of the issue price. Common stock at selling price of RM 5 per share and flotation cost of 2.5% of the selling price. The company paid a RM 0.50 dividend per share last year and the dividend is expected to grow at a 6% annual rate Corporate tax is 28%. Calculate: Cost of each sources of financing WACC and WAFC Net present value of the proposed project before considering flotation cost Net present value of the proposed project after considering flotation cost i. ii. iii. iv