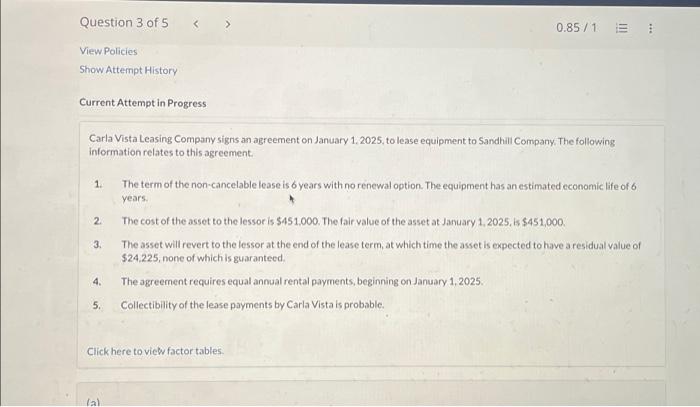

Question 3 of 5 View Policies Show Attempt History Current Attempt in Progress 1. Carla Vista Leasing Company signs an agreement on January 1, 2025, to lease equipment to Sandhill Company. The following information relates to this agreement. 2. 3. 4. 5. (a) 0.85/1: The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. Click here to view factor tables. The cost of the asset to the lessor is $451,000. The fair value of the asset at January 1, 2025, is $451,000. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $24,225, none of which is guaranteed. The agreement requires equal annual rental payments, beginning on January 1, 2025. Collectibility of the lease payments by Carla Vista is probable.

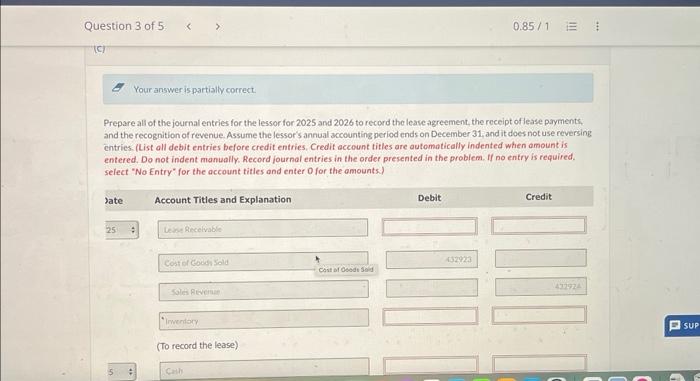

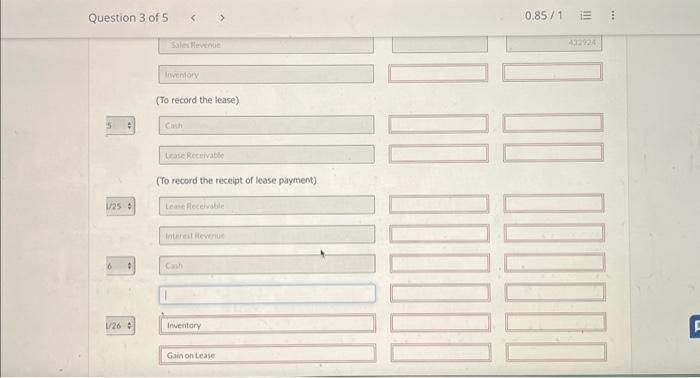

Carla Vista Leasing Company signs an agreement on January 1,2025, to lease equipment to Sandhill Company, The following information relates to this agreement. 1. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated cconomic life of 6 years. 2. The cost of the asset to the lessor is $451,000. The fair value of the asset at January 1,2025, is $451,000. 3. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $24.225, none of which is guaranteed. 4. The agreement requires equal annual rental payments, beginning on January 1,2025. 5. Collectibility of the lease payments by Carla Vista is probable. Prepare all of the journal entries for the lessor for 2025 and 2026 to record the lease agreement, the receipt of lease payments. and the recognition of revenue Assume the lessor's annual accounting period ends on December 31, and it does not use reversing entries, (List all debit entries before credit entries, Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required. select "No Entry' for the account tities and enter ofor the amounts.) Question 3 of 5 0.85/1 Salkithewhe 432724 Inventory (To record the lease) 5 Canih trase Recivivabe (To record the receipt of lease payment) 1/25 Leas heceivabile interat hownos 6 CMM 4/26 Inventory Gainontease Carla Vista Leasing Company signs an agreement on January 1,2025, to lease equipment to Sandhill Company, The following information relates to this agreement. 1. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated cconomic life of 6 years. 2. The cost of the asset to the lessor is $451,000. The fair value of the asset at January 1,2025, is $451,000. 3. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $24.225, none of which is guaranteed. 4. The agreement requires equal annual rental payments, beginning on January 1,2025. 5. Collectibility of the lease payments by Carla Vista is probable. Prepare all of the journal entries for the lessor for 2025 and 2026 to record the lease agreement, the receipt of lease payments. and the recognition of revenue Assume the lessor's annual accounting period ends on December 31, and it does not use reversing entries, (List all debit entries before credit entries, Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required. select "No Entry' for the account tities and enter ofor the amounts.) Question 3 of 5 0.85/1 Salkithewhe 432724 Inventory (To record the lease) 5 Canih trase Recivivabe (To record the receipt of lease payment) 1/25 Leas heceivabile interat hownos 6 CMM 4/26 Inventory Gainontease